- Blue chips close at 7,943

- Entain up 5% on take private reports

- Gold at all-time high

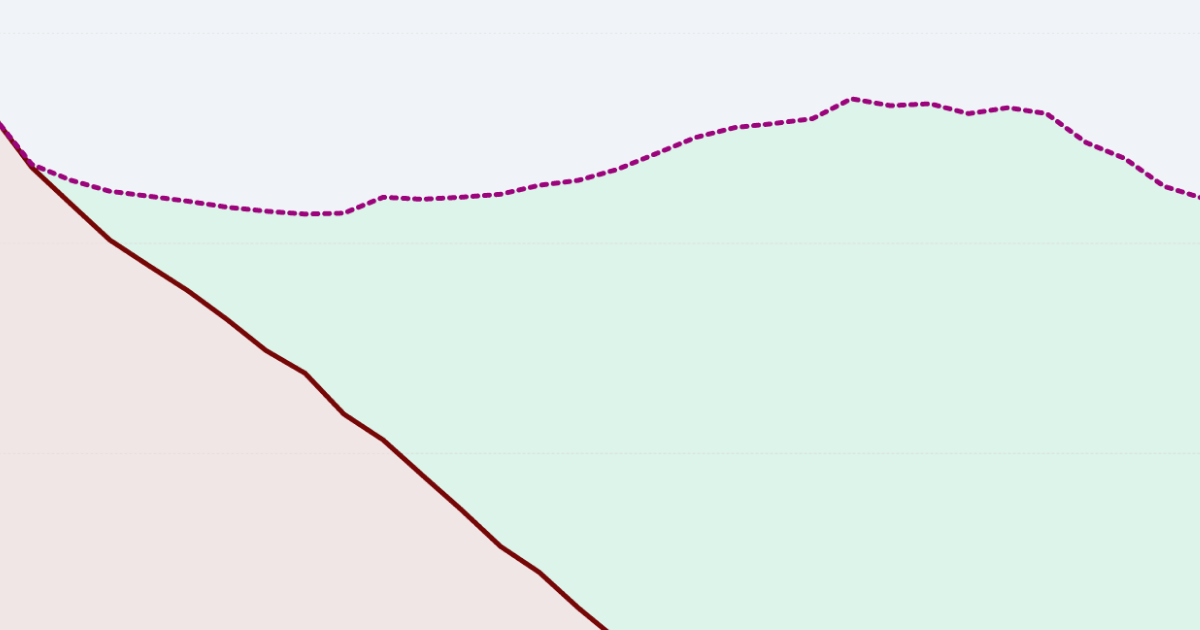

17.05pm: FTSE 100 ends day in green

London’s blue-chip index closed the day 32 points higher at 7,943.

16.04pm: FTSE 100 to close slightly higher

London’s blue-chip index is set to see out Monday higher as it continues to lift around 25 points higher at 7,936.

While the FTSE 100 slipped lower in early trading, the index was able to regain momentum, helped somewhat by miners jumping on news iron ore demand has increased.

While a number of the index’s mining stocks were leading the risers, only Rio Tinto has been able to make a significant jump, up 4%.

Meanwhile, Ladbrokes owner Entain led the charge, up around 5%, after reports revealed private equity firm Apollo was mulling making an offer for some of its assets.

Other risers included newly promoted easyJet, up 4%, and Scottish Mortgage Trust, up 2.5%.

Meanwhile, leading the fallers was Entain’s direct rival and Sky Bet owner Flutter, which dropped 2.5%, likely in connection with today’s reports.

Marks and Spencer dropped around 2% after it was revealed retail insolvencies had surged by a fifth within the last year.

Other fallers included Sage, down 2.5%, and Severn Trent, down 2%.

15.33pm: Jaguar Land Rover sees sales jump by a fifth

Jaguar Land Rove saw car sales soar by a fifth within the last year after it experienced improvements in its production amid “sustained global demand”.

Owner Tata Motors said Britain’s largest carmaker saw sales jump 12% to more than 431,700 units in the year to March 31 2024.

In an update, the carmaker said: “Compared to the prior year, retail sales in the quarter were up 21% in North America, 32% in the UK and 16% Overseas.

“Compared to the prior year, retail sales in China were down 9% and down 2% in Europe for the quarter.”

In November last year, JLR said it brought in record revenues as Chinese demand rebounded, effects from the pandemic dispersed and computer chip supply improved.

The group also had to deal with concerns that Land Rovers may be difficult to insure, with some owners being quoted four and five-figure sums for annual premiums.

In response, JLR restarted its Land Rover insurance programme which provides support for owners.

15.15pm: Aldi overtakes Asda as UK’s third largest supermarket

Aldi is now the third largest supermarket in Britain after overtaking Asda, one set of industry data revealed, highlighting the desire from UK consumer to find value in their everyday shops.

Some 12.2% of the UK supermarket industry is taken up by Aldi, according to data compiled by NIQ in the 12 weeks to 23 March.

Meanwhile, Asda’s market share has slipped to 11.7%, with it being the worst-performing supermarket in the last quarter, having experienced sales growth of 0.8%.

Aldi’s growth in dominance has come in recent years as the cost-of-living crisis squeezes pockets and it continues to be the cheapest supermarket.

Once again, in March Aldi came in the cheapest, with a trolley of groceries setting shoppers back £121.06 compared to Tesco’s £139.23 and Asda’s £138.31.

14.31pm: Wall Street opens higher

Wall Street has opened slightly higher as investors hope the rally which has carried through much of 2024 can continue this week.

The Dow Jones opened 30 points higher at 38,934, while the S&P 500 jumped 5 points to 5,208.

The Nasdaq lifted 34 points to 16,283.

Some of the big movers included Tesla, which shot up a little over 2% after boss Elon Musk said it would be showcasing its hotly-awaited robotaxi on August 8.

BJ’s Wholesale, the members-only warehouse retailer, added around 2.5% after it was upgraded to a buy from neutral by Goldman Sachs.

Aircraft maker Boeing avoided a sharp drop, only slipping 0.5% despite one of its planes being involved in another malfunction.

This time an engine cover on a Southwest Airlines flight came off minutes after it took off, leading to regulators launching yet another investigation into its aircrafts.

14.08pm: Ted Baker to shut 15 stores

Ted Baker administrators revealed that 15 stores will be closing within the next few weeks as it looks to find a way for the brand to return to liquidity.

Teneo, the fashion brand’s administrator, said it decided to shut 11 outlets by April 19, which will result in the loss of 120 jobs.

Stores closing include those in Bristol, Liverpool One, London Bridge, Oxford, Nottingham and others.

25 head office workers will also be laid off as part of the cuts.

Landlords at an additional four sites, which include a store in Floral Street, London and Manchester Trafford have served Ted Baker with notice, leading to an extra 100 jobs cuts.

Benji Dymant, joint administrator said: “These store closures, whilst with a regrettable impact on valued team members, will improve the performance of the business, as Authentic continues to progress discussions with potential UK and European operating partners for the Ted Baker brand to bring the business back to health.”

13.49pm: TUI ascends in first session after leaving London

TUI, the airline, is trading more than 4% higher on its first day as a solely German stock, having exited its London listing.

Shareholders voted in February in favour of removing its listing in London, in which it was placed in FTSE 250, and instead become exclusive to the Frankfurt Stock Exchange.

As the stock jumped to €7.90, the immediate surge reinforced the issue that many others have brought up. London is undervaluing its listings.

From small caps to FTSE 100 constituents, many have gone across the Atlantic, been taken private or set up listings in mainland Europe in response to the poor valuations.

However, the issue reached a new level today when Shell, the FTSE 100’s largest company, warned it would consider other locations for listing if the LSE doesn’t improve.

13.28pm: US stocks to open flat

US stocks are on course to start the week flat having suffered a pullback from 2024’s rally during the first week of the second quarter.

Today, the Dow Jones is on track to open 11 points higher at 39,232, while the S&P500 and Nasdaq are flat at 5,254 and 18,303 respectively.

Despite the index sliding backwards last week, it ended on a positive note, having posted stronger-than-expected jobs data, highlighting a resilient economy and growth in corporate earnings – even if it is at the expense of higher interest rates for longer.

Investors will also be reading through an open letter from JP Morgan boss Jamie Dimon, who spoke on topics from global economics to the power of shareholder advisors.

Of course, he spoke on AI too, arguing that the tech “has the potential to augment virtually every job, as well as impact our workforce composition.”

13.09pm: Bitcoin rallies as gold hits all-time highs

Digital currency Bitcoin (BTC) joined its physical gold brethren in a rally this Monday, though it has yet to match the latter in hitting an all-time high (yet).

Bitcoin rose sharply as the UK headed to lunch, adding 4.3% to knock above $72,360 at the time of writing – still some way off the record highs of US$73,737.

If momentum persists, the BTC/USD pair is likely to surpass fortnightly highs, putting it within reach of the ATH seen in the middle of March.

A glance at Binance’s order book shows sell orders pitched at $71,500, making this a short-term resistance point for the bulls to surpass.

Meanwhile, gold prices reached a new all-time high after jumping to US$2,353 per ounce.

Analysts at UBS believe gold prices could go above US$2,500.

AuAg Funds founder and CEO Eric Strand sat down with Proactive to discuss the current dynamics of the gold market.

12.52pm: Shell threatens to swap London listing for New York

London could be set to experience its biggest hit in the exodus of listed companies after Shell warned it may move its listing to the US.

Wael Sawan, the boss of the largest company in the FTSE 100, said the oil giant was considering “all options” regarding listings.

He said Shell’s current undervaluation presented “a fantastic investment opportunity”.

“I will keep buying back those shares, and buying back those shares at a discount,” he added.

Sawan noted the discrepancy in valuation between Shell and US-listed oil groups like Exxon Mobil and Chevron.

In a clear warning to the LSE, he said: ““If we work through the sprint, and we are doing what we are doing, and we still don’t see that the gap is closing, we have to look at all options.”

12.30pm: Deal for first UK cannabis vertical scrapped

A deal to create the UK’s first vertically integrated cannabis company has been scrapped after it failed to raise funds for working capital.

Voyager, the Cannabidiol oil firm from Scotland, said it was planning on a merger with Jersey cannabis grower Northern Leaf last week.

The plans included a fundraiser to provide working capital when the two businesses come together.

However, due to “the Easter holiday period and slower investor response time” the funds weren’t able to be raised.

Nick Tulloch, chief executive officer and founder of Voyager, said: “Needless to say, it is hugely disappointing to bring our proposed merger with Northern Leaf to an end.

“As we look back over the past few months, a transaction well received by the industry and investors has been prevented by circumstances outside of our control.

“Many companies in this space are now cash-constrained due to development costs outpacing market growth and, whilst this does create excellent value propositions, as a management team we go in fully aware that work is needed to reinvigorate or accelerate sales.”

12.09pm: First home at 36, peak earnings at 47 and mortgage-free at 61

Brits on average are buying their first homes at 36 hitting their peak earnings at 47 before paying off their mortgages by 61, data from the Office of National Statistics found.

As house prices continue to increase faster than incomes, homes are becoming less affordable for UK residents, meaning the average homeowner is now 36 years old rather than the 32-year-old average back in 2004.

Despite house prices rising faster, between 2013 and 2022 the average age has remained the same, highlighting the rise of longer mortgages.

For Brits hoping to know when they have hit their peak earnings, the ONS found that by 47 the average wage reached £18.78 per hour in 2023.

The average for peak earnings has risen from 38 years in 2013 to 40 years in 2018 before reaching 47 post-pandemic.

11.50am: FTSE 100 holds flat

The FTSE 100 remained muted throughout much of Monday morning, likely still feeling the hangover from last week which saw the index breach the 8,000 mark before falling sharply on Friday.

London’s blue chips are now 10 points higher at 7,920, with miners helping lead the charge after it was revealed iron ore demand had been increasing.

Rio Tinto, up 3%, Fresnillo, up 2.5%, and Anglo American, up 2%, all helped push the index slightly higher.

However, the leading riser was Ladbrokes owner Entain, which jumped 5.5% after it was reported private equity firm Apollo could be interested in “a whole range” of its assets.

Departing chairman Barry Gibson has turned down multiple takeover bids during his tenure, but his exit may pave the way for an accepted bid.

Falling the other way are retailers Ocado and M&S, down 2.5%, after it was revealed insolvencies in the industry had soared by a fifth in the last year.

Other fallers include Sage, down 2%, Rightmove, down 1.5%, and Severn Trent, down 1.5%.

11.30am: Retailers lose £11.3 billion from payment fraud

Britain’s retail industry saw £11.3 billion swiped by fraudsters last year, new research found.

Some 35% of UK businesses suffered fraudulent activity, cyber-attacks or data leaks during the twelve months, jumping by 37% compared with 2022 figures, the Centre for Economic Business and Research (CEBR) found.

On average, each retail business lost close to £1.4 million due to fraudulent activities, while luxury fashion groups lost around £2.8 million each.

It comes as retailers attempt to drum up online sales by making their return policies lenient.

However, this has led to a surge in chargeback fraud, where cardholders claim they did not make the payment themselves.

Roleant Prins, the chief operating officer at Ayden, said: ““Criminals are deploying more sophisticated methods when they attack businesses, including the application of AI, and it’s therefore critical to invest in the right defence mechanisms to protect the company and customers”

11.07am: Taiwan Semiconductor wins US$11.6 billion from US government

Taiwan Semiconductor Manufacturing Company (TSMC) will help produce a new state-of-the-art facility in Arizona after receiving a whopping US$11.6 billion from the US government.

Biden’s administration will provide the world’s most advanced semiconductor manufacturer with grants and loans to help build and develop the site.

Plans are already in place for TSMC to produce two new facilities in Phoenix, but the additional funding will now allow the group to produce 2-nanometer designs, the most advanced versions of chips.

The funding is part of the government’s CHIPS and Sciences Act, which also provided Intel with US$8.5 billion in grants and US$11 billion in loans last month.

10.47am: New John Lewis chair has the “knowhow”

John Lewis will appoint Jason Tarry, the former Tesco UK boss, as its chairman when Sharon White departs at the end of her tenure next year.

Tarry, who will earn the same £1.1 million as White at John Lewis, will join with the target of helping the retailer reach the end of its turnaround plan.

John Lewis’ woes have led to the group scrapping annual bonuses, cutting staff and even leaving White mulling cancelling its 100% employee-owned model.

Yet, analysts are confident Tarry could be the right person for the job.

Zoe Mills, lead retail analyst at GlobalData, said: “Jason Tarry was at the helm of Tesco during the crucial development of its Clubcard loyalty scheme, taking the discounters head-on and creating a retail model that its competitors have emulated since.

“He certainly has the experience and knowhow to rejuvenate the John Lewis Partnership.”

10.28am: BoE undermined as homeowners switch to fixed mortgages, IMF finds

The Bank of England’s monetary policy is being undermined as a horde of homeowners switch to fixed-rate mortgages, the International Monetary Fund believes.

research found the UK saw some of the highest percentage of people switch to fixed mortgage rates out of the entire globe.

In 2011, around a third of mortgage holders were on fixed-rate deals, usually for periods of two to five years. However, by the end of 2022 this figure reached 90%.

More recent findings from the Financial Conduct Authority found this share has remained stable since 2022.

“Central banks have raised interest rates significantly over the past two years to combat post-pandemic inflation,” the IMF said.

“Many thought this would lead to a slowdown in economic activity. Yet, global growth has held broadly steady, with deceleration only materialising in some countries.”

10.01am: Vet group CVS suffers cyber-attack

While the FTSE 100 continues to hold flat, in small caps, vetinary group CVS revealed its IT systems were hit by a cyber attack, which is still affecting some operations at its practices.

The company said it has informed the Information Commissioner’s Office “due to the risk of malicious access to personal information”.

While it “intercepted” the unauthorised external access to a number of its IT systems, there was “considerable operational disruption” in the past week at its 500-plus vet practices.

IT systems were temporarily put offline as part of a response plan.

Vet Collection, the chain owned by CVS, said on its website: “We are having issues with our online forms and emails, please call your practice for appointments and queries.”

9.40am: Retail insolvencies soar as high interest rates wreak havoc

Retailers like Marks and Spencer and Sainsbury’s are some of the top fallers on Monday after new research highlighted the soaring rate of insolvencies in the industry.

There have been almost 20% more insolvencies in the last twelve months, Mazars data showed, as the effect of higher interest rates hits high streets.

Some 2,200 retailers went into administration in the twelve months to the end of January, up against 1,843 recorded a year earlier.

As the Bank of England continued to hold interest rates at 5.25% since August, the burden on debt-laden businesses has been found to have devastating effects.

Rebecca Dacre, a partner at Mazars, said: “We are unlikely to see the retail sector trading comfortably until interest rates start to fall.”

9.14am: Microsoft to open AI hub in London

Microsoft is opening a new AI hub in London in another boost as the capital returns to business.

The artificial intelligence lab will be focused on developing the technology for consumers and will be led by Jordan Hoffman, a former scientist at Google’s DeepMind.

It comes after both OpenAI and Anthropic also announced they would be opening offices in London as they look to expand their workforce with European AI experts.

Mustafa Suleyman, the DeepMind co-founder and newly appointed boss of Microsoft’s AI consumer division, said: “There is an enormous pool of AI talent and expertise in the U.K., and Microsoft AI plans to make a significant, long-term investment in the region as we begin hiring the best AI scientists and engineers into this new AI hub.

“In the coming weeks and months, we will be posting job openings and actively hiring exceptional individuals who want to work on the most interesting and challenging AI questions of our time.

“We’re looking for new team members who are driven by impact at scale, and who are passionate innovators eager to contribute to a team culture where continuous learning is the norm.”

8.53am: The morning so far

With company news sparse and a barren macroeconomic calendar, attention turned to gold prices this Monday.

Prices for the precious metal hit a fresh all-time high of $2,350 an ounce after swinging $27 higher during Monday’s Asia trading window.

Analysts pointed to high central bank purchasing as a key driver, with UBS stating: “At a stretch one could question whether the dollar’s failure to advance has something to do with de-dollarisation trends.

“We note that gold is still pushing ahead strongly, and recent data shows that the People’s Bank of China has been a consistent buyer of gold.” India’s central bank has also been on a buying spree.

Miners Rio Tinto plc, Anglo American PLC (LSE:AAL) and Fresnillo PLC (LSE:FRES) were among the top FTSE 100 risers.

Other top risers among the blue chips include easyJet plc (up 3.5%), Entain PLC (LSE:ENT) (up 2.8%) and Diploma PLC (LSE:DPLM) (up 1.9%).

Digital gold (aka bitcoin) was also seen higher, adding a little over a percentage point to approach $70,200.

Elsewhere on the news front, Banco Santander (LSE:BNC) is quitting the Lending Standards Body, according to a Sky News report.

The UK’s fifth-largest lender cited confusion with other regulatory standards, chiefly the Financial Conduct Authority’s Consumer Duty and new fraud reimbursement rules.

These new regulations “supersede the existing voluntary industry standards that are set out in the current LSB codes”, Santander is reported to have said. “This inevitably leads to duplicative regulation and can create confusion among staff and customers about which standards apply.”

The FTSE 100 was last seen 11 points higher at 7,922, having started the day in the red.

8.34am: Bitcoin gains against dollar

Digital gold, aka bitcoin (BTC), is also up today, with the BTC/USD pair adding 1.1% in early exchanges.

It marks the third green candlestick in a row for the world’s largest cryptocurrency, though unlike physical gold, it is off its all-time high seen in mid-March.

At the time of writing, bitcoin was swapping for $70,161, or around half a percentage point higher week on week.

Back to stocks, the FTSE 100 is currently down 12 points to 7,898, adding to last Friday’s steep losses.

8.16am: Rents through the roof

The Resolution Foundation has allayed private landlords of blame for rising rent prices, instead pointing the finger at earnings growth and “post-pandemic readjustment”.

A report titled ‘Through the Roof’ showed that private rent prices have risen by 15% since January 2022 and are rising at their fastest pace on record.

Pushing back against “popular theories about the rise”, the foundation suggest that the private rental sector (PRS) has seen only a modest decrease in size, suggesting that landlords leaving the market en masse are not driving up rents significantly.

Rising costs for Buy-to-Let mortgages have been suggested as a factor for the rent hikes, but this doesn’t fully explain the trend as 38% of landlords have no debt, the report said.

The report stated: “Some have been keen to pin the blame for recent rent rises on the rising costs of servicing Buy-to-Let mortgages, which landlords have passed on to tenants.

“Many landlords will have wanted to recoup those higher costs (although it should be noted that 38 per cent of landlords hold no debt), but it’s just not the case that the UK’s landlords can unilaterally set prices: although there are clear power imbalances in landlord-tenant relationships, the ability of landlords as a whole to increase prices is constrained by the wider rental market.

“If this weren’t the case, then landlords would have been increasing rents long before the recent rise in interest rates.”

7.55am: Gold hits new record high

Gold prices have hit a fresh all-time high of $2,350 an ounce after swinging $27 higher during Monday’s Asia trading window.

Analysts have pointed to high central bank purchasing as a key driver.

“Touching on a theme we introduced last week, at a stretch one could question whether the dollar’s failure to advance has something to do with de-dollarisation trends,” said UBS in a Monday research note.

“We note that gold is still pushing ahead strongly, and recent data shows that the People’s Bank of China has been a consistent buyer of gold.

Traders are also likely to be turning to gold as a safe haven amid ongoing Middle East conflict.

7.29am: Santander reportedly quitting Lending Standards Body

Banco Santander (LSE:BNC) is quitting the Lending Standards Body according to a Sky News report.

The UK’s fifth-largest lender cited confusion with other regulatory standards, chiefly the Financial Conduct Authority’s Consumer Duty and new fraud reimbursement rules.

These new regulations “supersede the existing voluntary industry standards that are set out in the current LSB codes”, Santander is reported to have said. “This inevitably leads to duplicative regulation and can create confusion among staff and customers about which standards apply.”

The LSB is a self-regulating body established to promote fair and transparent banking practices among its members, focusing on improving customer outcomes in the UK banking and financial services sector.

It sets the standards for the industry through its Lending Code, which provides guidelines on responsible lending and borrowing.

It was created in 2009 in the wake of the Global Financial Crisis.

7.11am: Blue chips to open higher

The FTSE 100 index is tipped to open the week 10 points higher at 7,913 when markets open on Monday after suffering a 73-point slide on Friday after weak retail and housing data impacted market sentiment.

There’s not a lot scheduled on today’s UK financial calendar, barring a trading update from Ferrexpo PLC (LSE:FXPO) and final results from Bango PLC (AIM:BGO, OTCQX:BGOPF).

Overnight, it was learned that US airline regulators have launched an investigation into Boeing after yet another incident, this time involving an engine cowling on a 737-800 aircraft falling off during take-off and striking a wing flap.

Later this week, the European Central Bank will convene for its latest interest rate decision on Thursday, with markets expecting policymakers to hold at 4.5%

Sophie Anderson, a UK-based writer, is your guide to the latest trends, viral sensations, and internet phenomena. With a finger on the pulse of digital culture, she explores what’s trending across social media and pop culture, keeping readers in the know about the latest online sensations.