- Arbitrum saw a daily active address number of over 400,000.

- This was the first time in history that it saw such a number.

Arbitrum [ARB] has recently achieved a new milestone in one of its critical metrics, solidifying its position as a leader among Ethereum [ETH] Layer 2 solutions.

However, despite this achievement, an examination of another related metric indicates that the recent development has yet to have an impact in that aspect.

Arbitrum sets active address record

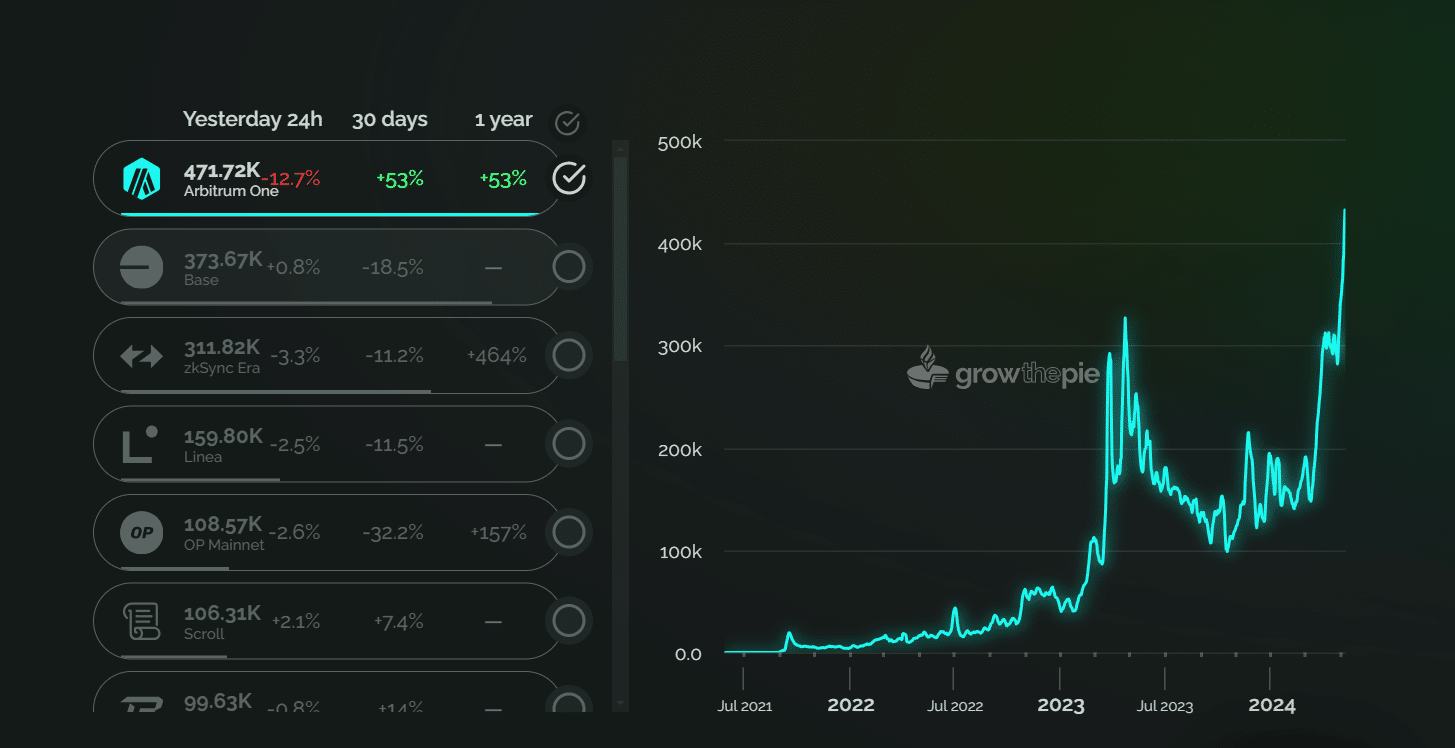

According to data from GrowthePie, Arbitrum recently set a new record for daily active addresses.

Analysis of the active addresses chart revealed that on the 8th of May, the Ethereum Layer 2 network saw its daily active addresses surge to 432,531.

This was the first time in its history that it had seen such a volume of daily active addresses.

Source: GrowthePie

What’s particularly noteworthy about this data is that Arbitrum also had the highest number of daily active addresses among other Layer 2 platforms on the 8th of May.

The closest competitor was Base, but its daily active addresses were less than 400,000.

Arbitrum leads in TVL but is behind in transaction count

Analysis of the transaction chart revealed a respectable count on the 8th of May, although it did not reach a record high like the active addresses.

The chart indicated that by the end of the day, the transaction count had surpassed 1.58 million. As of the latest data available from GrowthePie, the transaction count in the last 24 hours was around 2.24 million.

Despite this robust figure, it ranked as the second-highest count, with Base recording more transactions, exceeding 2.45 million on the 8th of May.

Over the past 24 hours, Base also outpaced Arbitrum in transaction count, reaching around 2.26 million transactions.

Also, despite the surge in active addresses, there was no significant movement in Arbitrum’s volume over the last 24 hours. Data from DefiLlama indicated that the volume remained at $510.78 million on 8th May.

Furthermore, there was no noticeable impact on its Total Value Locked (TVL) at the time of writing.

Nevertheless, according to data from L2 Beats, it continued to maintain the largest TVL among other Layer 2 networks. Its TVL was around $16.6 billion as of this writing.

ARB’s negative trend struggles continue

Despite the positive developments in various metrics, the enthusiasm did not translate into a significant movement in the price of ARB.

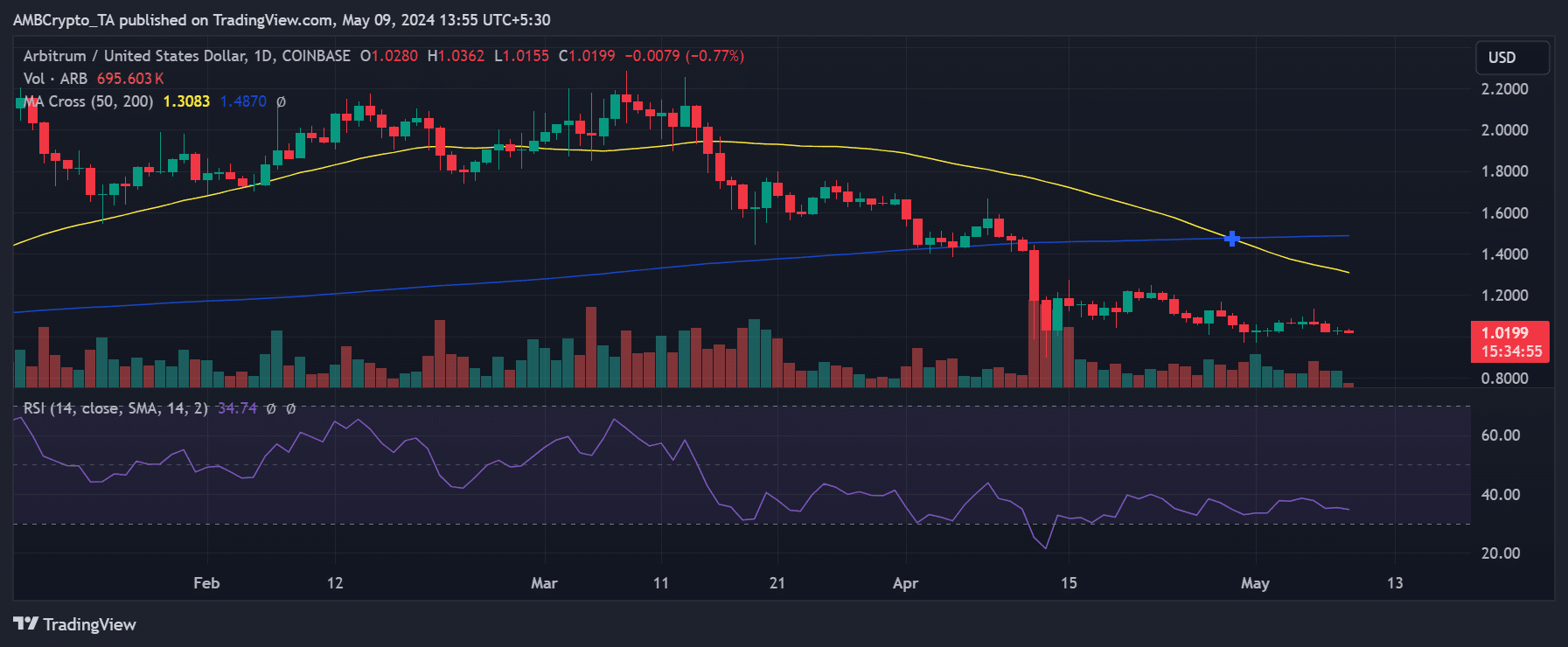

According to AMBCrypto’s analysis of ARB’s daily trend, it has remained on a downward trajectory.

Realistic or not, here’s ARB’s market cap in BTC’s terms

Although there was a minor uptick observed on the 8th of May, amounting to less than 1%, the overall trend has been bearish.

Source: TradingView

As of this writing, ARB was trading at around $1.01, reflecting a decline of around 0.7%. Also, the Relative Strength Index (RSI) indicated that ARB was entrenched in a strong bearish trend.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.