U.K.

Sunak to tackle ‘sick note culture’ in speech on welfare reform

The economics of running

Science

Unlock the Editor’s Digest for free Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter. Parkrun, a …

Mystery of cave known as ‘most dangerous place on Earth’ that left visitors with one of the deadliest diseases known to man

Health

Featured Image Credit: Getty Stock Images / Mount Elgon National Park The cave has welcomed all sorts of visitors over time, but …

Nursery manager accused of manslaughter of baby girl sang ‘stop whinging’ before tragedy, jury told

U.K.

A nursery manager on trial for the manslaughter of a baby girl ‘took against’ the child for ‘some inexplicable reason’ – and …

Major update on baby stabbed in Westfield Bondi Junction attack

World

By David Southwell For Daily Mail Australia 07:59 19 Apr 2024, updated 08:41 19 Apr 2024 In welcome news the baby who …

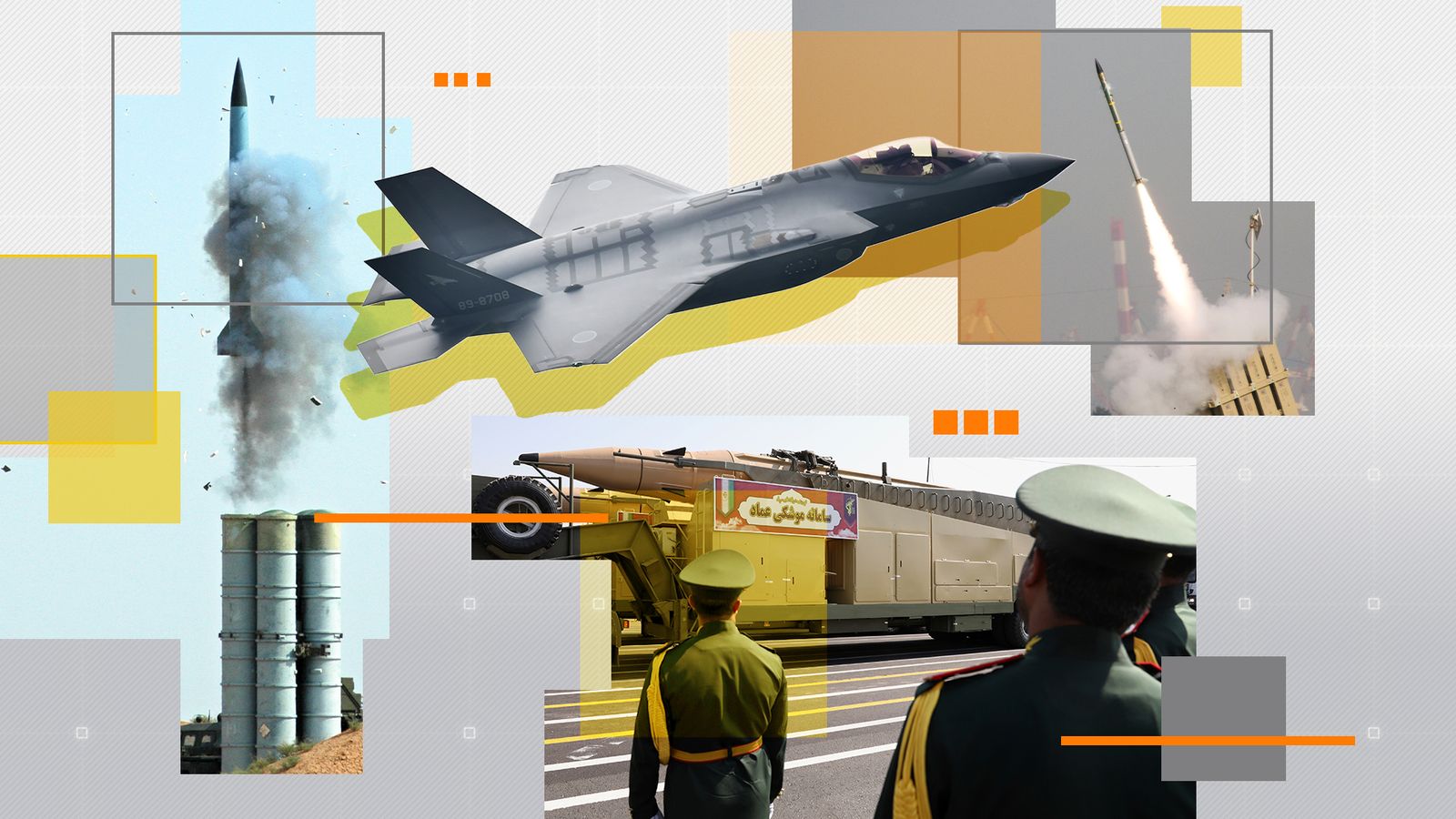

Google fires 28 staff after protests against cloud contract with Israel | Israel War on Gaza

Business

Tech giant says employees engaged in ‘completely unacceptable behaviour’ during sit-in at company offices. Google has fired 28 employees following a sit-down …

Meta’s AI tells Facebook user it has disabled, gifted child in response to parent asking for advice | Science & Tech News

Technology

The bot responded in a privating parenting group and even named the school its child had supposedly attended. One user who spotted …

Taylor Swift surprises fans with secret ‘double album’ edition of her new record

Entertainment

For free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails Sign up to …

Man City face unthinkable Erling Haaland and Kevin De Bruyne decision they don’t want to make

Sports

Manchester City needed to find a goal against ‘Kings of Europe’ Real Madrid on Wednesday night. So they took off Erling Haaland. …