- Bitcoin’s miner revenue has fallen to its lowest in the last year.

- This is due to the recent decline in network activity.

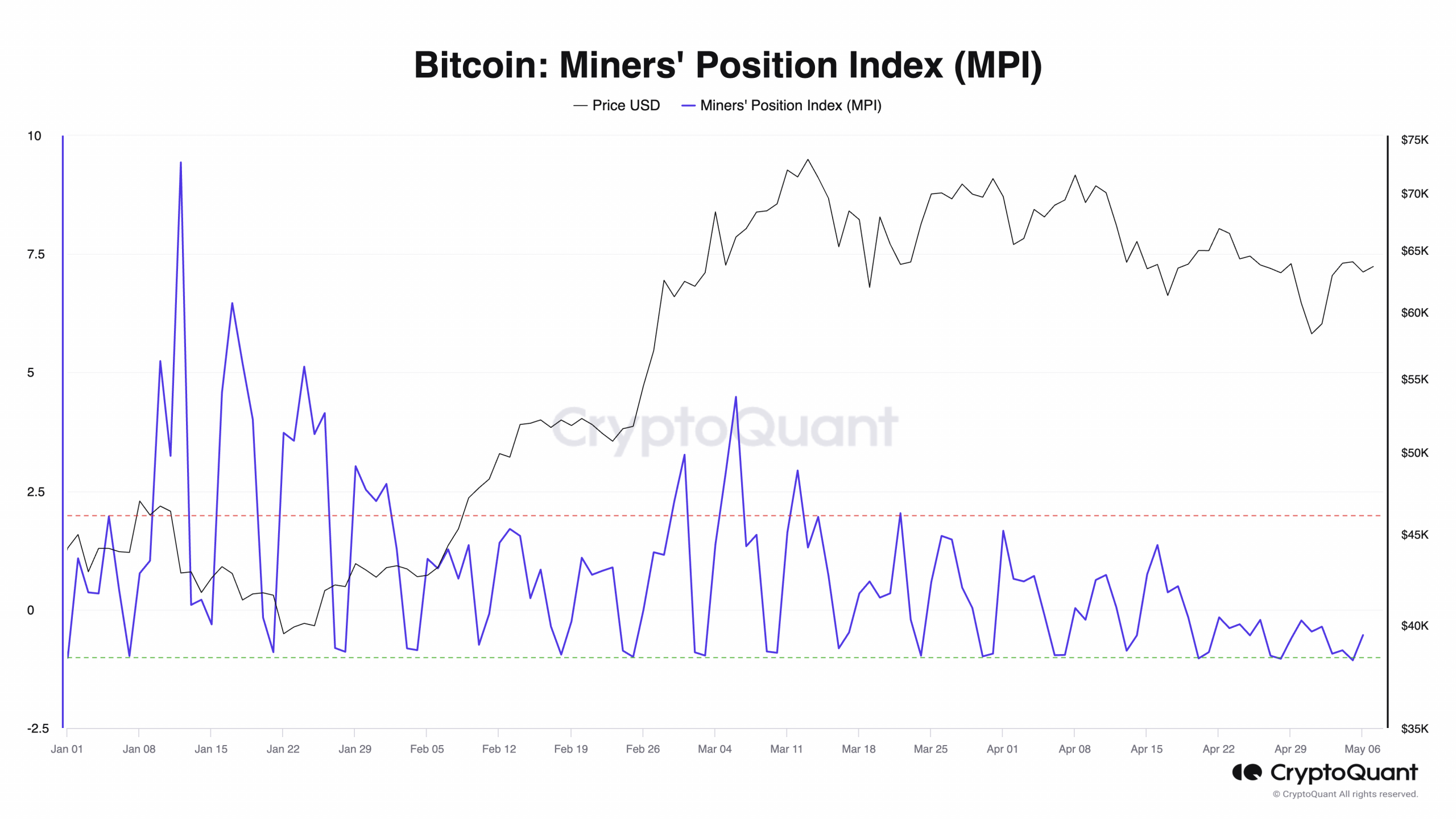

Per Bitcoin’s [BTC] Miner Position Index [MPI], the leading cryptocurrency is currently at its longest period of reduced miner sell pressure after a halving event, pseudonymous CryptoQuant analyst Papi found in a new report.

BTC’s MPI measures the ratio of the coin’s total miner outflow in US dollars to its one-year moving average of total miner outflow, also valued in dollars.

When it rises, it indicates that miners are selling more of their holdings. Conversely, when it declines, it suggests they are holding onto their assets or accumulating more.

According to CryptoQuant data, BTC’s MPI was -0.23 as of this writing. After peaking at a year-to-date (YTD) high of 9.43 on the 8th of January, the metric has since declined by over 100%.

Source: CryptoQuant

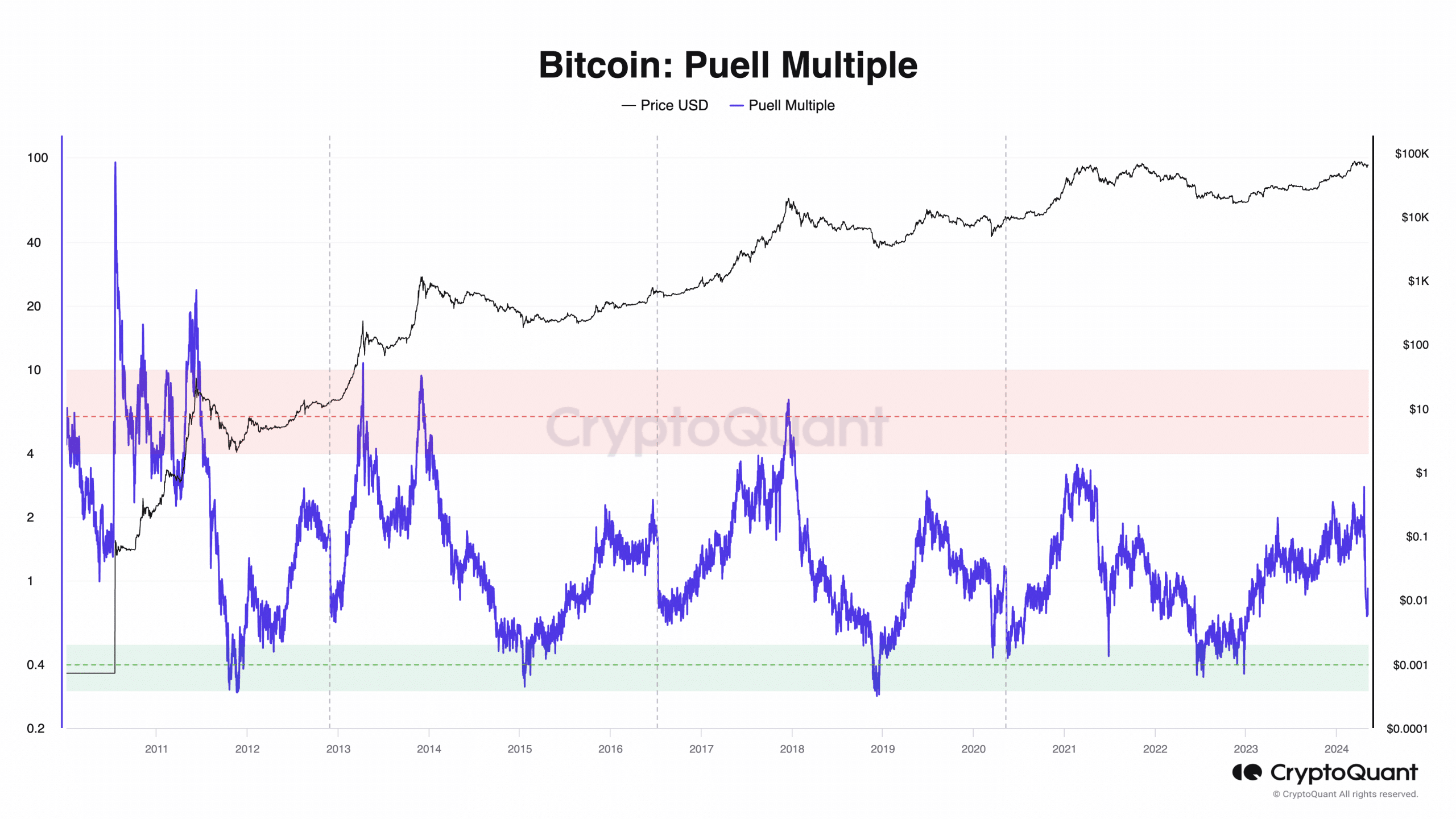

Papi noted in the report that in addition to a falling MPI, BTC’s Puell Multiple has also cratered, causing miner revenue to fall to its lowest level in a year.

BTC’s Puell Multiple tracks miner profitability by measuring the daily issuance of new coins (block rewards) in relation to its 365-day moving average.

When the metric’s value is high, it is interpreted to mean that miners are generating revenue in relation to the historical average.

Conversely, when the metric witnesses a decline, miners’ revenue is low compared to the historical average.

As of this writing, BTC’s Puell Multiple was 0.69. It cratered to a YTD low of 0.67 on the 1st of May. According to CryptoQuant’s data, this metric last reached the 0.6 region in February 2023.

Source: CryptoQuant

Miners “pay” the price

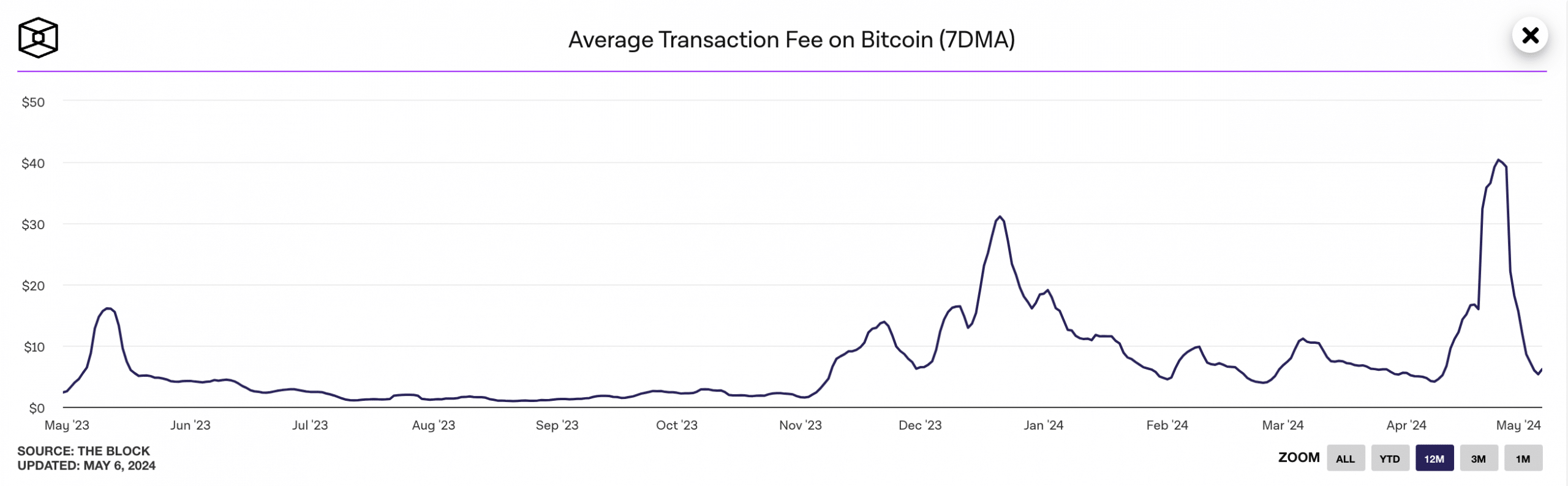

Following the Bitcoin halving event, there was a surge in average transaction fees on the network due to a spike in activity around Runes.

However, as the hype around the protocol begins to wane, the transaction count on the network has plummeted, impacting network fees.

Runes “etching” on the Bitcoin network pushed its average transaction fee (assessed on a seven-day moving average) to a high of $40 on the 24th of April, according to The Block data dashboard.

However, as network activity normalized, network fees trended downward. As of the 5th of May, network users paid an average transaction fee of $6, representing an 85% fall from the high on the 24th of April.

Source: The Block

Is your portfolio green? Check out the BTC Profit Calculator

Due to this decline, the percentage of miner revenue derived from network fees declined. According to Messari’s data, as of the 20th of April, miners derived 74% of their revenue from network fees.

However, this has been reduced due to the fall in network activity. On the 5th of May, only 22% of miner revenue was derived from transaction fees on the network.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.