In a rallying cryptocurrency landscape, each pump and opened long position leave liquidity pools behind, which can cause long squeezes. Therefore, traders can look for cryptocurrencies with an increased volume of longs to prepare for retracements.

Finbold gathered data from CoinGlass on March 2 to analyze the derivatives market. Cryptocurrencies have shifted to a dominating bullish sentiment amid a notable rally. In particular, Bitcoin (BTC) and Ethereum (ETH) accumulated massive gains and now threaten a correction.

Essentially, traders tend to open longs when the market is going up while favoring short positions when it goes down. However, longs are trading contracts that require deposited collateral, setting a liquidation price downwards.

If this liquidation price is reached, the contract closes and liquidates the trader’s position, selling the collateral. This might drive prices further down, liquidating more trading contracts in a cascade effect called a long squeeze.

Thus, market makers can use high liquidity pools as targets to increase volatility and their profits.

Long squeeze alert for Bitcoin (BTC) at $50,000

Interestingly, Bitcoin accumulated relevant long liquidations in the $50,000 zone, which plays an important psychological support and resistance.

The monthly chart shows eight liquidity pools with over $1 billion each, from $50,700 to $49,700. At least half of them have over $2 billion worth of long liquidations, up to over $12 billion in total.

Nevertheless, there are smaller liquidity pools to the upside, with a candle wick at $64,300. Professional traders could use this wick for one more impulse seeking to attract more liquidity to the $50,000 zone before moving to a long squeeze.

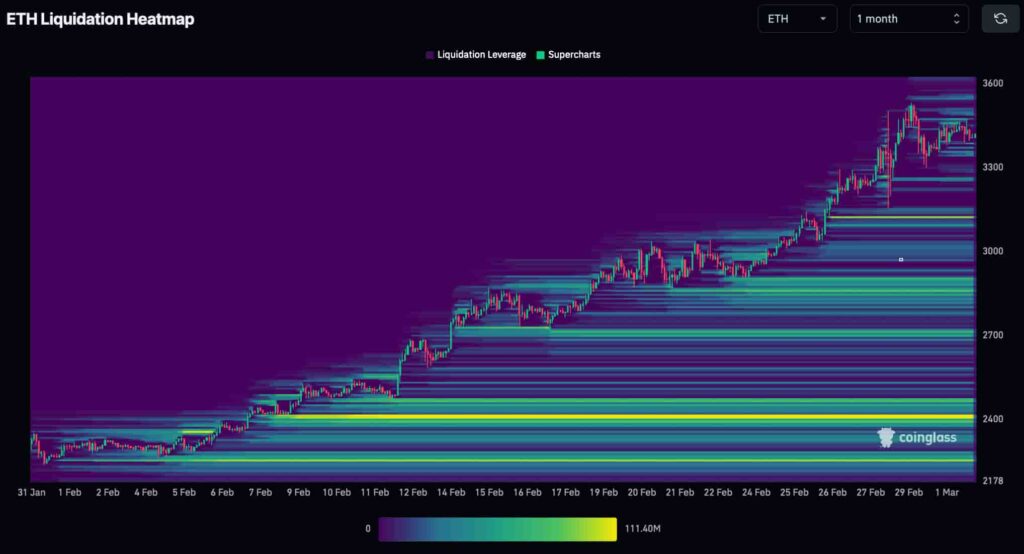

Ethereum could soon retrace to $2,400

On the other hand, Ethereum has even larger liquidity pools to the downside from February’s historical perspective. These pools point to a possible long squeeze down to $2,400, meanwhile liquidating many traders at previous levels.

Like Bitcoin, ETH could first visit the local top at around $3,500 to accumulate more long liquidations before the bigger move.

Conclusion

In summary, Bitcoin and Ethereum could soon retrace to lower levels in a correction movement following the recent rally. A long squeeze could cause 18% and 29% losses from their current prices at $61,000 and $3,400, respectively.

Notably, these are historically common retracements in the highly volatile cryptocurrency market during bull runs.

Still, the two cryptocurrencies could see a brief pump to their local top before moving down, or the derivatives market could shift entirely in the following weeks – eliminating this reported long squeeze treat.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.