- SEC issued a Wells Notice to Robinhood for potential securities violations.

- Robinhood responds proactively to regulatory challenges by adjusting operations.

Once again, the United States Securities and Exchange Commission (SEC) has issued a Wells Notice, this time directed toward Robinhood Markets, Inc.

What’s the matter?

In an 8-K filing submitted over the weekend, Robinhood disclosed that it had received a Wells Notice from the SEC’s staff.

The notice suggests that the SEC may take action against the trading platform for purported securities violations.

Shedding light on the issue, Dan Gallagher, chief legal, compliance, and corporate affairs officer at Robinhood, in a blog post, said,

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be.”

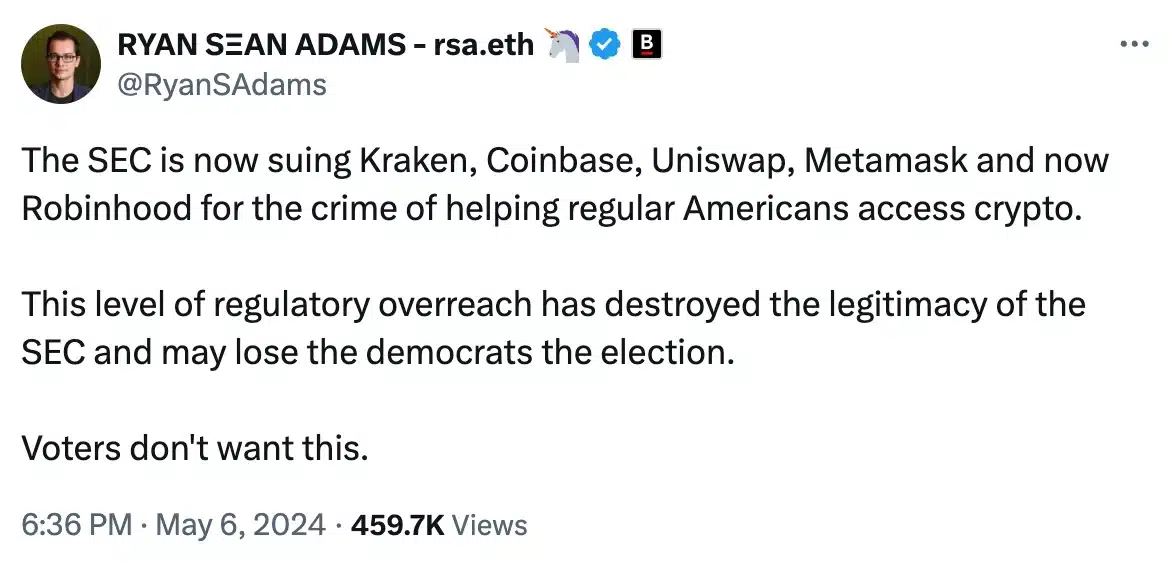

Underlining a unique perspective on the potential impact on the upcoming US elections, Ryan S Adams, a known crypto investor, noted,

Source: Ryan Adams/X

Echoing similar sentiments, Hayden Adams, Uniswap’s CEO, in a separate interview with the “Bankless” podcast, noted,

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

The potential impact

The impact of the Wells Notice sent to Robinhood was immediately felt in the market.

Following the news, HOOD (Robinhood’s stock) experienced a significant downturn of approximately 10% during pre-market trading on the 6th of May.

As of the latest update, Robinhood’s stock has declined by 0.95% within the past 24 hours.

Source: Google Finance

Highlighting his disappointment on the issue, Gallagher, added,

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business.”

Interestingly, Wick, a cryptocurrency influencer noted,

Source: Wick/X

This highlights a common characteristic of bull markets, where asset prices show resilience and fail to react significantly to negative news.

The uncertain fate of Robinhood

Despite regulatory challenges and a pending SEC lawsuit, Robinhood has taken proactive steps, such as delisting tokens including Solana [SOL], Cardano [ADA], and Polygon [MATIC], and adjusting trading fees.

In conclusion, being behind other exchanges in the SEC’s timeline could benefit Robinhood for strategic adjustments and legal prep.

Yet, immediate impact hinges more on market performance and investor sentiment toward digital assets.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.