U.K.

Angela Rayner’s husband expanded home before couple married and had second child

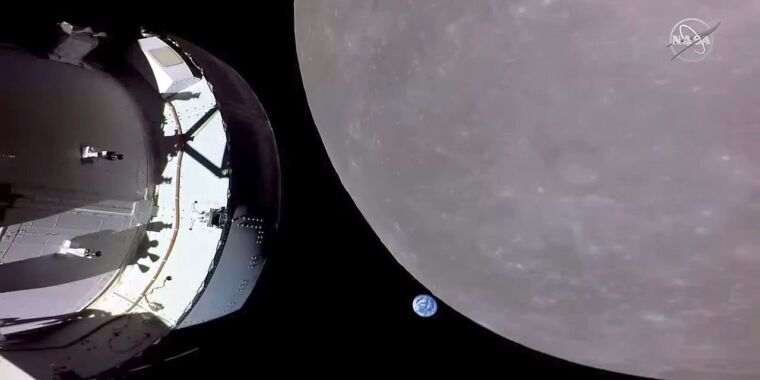

NASA may alter Artemis III to have Starship and Orion dock in low-Earth orbit

Science

Enlarge / This image taken by NASA’s Orion spacecraft shows its view just before the vehicle flew behind the Moon in 2022. …

Rise in unplanned pregnancies in women taking slimming jabs sparks warnings from top fertility experts

Health

By Emily Stearn, Health Reporter For Mailonline 15:49 19 Apr 2024, updated 16:25 19 Apr 2024 Could taking Ozempic help get you …

Woman in her 50s is found dead at luxury five star hotel in Surrey where England’s rugby team train

U.K.

A murder investigation has been launched after a woman in her 50s was found dead at a luxury five star hotel. The woman was …

What is a Sandoval hearing? Trump weighs potential testimony in New York hush money trial

World

Sign up for the daily Inside Washington email for exclusive US coverage and analysis sent to your inbox Get our free Inside …

European markets open to close: Oil, stocks, interest rates

Business

10 Mins Ago European markets close lower European markets closed lower on Friday as investors continued to monitor escalating tensions in the …

Dragon’s Dogma 2 patch makes Dragonsplague easier to spot, Pawns less likely to fall off cliffs

Technology

Capcom will release a new update for Dragon’s Dogma 2 which will make some changes to Dragonsplague and adjust some Pawn …

The Scargiver’ Debuts With Snyder’s Worst-Ever Review Scores

Entertainment

Rebel Moon Netflix Netflix has thrown so much money and advertising into Zack Snyder’s attempt to craft his own Star Wars universe, …

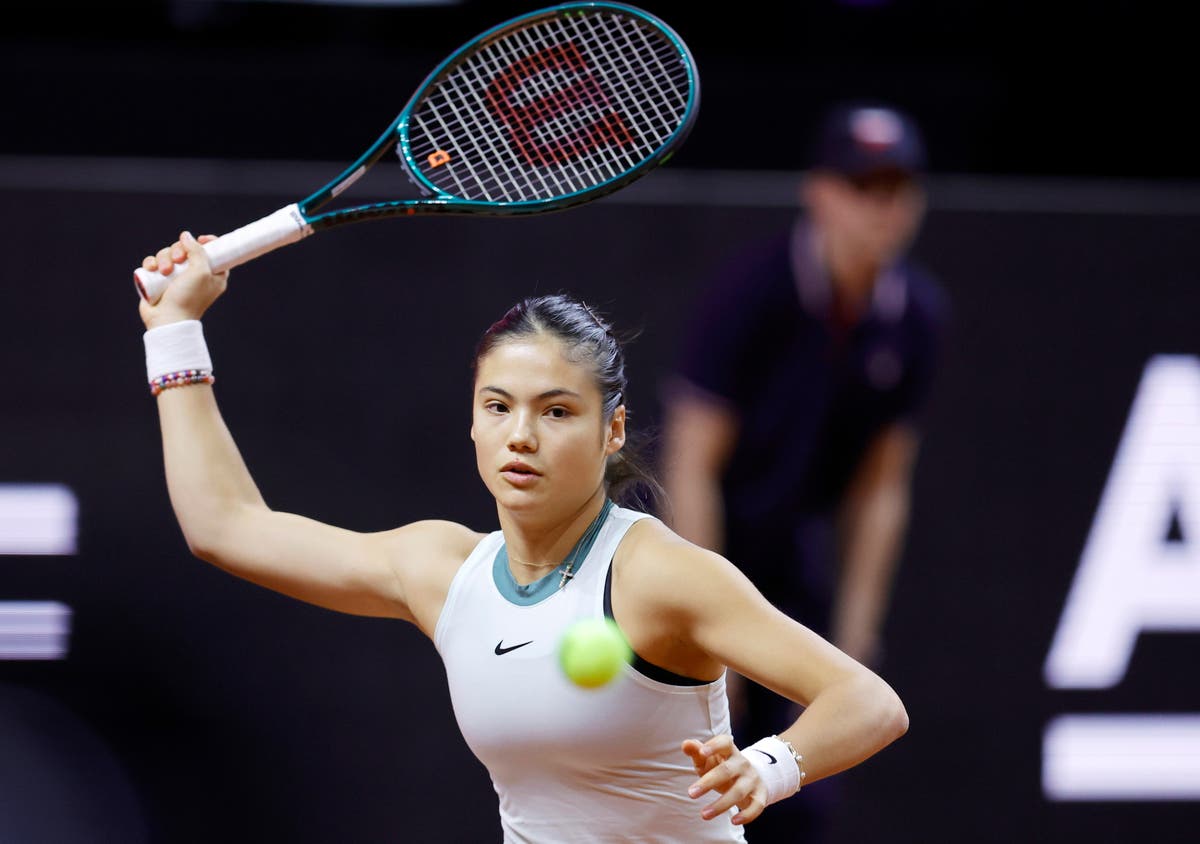

FA Cup replays scrapped: The Football Association says ‘all parties accepted’ decision

Sports

19 April 2024, 12:28 BST Updated 44 minutes ago Image source, Getty Images Image caption, Manchester City beat Manchester United in the …