- By Michael Race

- Business reporter, BBC News

Image source, Getty Images

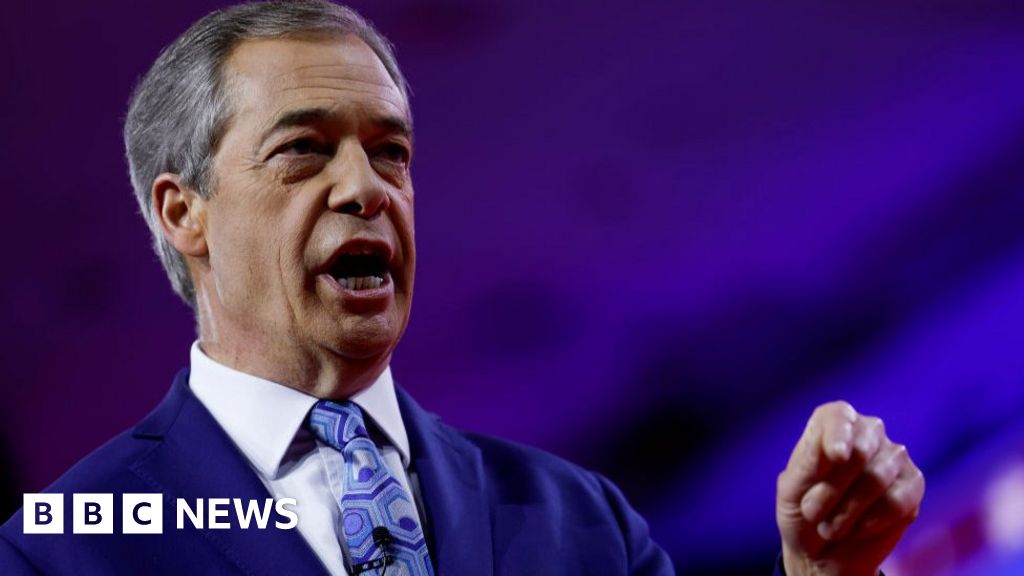

NatWest’s shares tumbled after the bank lowered its profit expectations and admitted to “serious failings” in its treatment of Nigel Farage.

An independent report found the bank failed to communicate its decision properly when it decided to shut Mr Farage’s Coutts account.

But the closure was lawful, and based mainly on commercial reasons, it said.

NatWest’s shares fell by as much as 18%, the most since the 2016 Brexit vote, on Friday.

It finished the day 11% down after its latest results disappointed investors.

The bank, which is 39% owned by the taxpayer, cut its forecasts for lending margins for the year, which it said was largely due to customers moving cash from current accounts to savings accounts. Its £1.3bn profits for the three months to the end of September also fell short of forecasts.

The results were published at the same time as the independent report by law firm Travers Smith, which had been commissioned to investigate the closure of ex-UKIP leader Mr Farage’s account.

Russ Mould, investment director at AJ Bell, said investors had turned their attention from the report “to an equally damaging profit downgrade” which he said showed “any benefit from higher interest rates seems to be evaporating” for the bank.

Mr Farage, a prominent Brexiteer, said earlier this year that Coutts, the prestigious private bank for the wealthy and owned by NatWest, planned to shut down his account and that he had not been given a reason.

However, the politician later obtained a report from the Bank which indicated his political views were also considered.

Travers Smith concluded the decision to close Mr Farage’s Coutts account was “predominantly a commercial decision” and said the bank “considered its relationship with Mr Farage to be commercially unviable because it was significantly loss-making”.

But it said other factors were considered, including Coutts’ reputation with customers, staff and investors due to Mr Farage’s public statements on issues such as the environment, race, gender and migration.

Travers Smith said these public views were not a determining factor in closing his Coutts account, but the law firm did “consider them to have supported the decision”.

It also said a decision taken in May 2022 to continue classifying Mr Farage as a Politically Exposed Person or PEP was “incorrect”.

Someone classed as a PEP generally presents a higher risk for financial institutions as they are deemed to be more exposed to potential involvement in bribery and corruption by virtue of their position and the influence they may hold. As a result, banks are required to do extra due diligence on them.

Mr Farage branded the review a “whitewash”, accused Travers Smith of having taken a “mealy-mouthed approach to this complex issue”, and described some of the findings as “laughable”.

Sir Howard Davies, NatWest Group’s chairman, said although the investigation confirmed the decision to close the account was lawful, “the findings set out clear shortcomings in how it was reached as well as failures in how we communicated with him and in relation to client confidentiality”.

“We apologise once again to Mr Farage for how he has been treated. His experience fell short of the standards that any customer should expect,” he added

Travers Smith said Dame Alison’s disclosures about Mr Farage “probably amounted” to a personal data breach, but added she “honestly, but incorrectly, believed that the client [Mr Farage] had publicly confirmed that he was a customer of Coutts”.

Mr Farage told the BBC’s Today programme that Dame Alison was “given a chance” to correct her error prior to information being made public but that “she didn’t”.

The financial watchdog, the Financial Conduct Authority, which regulates banks, said the review highlighted potential regulatory breaches and said it was investigating both NatWest and Coutts.

In response to Friday’s report, Dame Alison said that the review had “concluded that I inadvertently confirmed what had already been widely reported, that Mr Farage held an account at Coutts”.

“Travers Smith is clear that ‘there was no leak of specific detailed financial information’,” she added.

Despite quitting, Dame Alison is set to receive a £2.4m pay package for 2023, but could also get a further £2.8m maximum pay out in bonuses and share awards.

NatWest has said the pay out linked to share awards could yet be adjusted and that the bank could decide to “claw back” those awards at a later date. A decision is yet to be made.

Separately, the bank said it was taking several steps including one to ensure “lawfully protected beliefs or opinions of customers do not play any role” in bank account closures.

“Our job now is to make sure that does not happen again,” added Sir Howard.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.