- Demand for ETH grew as put-to-call ratios declined

- ETH’s price action remained stagnant as prices fluctuated

Ethereum [ETH] has remained stagnant around the $3500-mark for quite some time now. Despite its sideways movement, however, bullish sentiment around ETH has been growing.

Ethereum demand surges

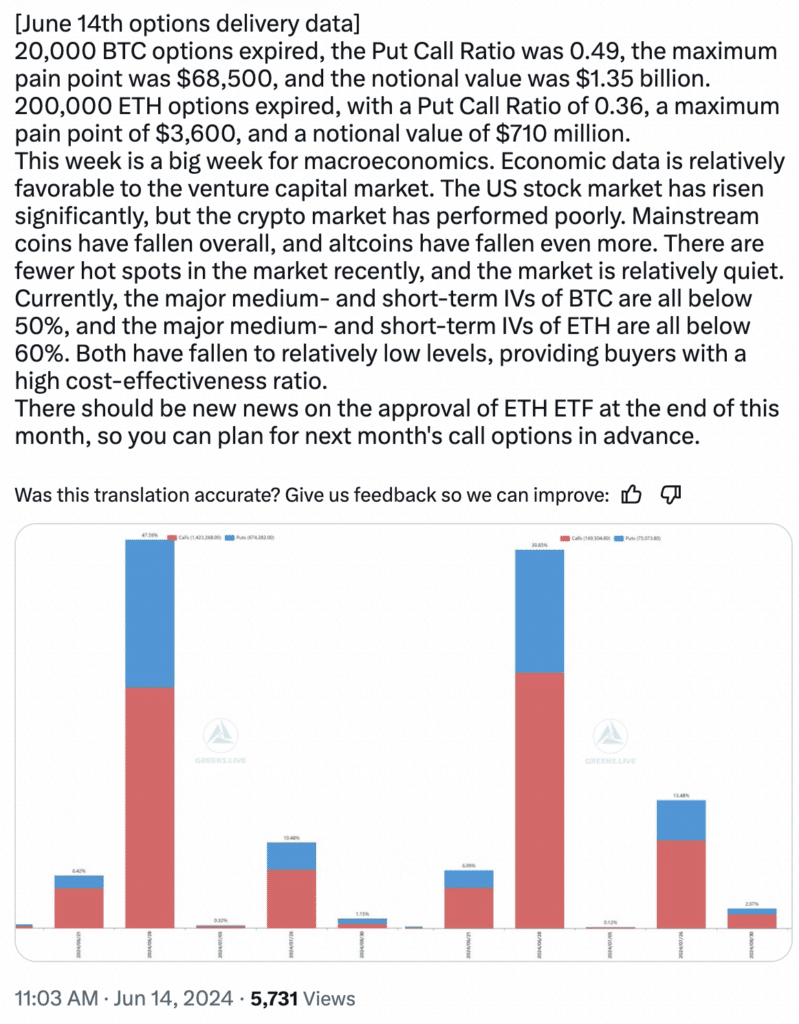

According to recent data, 200,000 Ethereum options contracts recently expired, and the data surrounding this event hinted at a surge of bullish sentiment in the Ethereum market. The Put-Call Ratio, a key indicator of market bias, sat at a low 0.36 at press time.

This means there has been significantly less buying of put options compared to call options – A sign that most options traders anticipate Ethereum’s price to rise. Further adding to the optimism is the maximum pain point of $3,600. This price level signifies the point where most options contracts expire worthless.

If Ethereum surpasses $3,600 at expiry, most call options will be profitable, again reflecting a bullish bias.

Finally, low implied volatility (IV) below 60% across all short-term ETH options contracts further fueled the bullish outlook. Here, implied volatility reflects expected price movement, and lower IV suggests investors anticipate Ethereum’s price to remain stable or hike in the near term.

Source: X

Looking at the price movement

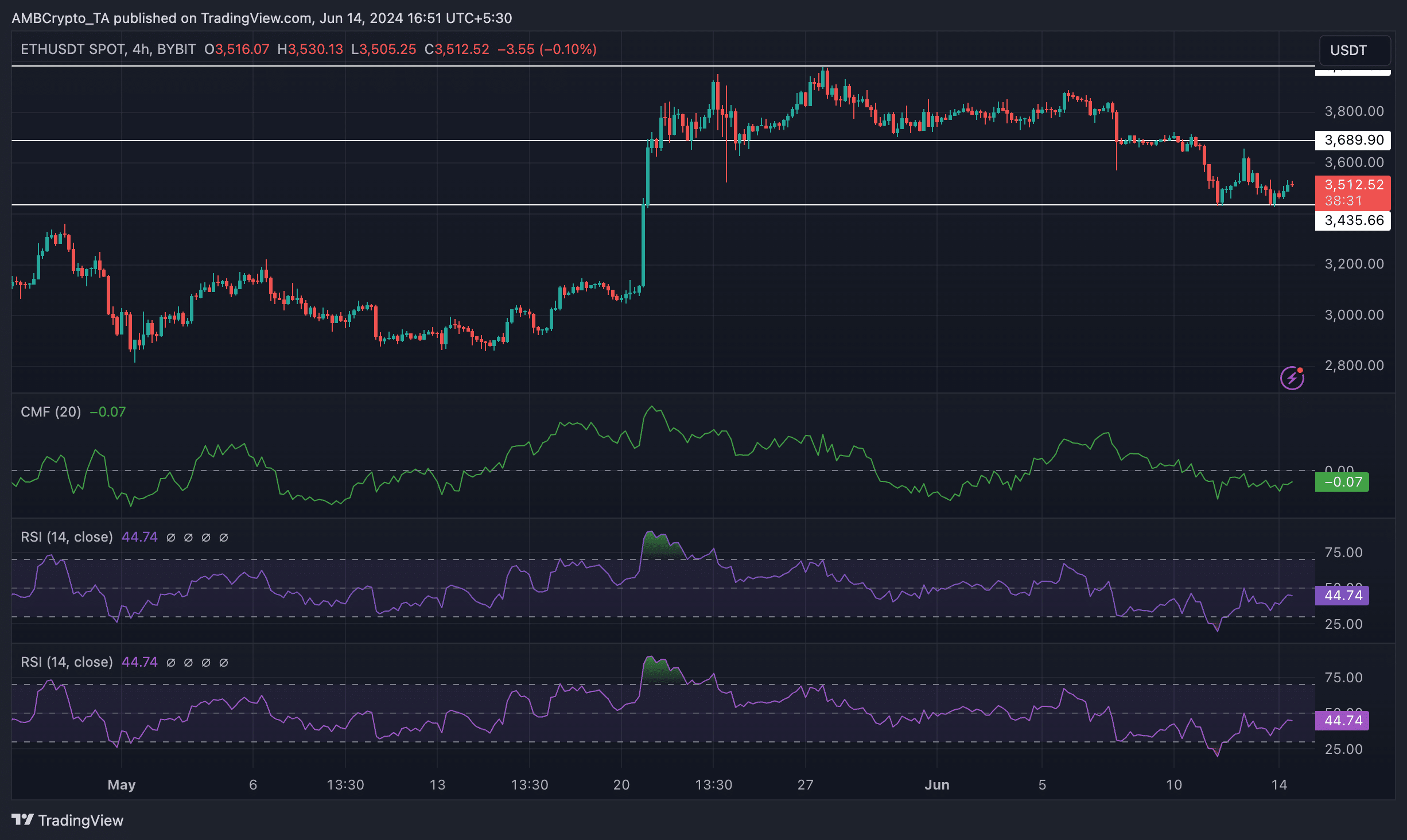

At press time, ETH was trading at $3,512.52. While the price of ETH has appreciated significantly after 20 May, as time went on, the bullish sentiment around ETH depleted itself. In fact, as the altcoin’s price fell again after 27 May, its market trend reversed itself too.

If bearish sentiment persists, the price of ETH could go down to the $3,000-level. The CMF (Chaikin Money Flow) for ETH fell significantly during this period as well.

This indicated that the money flow for ETH fell materially. The RSI (Relative Strength Index) for ETH was also relatively low. The declining RSI could be a sign of ETH’s bullish momentum waning on the charts.

Source: Trading View

How will new addresses adapt?

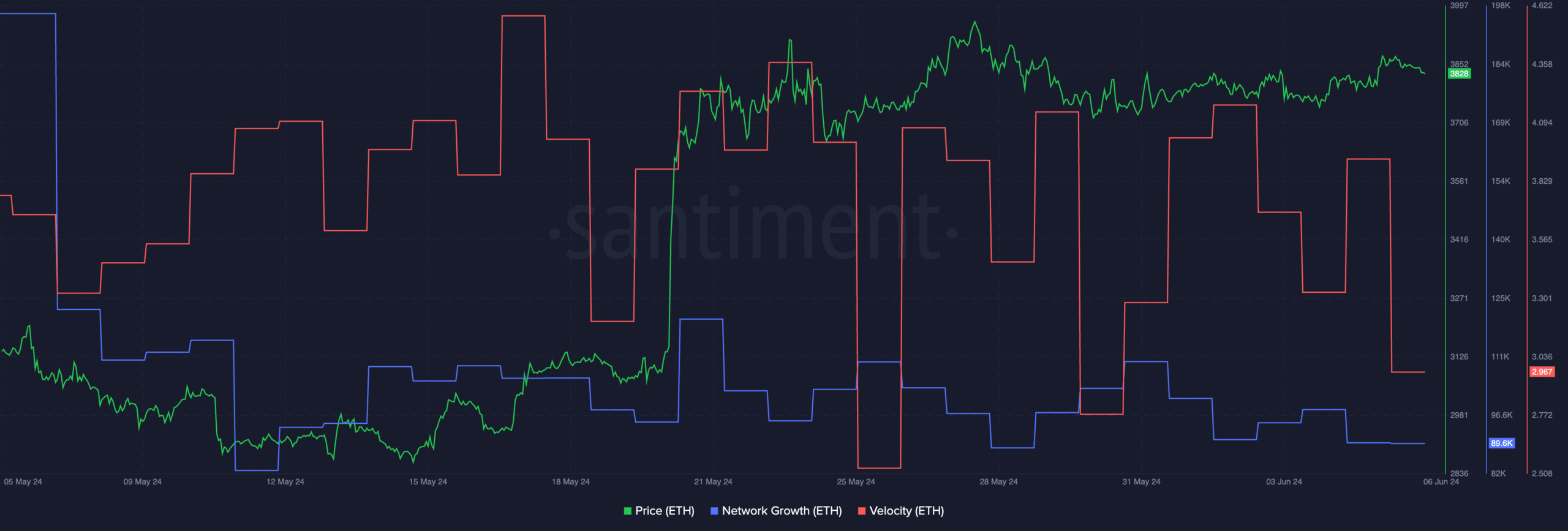

AMBCrypto’s analysis of Santiment’s data revealed that the network growth for ETH also fell materially as the price of declined. The falling network growth implied that new addresses have been losing interest in ETH and were not willing to buy the altcoin at the recent discount.

Read Ethereum (ETH) Price Prediction 2024-25

If this trend continues and addresses the refusal to buy more ETH, it may further impact the price of ETH negatively.

Moreover, the velocity of ETH also plummeted during this period, implying that the frequency at which the trades were occurring had also fallen significantly over the last few days.

Source: Santiment

However, if the popularity of ETFs continues to rise, the overall interest in ETH will also grow significantly as Wall Street money flows in.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.