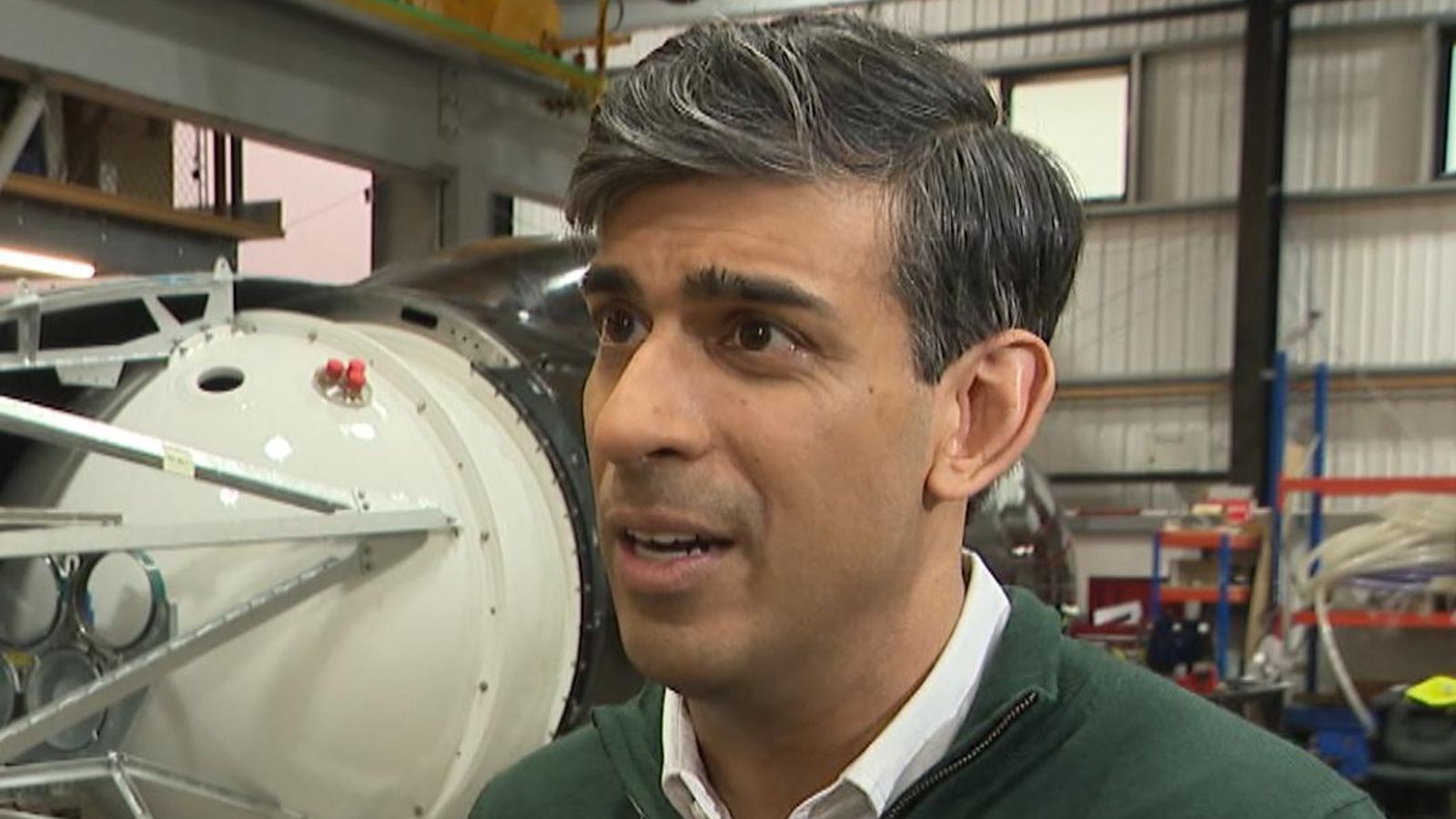

Rishi Sunak has published his personal tax return, showing he paid more than £500,000 in UK tax last year, as his total income rose to £2.2 million.

The summary of the prime minister’s financial affairs was slipped out on Friday afternoon as parliament was in recess.

Politics Live: Sir Rod Stewart says Labour ‘deserve a crack’ at power

The document shows he paid a tax bill of £508,308 in the financial year 2022-23 – around £75,000 more than what he paid in the previous year.

Mr Sunak made nearly £1.8 million through capital gains – up from £1.6 million in 2021/22 – as well as £293,407 in other interest and dividends.

All of the investment income and capital gains came from a US-based investment fund listed as a blind trust, according to the summary.

He also earned £139,477 from his roles as an MP and prime minister.

Rather than a full tax return, Number 10 published “a summary” of Mr Sunak’s UK taxable income, capital gains and tax paid over the last tax year as reported to HM Revenue & Customs. It was prepared by accountancy service Evelyn Partners.

A summary of his tax affairs for the year 2021/22 was also published last March, showing the prime minister paid £432,493 in taxes that year.

The latest document shows the Tory leader’s total income was up 13% from the previous year, rising from nearly £2 million to £2.2 million.

He paid an overall tax rate of about 23% of his annual income, because most of his earnings were in the form of capital gains, which is taxed at a lower rate than income.

Mr Sunak vocally backed the slashing of the top rate of capital gains tax from 28% to 20% by the Tory government in 2016.

Capital gains tax is a tax on gains made on the value of your assets (things that you own). The top rate is 28%, compared to the top rate of income tax which is 45%.

Why did the prime minister publish his tax returns?

Mr Sunak first said he would publish his tax returns during his unsuccessful campaign to be Tory leader against Liz Truss in the summer of 2022.

The prime minister is thought to be one of the richest MPs in parliament and his personal wealth has long been used by opponents to attack him as being “out of touch”.

Read More:

Sunak accused of making ‘depraved bet’ with Piers Morgan on Rwanda plan

Who is Rishi Sunak’s wife Akshata Murty – and why are her family so wealthy?

Mr Sunak and his wife, Akshata Murty, the daughter of the billionaire co-founder of Indian IT giant Infosys, have a combined wealth estimated at about £529 million, according to 2023’s Sunday Times Rich List.

Pressure about their finances started piling on Mr Sunak while he was chancellor, after it emerged Ms Murty had non-dom status – meaning she did not have to pay UK tax on her international income.

Following a significant backlash, Ms Murthy announced she would pay UK tax on all her worldwide wealth to stop the issue from acting as a “distraction for her husband”.

However, the calls for the prime minister to release his tax details then grew louder following the controversy around Nadhim Zahawi, who was sacked as Tory Party chairman in January 2023 after he failed to disclose millions of pounds in tax.

Mr Sunak, a former investment banker and hedge fund manager has hit back at critics of his vast wealth, saying he “worked really hard for everything that I’ve got” and that those using it as a “political smear” lacked ambition for the country.

Chancellor Jeremy Hunt, whose tax summary was also published, paid a total of £117,418 in UK tax in 2022/2023.

His total income before tax was £416,605.

William Turner is a seasoned U.K. correspondent with a deep understanding of domestic affairs. With a passion for British politics and culture, he provides insightful analysis and comprehensive coverage of events within the United Kingdom.