Big banks are being slammed for being “subsidised by the taxpayer” and failing to pass on higher interest rates to savings and current accounts for customers.

This comes amid the wave of bank branch closures which has seen 6,000 locations from lenders such as Santander, Barclays and Halifax close since 2015.

Mark Mullen, the chief executive of Atom Bank, is hitting out at the country’s biggest financial institutions and calling for change in the banking sector.

He is among the 120 business leaders who have signed an open letter backing the Labour Party’s plan for the economy ahead of the upcoming General Election

Mullen shared that he is supporting Sir Keir Starmer’s party because “the country needs a change” after 14-years of the Conservative Party in Government.

On top of this, the chief executive criticised big banks for being slow to reward customers with high savings rates.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Major banks have raised savings interest rates but not by enough, according to experts

GETTY

Last week, Atom Bank claimed it had “comfortably outperformed the major high street lenders and building societies when it comes to offering savings customers a better deal”.

The competitor bank reports that it has an interest rate deposit beta of 88 per cent.

This is the proportion of official base rate rises it passed onto its own savings rates.

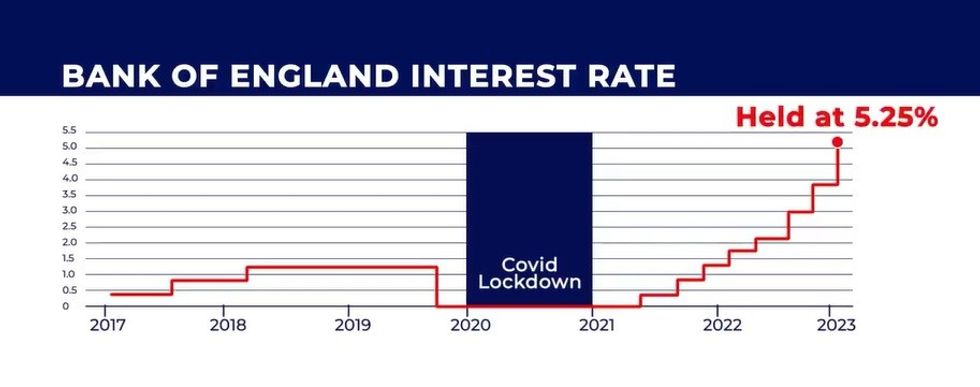

The Bank of England’s Monetary Policy Committee (MPC) is currently holding interest rates at 5.25 per cent.

“If you’re running a company that has a deposit beta of 88 per cent, then you are not being subsidised by the Bank of England, because we’re passing on the benefits straight to the customer.

“If, on the other hand, you’re running a bank which is only passing on 30 per cent of the benefits, and reserving 70 per cent for yourself… then frankly, you are being subsidised by the the taxpayer, and I’m not sympathetic to that.”

According to Atom Bank’s boss, he is “not against changing the current rules” in relation to how the Bank of England pays interest to commercial lenders on their reserves.

Banks in the UK are paid interest on the money they hold with the Bank of England with high street financial institutions currently paying deposits at 5.25 per cent.

The Reform UK party has asserted it wants to scrap these interest payments as part of ambitions to save the Bank of England billions.

Despite this, Mullen stressed that any change of the rules would need to be a “transition” rather than an immediate shift.

LATEST DEVELOPMENTS:

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

Many banks and building societies, including Nationwide and first direct, are offering savings interest rates on products of up to seven per cent.

On top of this endorsement from Atom Bank’s chief executive, Labour have also pledged to roll out 350 banking hubs to “breathe life into high streets”.

John Howells, Link chief executive, said: explained: “Link has already recommended 132 banking hubs right across the UK and they are proving a very popular way of providing access to cash and basic banking for consumers and businesses who need to use a high street branch.

“I’m expecting many more to open over the coming years to protect access to cash and provide a welcome boost to high streets across the country.”

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.