- The price of SuperRare crypto soared to yearly highs of above $0.34 on the 19th of August before a sharp downward correction.

- RARE’s rally was influenced by a surge in volume and transactions on the NFT marketplace, alongside rising Open Interest.

The cryptocurrency market experienced mild volatility on the 19th of August, with most top-ten altcoins trading within a narrow range.

However, SuperRare [RARE] has been on a wild ride, with the crypto’s price jumping to a yearly high before a sharp downward correction.

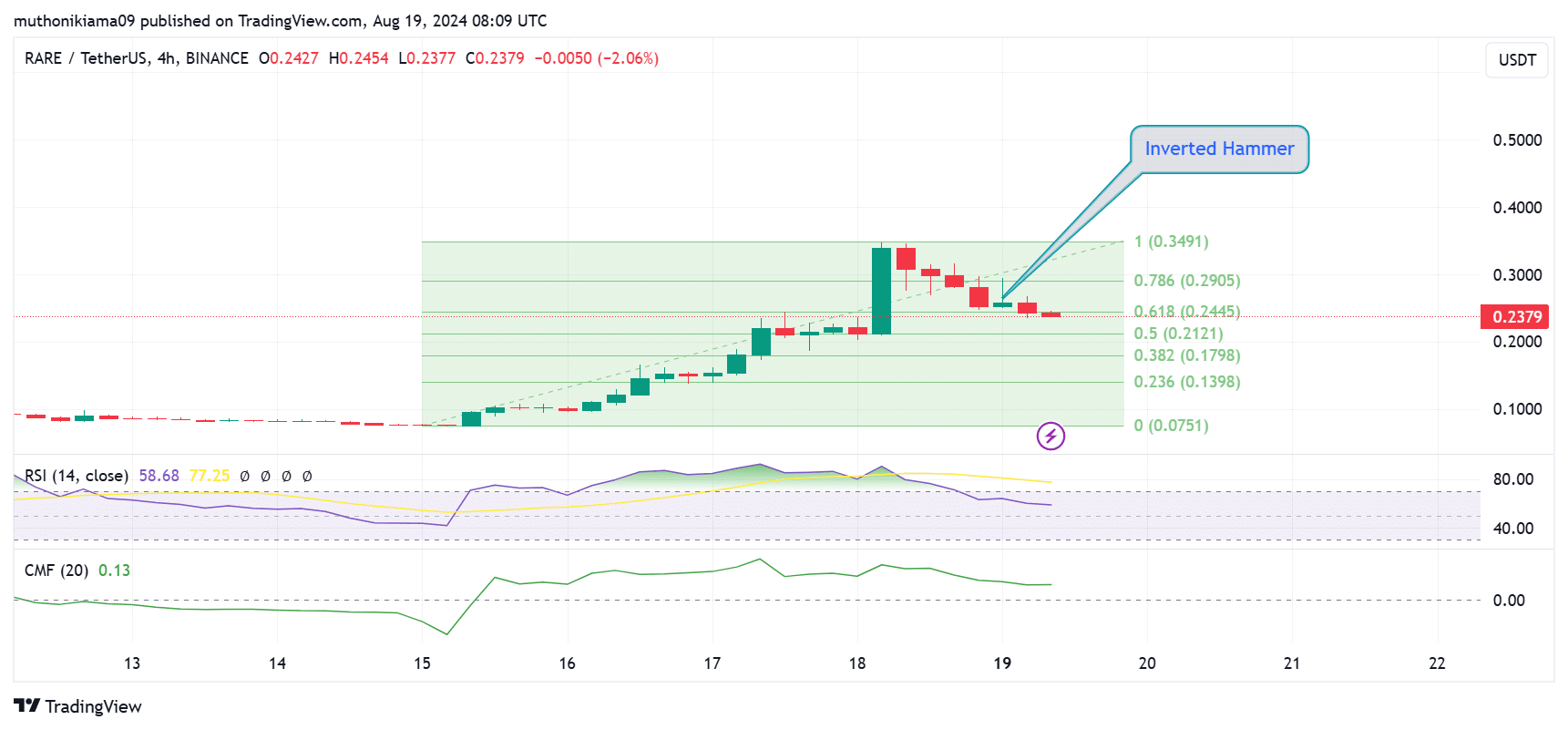

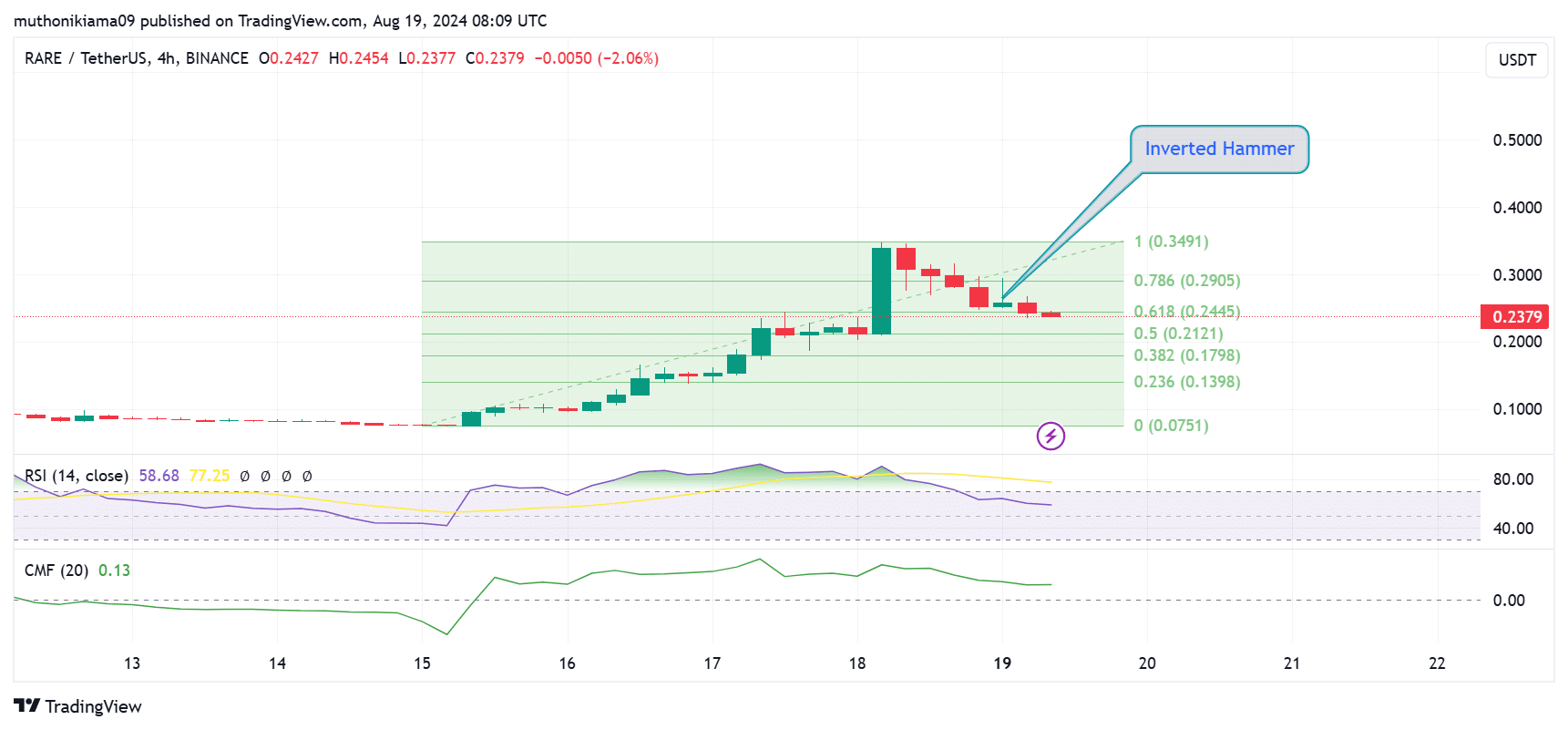

RARE was trading at $0.245 at the time of writing. The uptrend seems to have lost steam after the token reached overbought levels.

SuperRare crypto loses momentum

The past seven days have been extremely volatile for SuperRare crypto, with the price moving from $0.07 on the 15th of August to $0.34 at press time, its highest price since August 2022.

Thus, RARE’s price was up 175% in the last seven days.

However, the rally appeared to be cooling off, with the crypto price down by 25% at the time of writing. The market is pulling back after intense buying pressure into the rally that saw SuperRare hit overbought levels.

Technical indicators were now showing a sharp reversal. The Relative Strength Index was at 58 at press time after reaching overbought levels above 80, suggesting a bearish reversal.

The RSI line was also tipping south, having shifted below the signal line, showing that the bullish momentum was weakening.

Source: TradingView

The dominance of sellers over buyers in the market can also be seen in the Chaikin Money Flow (CMF), which has formed a lower high despite maintaining a positive value at 0.13.

SuperRare also formed an inverted hammer on the four-hour chart, followed by two red candles.

This pattern indicated that the crypto price attempted to move higher, but sellers countered the rally. The candle formation suggested that the bearish sentiment is strong and there is a risk of further downside.

If the 0.618 Fibonacci level ($0.24) fails to hold, RARE will test the support at 0.5 Fib ($0.21). Failure to hold this support risks a retracement to $0.13, and wiping out most of the recent gains.

What stirred the rally?

One of the factors behind the SuperRare crypto rally is an uptick in transactions on the non-fungible token (NFT) marketplace.

Per DappRadar data, the number of transactions has surged by 73% in the last seven days. Volumes on the platform have also increased by 145% to $243,000 at press time.

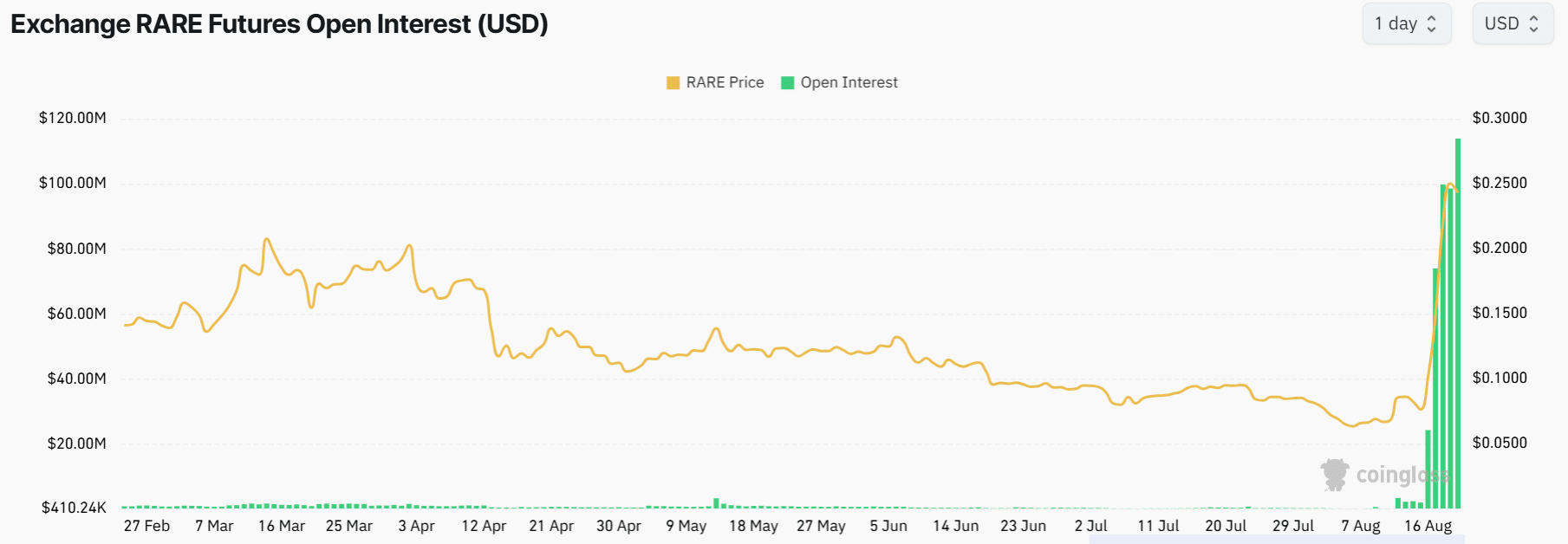

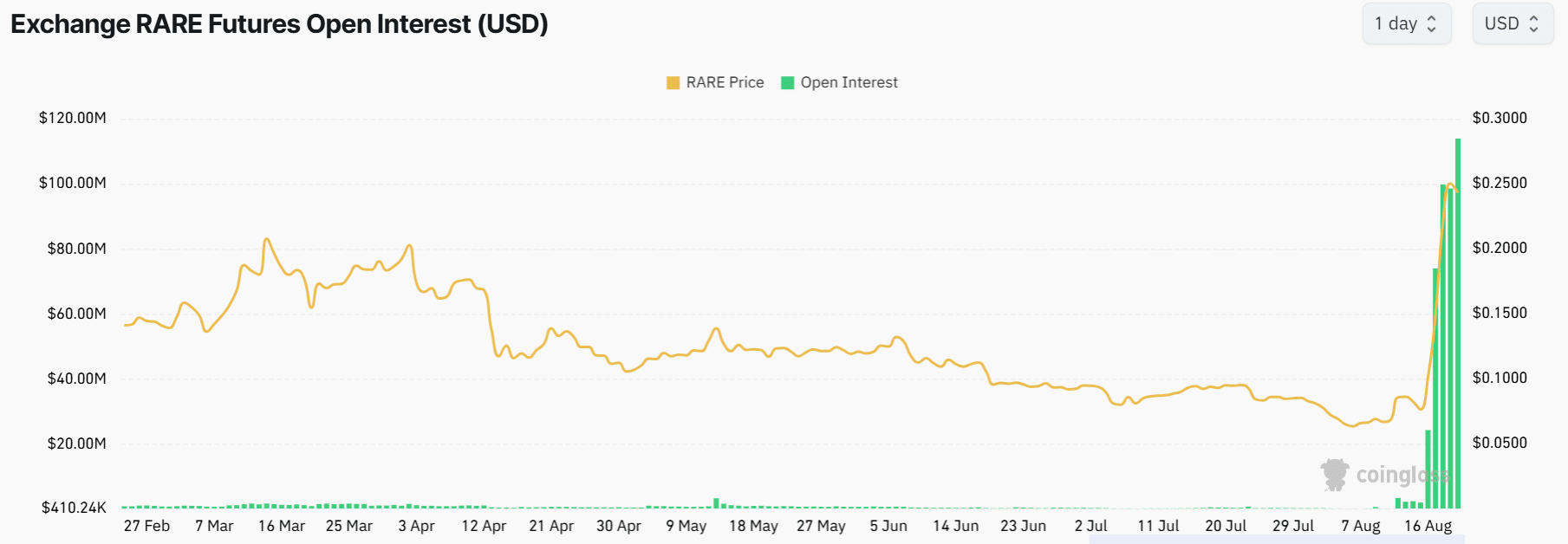

Increased market interest also stirred the SuperRare crypto rally. Coinglass shows RARE had an extended period of significantly low Open Interest. The metric shot up last week, coinciding with the price increase.

Open Interest has climbed from around $3 million to $114 million at press time.

Source: Coinglass

Data from IntoTheBlock further showed mostly bullish signals around SuperRare, with a significantly high number of wallets being “In The Money” at press time.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.