- The asset management firm withdrew ADA while leaving the other five

- ADA’s price might appreciate, despite lingering negative sentiment

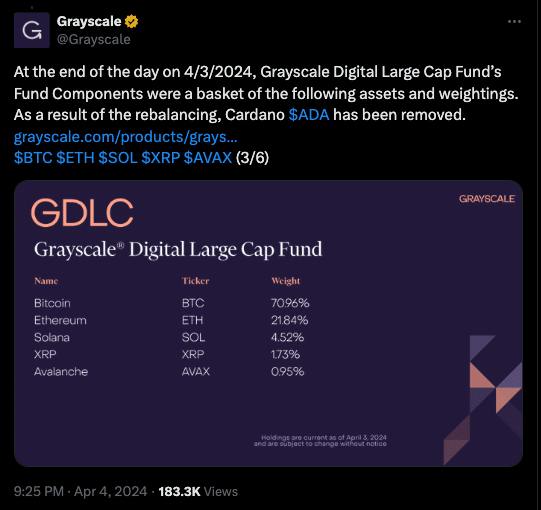

On 4 April, Grayscale revealed that it had pulled out Cardano [ADA] from its Digital Large Cap Fund (GDLC). The crypto-asset management firm noted that it decided to remove ADA as part of its quarterly rebalancing.

Interestingly, ADA was the only casualty out of the previous six. Though the firm did not disclose why it got rid of Cardano, AMBCrypto believes that it could be linked to the cryptocurrency’s price.

Source: X

Like ADA, like MATIC?

When Grayscale created the fund, its mission was to hold assets that perform well and add value to its portfolio. However, it seems that Cardano was no longer in the group of assets that did that.

On a Year-To-Date (YDT) basis, ADA’s price has fallen by 8.91%. XRP’s performance within the same period has been similar too. The firm decided to keep it, but others like Bitcoin [BTC] and Solana [SOL] have yielded good gains since the year began.

Cardano’s removal from the fund may be a sign of decreasing confidence in the token’s potential.

On previous occasions, AMBCrypto had explained how predictions could trace a possible path to $1 on the charts. However, that has not happened. Instead, the latest development implies that the token might find it challenging to hit such levels.

One reason for this assumption could be linked to Grayscale’s announcement in January. Back then, the company disclosed that it had removed MATIC from the GDLC. Since then, MATIC has found it difficult to jump back into the top-10. Also, its price has registered a 17.77% 30-day decline. Simply put, the crypto’s performance has reinforced the thesis that ADA could face a hard time now.

It’s not over yet

However, a conclusion without a proper analysis could be deemed inaccurate. Therefore, AMBCrypto checked what was happening with Cardano on-chain.

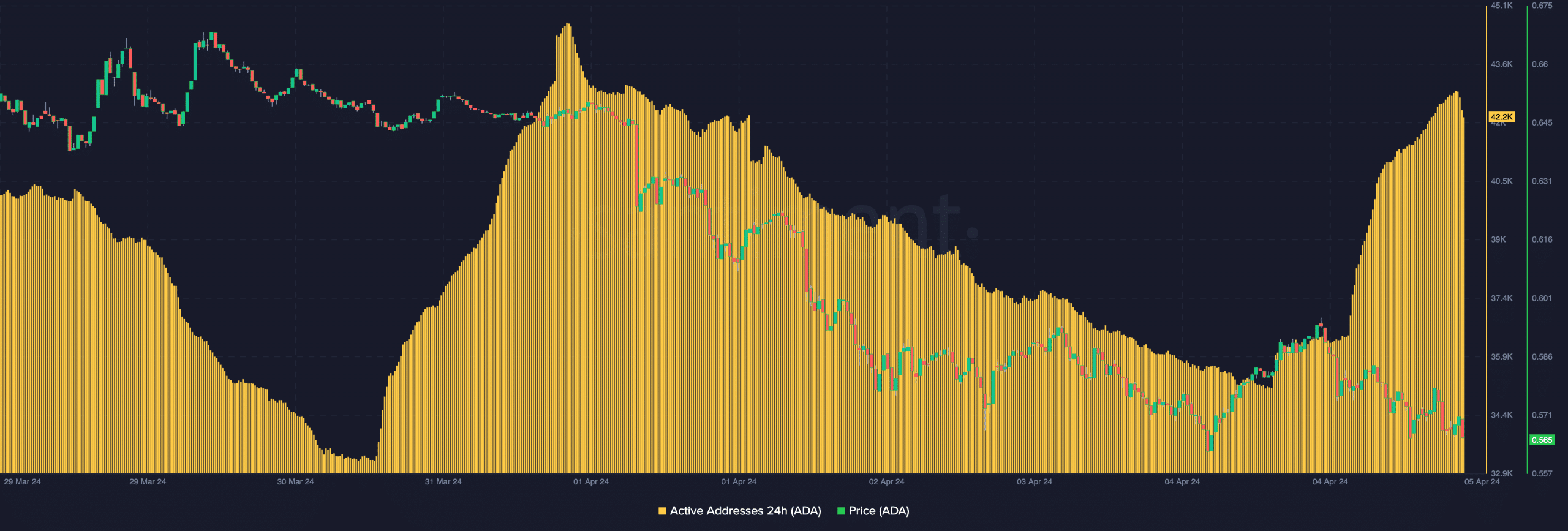

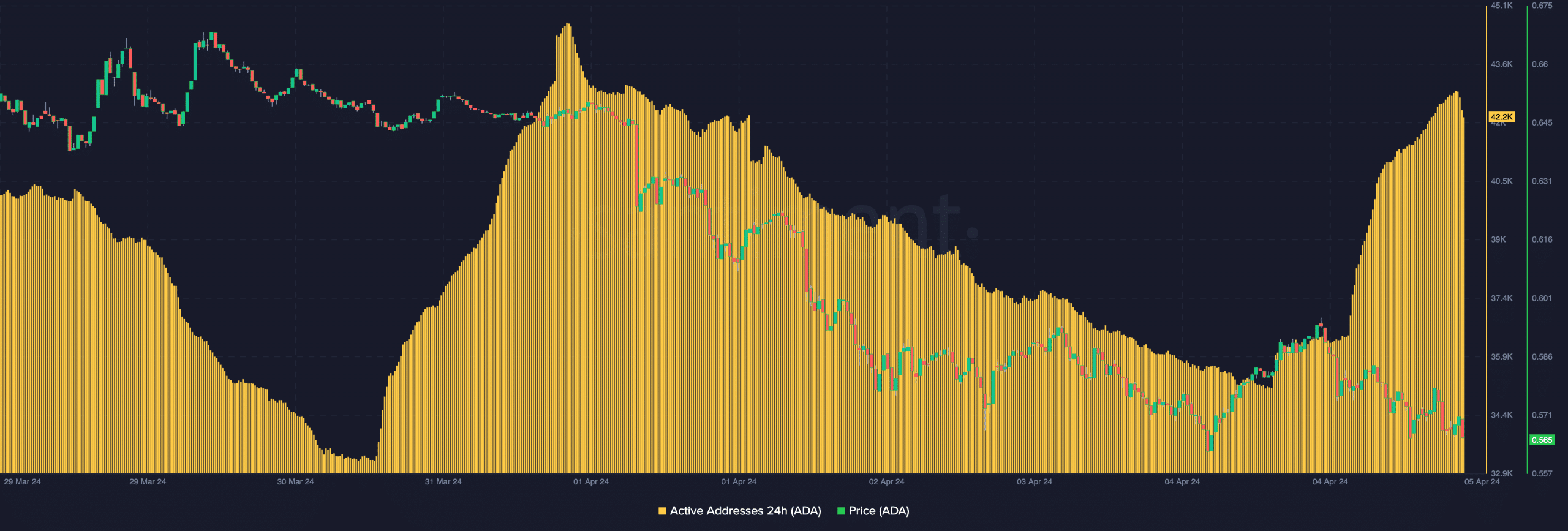

According to data from Santiment, the 24-hour active addresses jumped to 42,200 on 5 April. The rise in active addresses implies a growing interest in the use of ADA.

Source: Santiment

It also suggests a healthy network and, if possible, a price appreciation. With this metric, one can assume that Cardano might not have the same reaction to the development as MATIC. But, that’s not all.

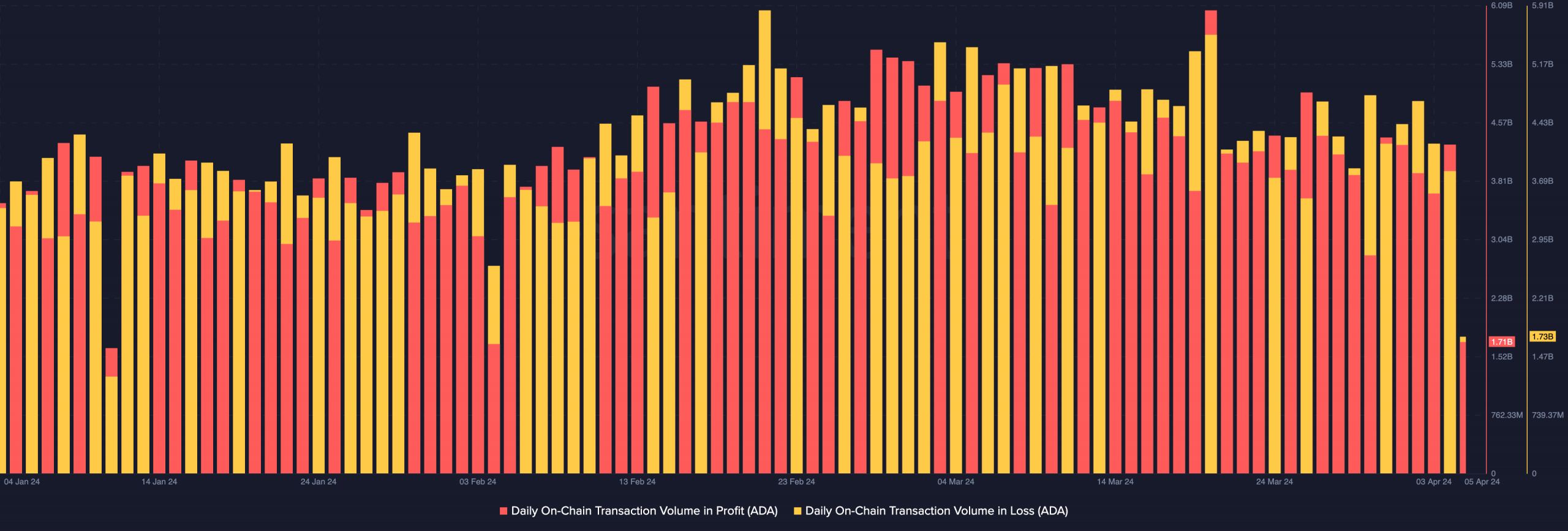

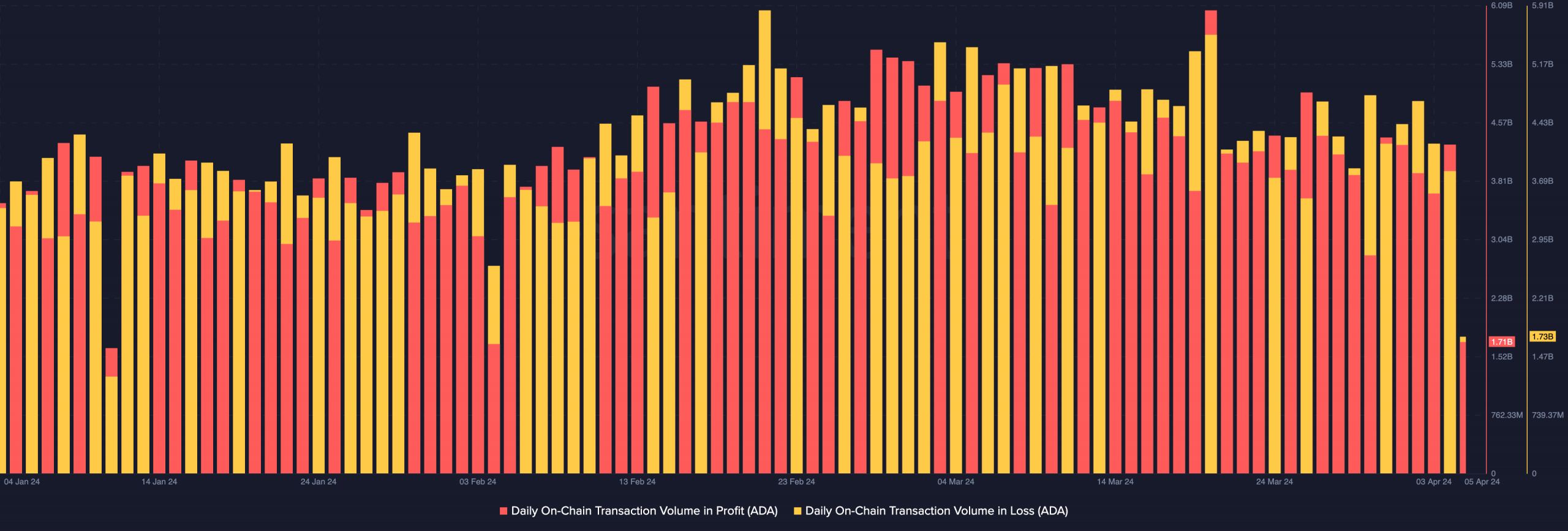

We also evaluated the daily on-chain transaction volume in loss and those in profits. At press time, ADA’s on-chain volume in profit was 1.71 billion.

On the other hand, the volume in loss was 1.73 billion. Though the number was close, the difference revealed that the cryptocurrency’s performance has affected holders’ position negatively.

Source: Santiment

Realistic or not, here’s ADA’s market cap in SOL terms

In the short term, ADA’s price might not register an uptrend. However, Grayscale’s action will not render it “dead.” Even so, the development could fuel some negative sentiment around the token.

In fact, Cardano’s founder Charles Hoskinson commented on the matter. According to him, “Wall Street” is responsible for the removal.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.