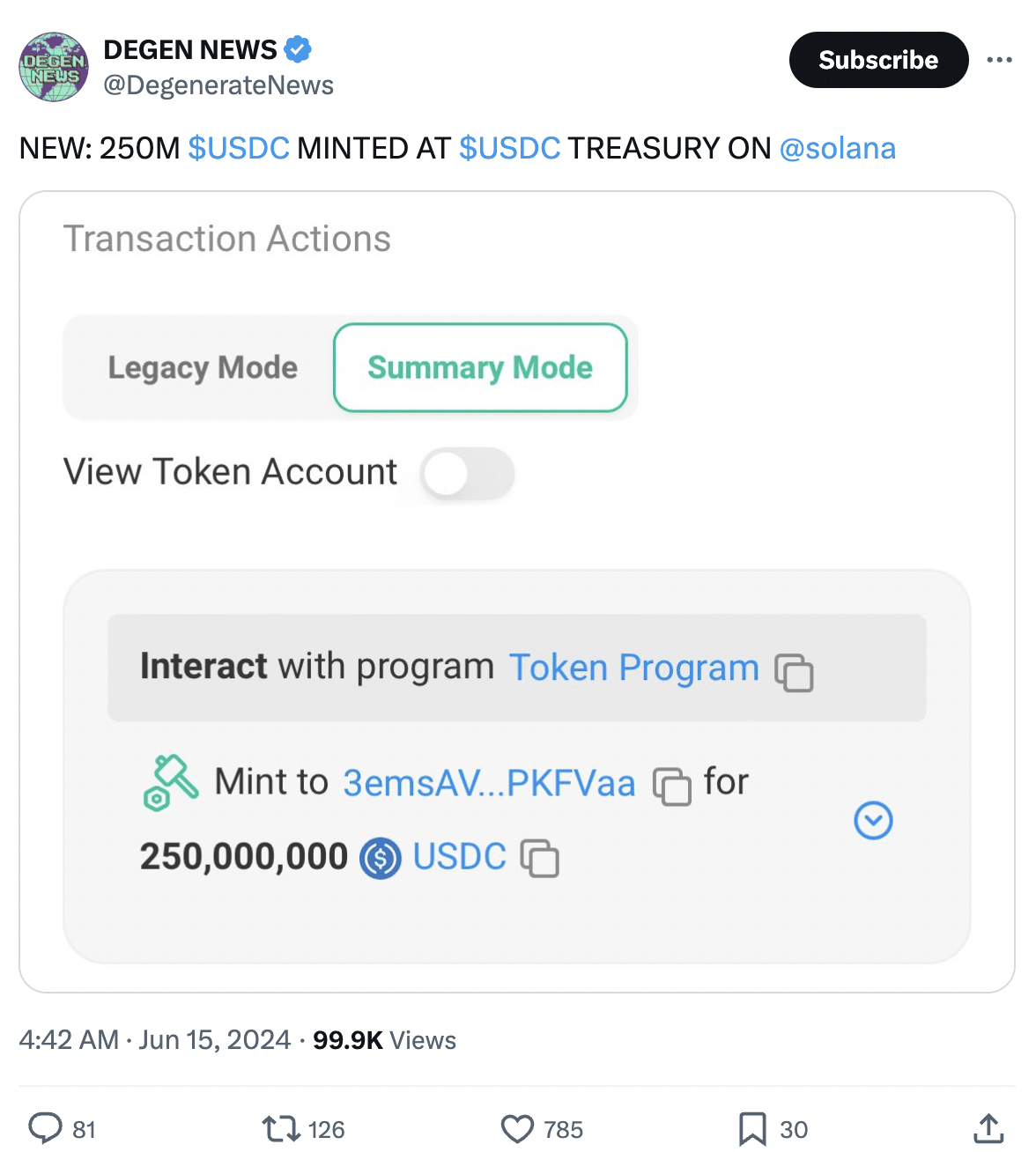

- In the last 24 hours, $250 million worth of USDC was minted on the Solana network.

- Activity on the Solana network fell materially.

250 million worth of USD Coin [USDC] was minted on Solana [SOL] in the last 24 hours. This will significantly boost the liquidity pool within the ecosystem.

Liquidity is critical for the efficient operation of various DeFi applications and decentralized exchanges (DEXs) built on Solana.

Source: X

What’s next?

With more USDC readily available, these platforms will be able to function more smoothly, facilitating transactions and fostering an improved environment and ecosystem for users.

Moreover, the recent surge in minting and buying memecoins on the Solana network might get a welcome boost from the influx of $250 million USDC.

Memecoins, by their nature, are highly speculative and often lack real-world utility.

However, they thrive on hype and community engagement. The easy availability of USDC could act like gasoline on this fire.

Users can quickly convert their USDC into memecoins, participating in the current trend without needing to convert their holdings from other cryptocurrencies.

This could lead to a further increase in memecoin trading activity on Solana.

Will SOL thrive?

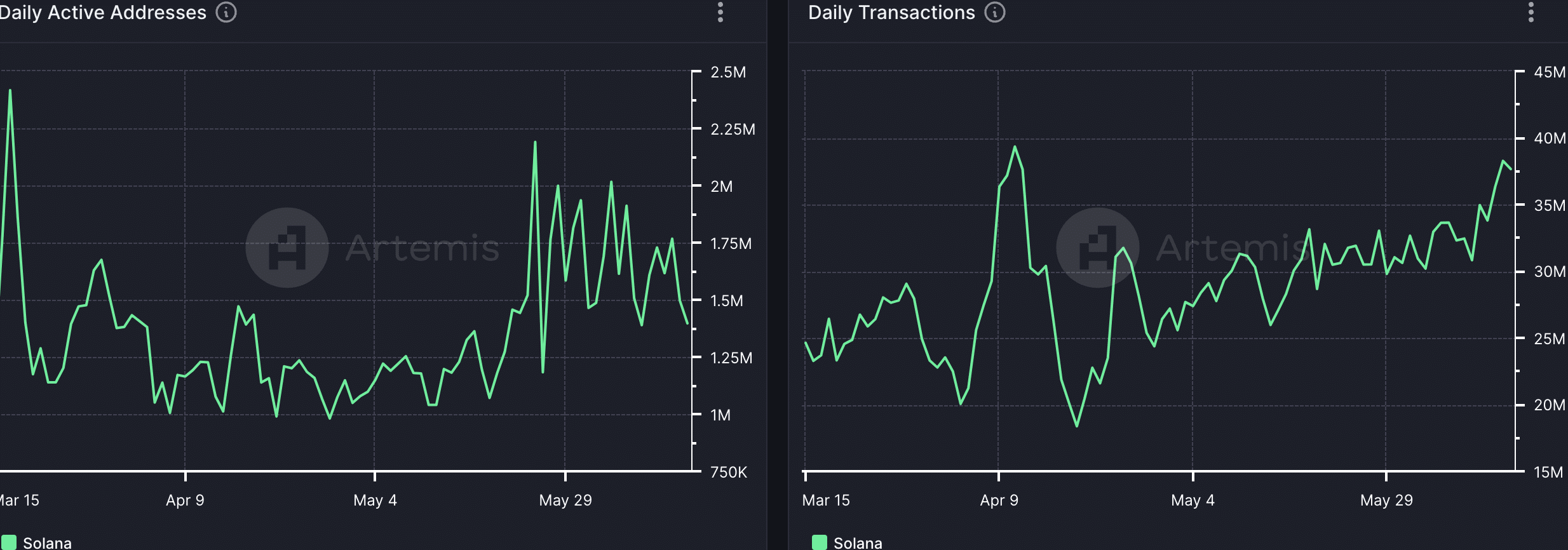

Coming to the state of the network, it was seen that the daily number of active addresses on the Solana network had declined, however, the number of transactions occurring on the network had soared.

The decline in Daily Active Addresses could indicate a decrease in the number of unique users interacting with the Solana network.

However, the soaring transaction volume suggested that existing users might be engaging in more frequent, smaller transactions.

Source: Artemis

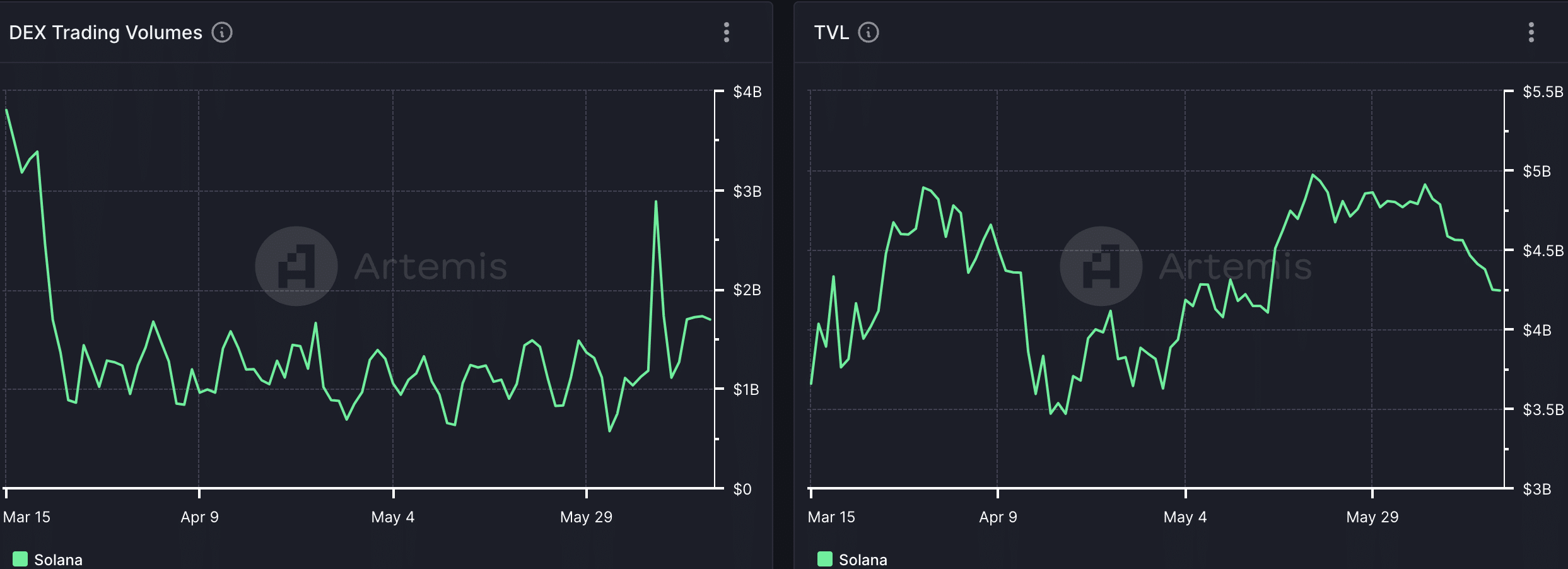

Moving on to the state of DeFi, it was seen that TVL (Total Value Locked) and DEX volumes had fallen. A decline in DEX volume could also indicate a decrease in user activity within Solana’s DeFi ecosystem.

This might lead to a drop in investor confidence, potentially creating a negative feedback loop and further reducing TVL and user engagement.

Source: Artemis

Is your portfolio green? Check out the SOL Profit Calculator

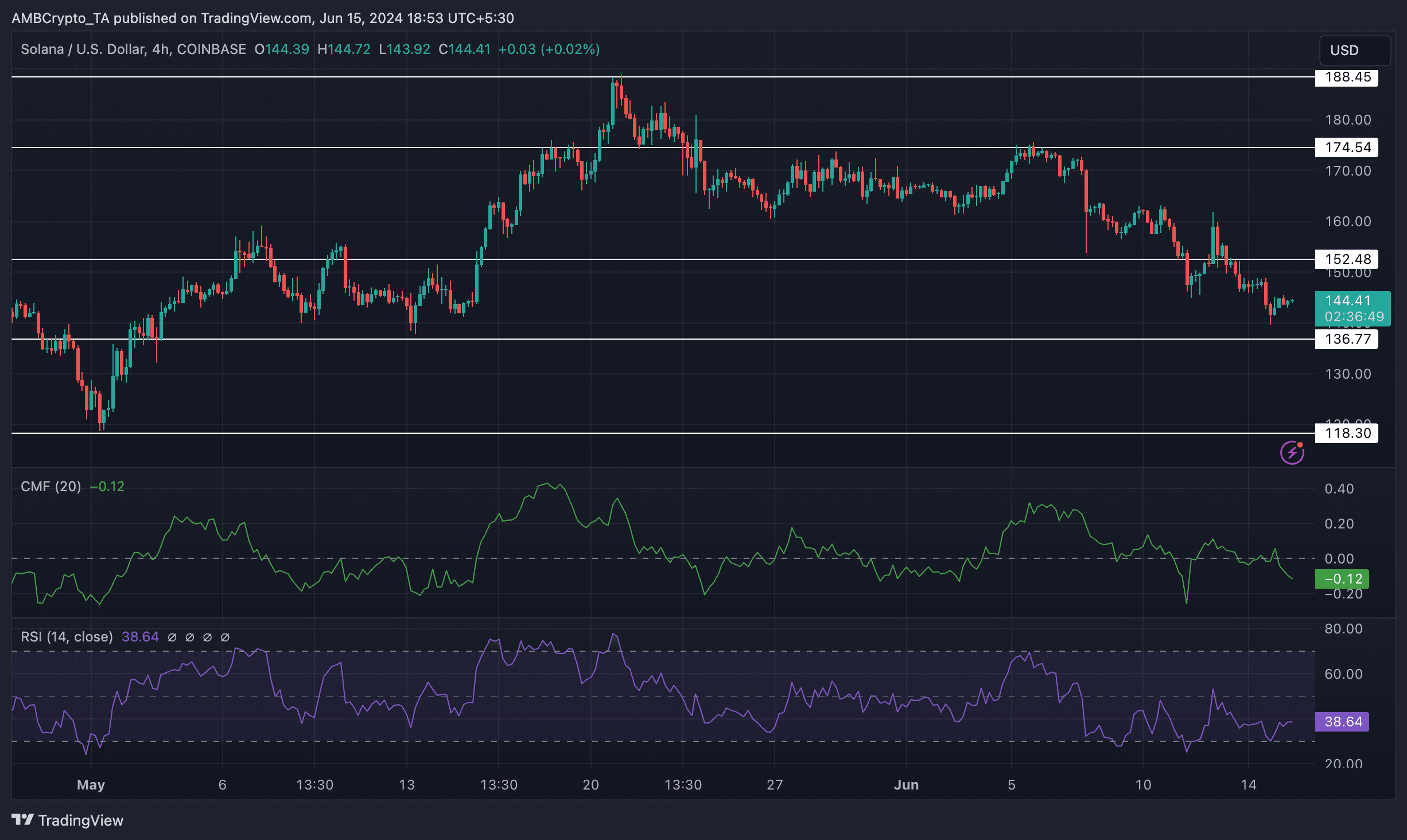

At press time, SOL was trading at $144.21 and its price had fallen by 2.50% in the last 24 hours. It had been following a bearish trend since the past few weeks.

The CMF (Chaikin Money Flow) had fallen significantly as well, implying that the money flowing into SOL had declined.

Source: Trading View

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.