EUR/USD and GBP/USD Rallies Fuelled by Ongoing US Dollar Weakness

EUR/USD and GBP/USD Latest

- The US dollar is sliding lower as US rate cuts near

- EUR/USD and GBP/USD post multi-month highs

Recommended by Nick Cawley

Get Your Free USD Forecast

The minutes of the last FOMC meeting are released later in today’s session and will show a more detailed picture of why the Fed decided to keep rates unchanged at 5.25%-5.5%. Since the July meeting, a string of data releases has pointed to growing weakness in the US economy, suggesting that the Fed will start to trim interest rates in September. Financial markets currently price in a 67.5% chance of a 25-basis point and a 32.5% chance of a 50-basis cut.

With today’s FOMC minutes already priced into the market, trader’s attention will turn to chair Powell’s appearance at this year’s Jackson Hole Symposium on Friday. Chair Powell is expected to acknowledge that conditions, and data, are now right for a series of interest rate cuts to start in September. Markets will be keen to see if Powell agrees with current market pricing of 100 basis points of cuts this year, or if he pushes back against current assumptions. With only three FOMC meetings left this year, 100 basis points of cuts would require a 50bp move at one of these meetings.

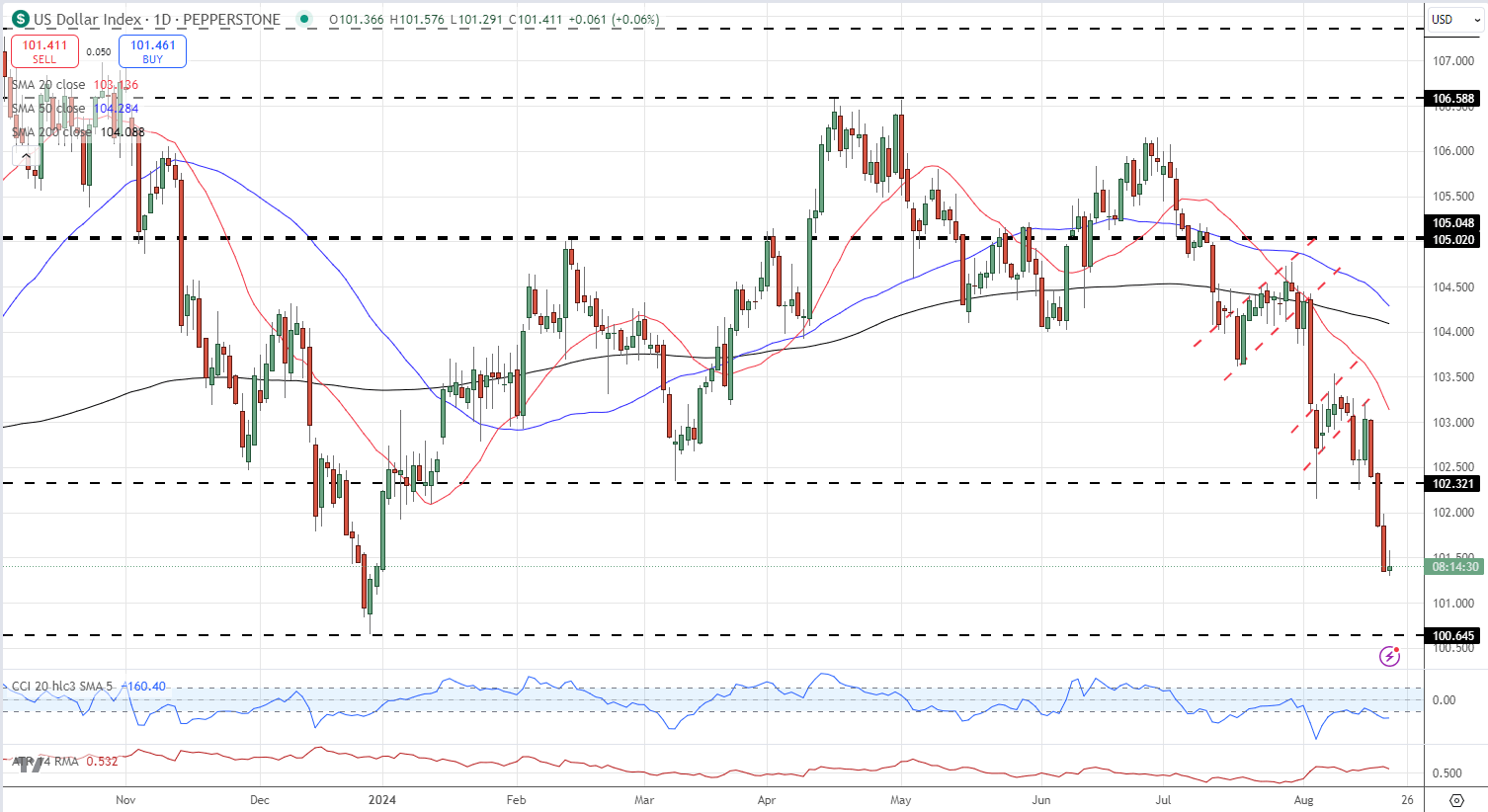

The US dollar index (DXY) has moved sharply lower over the last two months as traders price in a more dovish Fed. The technical outlook for DXY remains negative with two bearish flag formations on the daily chart keeping downward pressure on the dollar.

US Dollar Index (DXY) Daily Chart

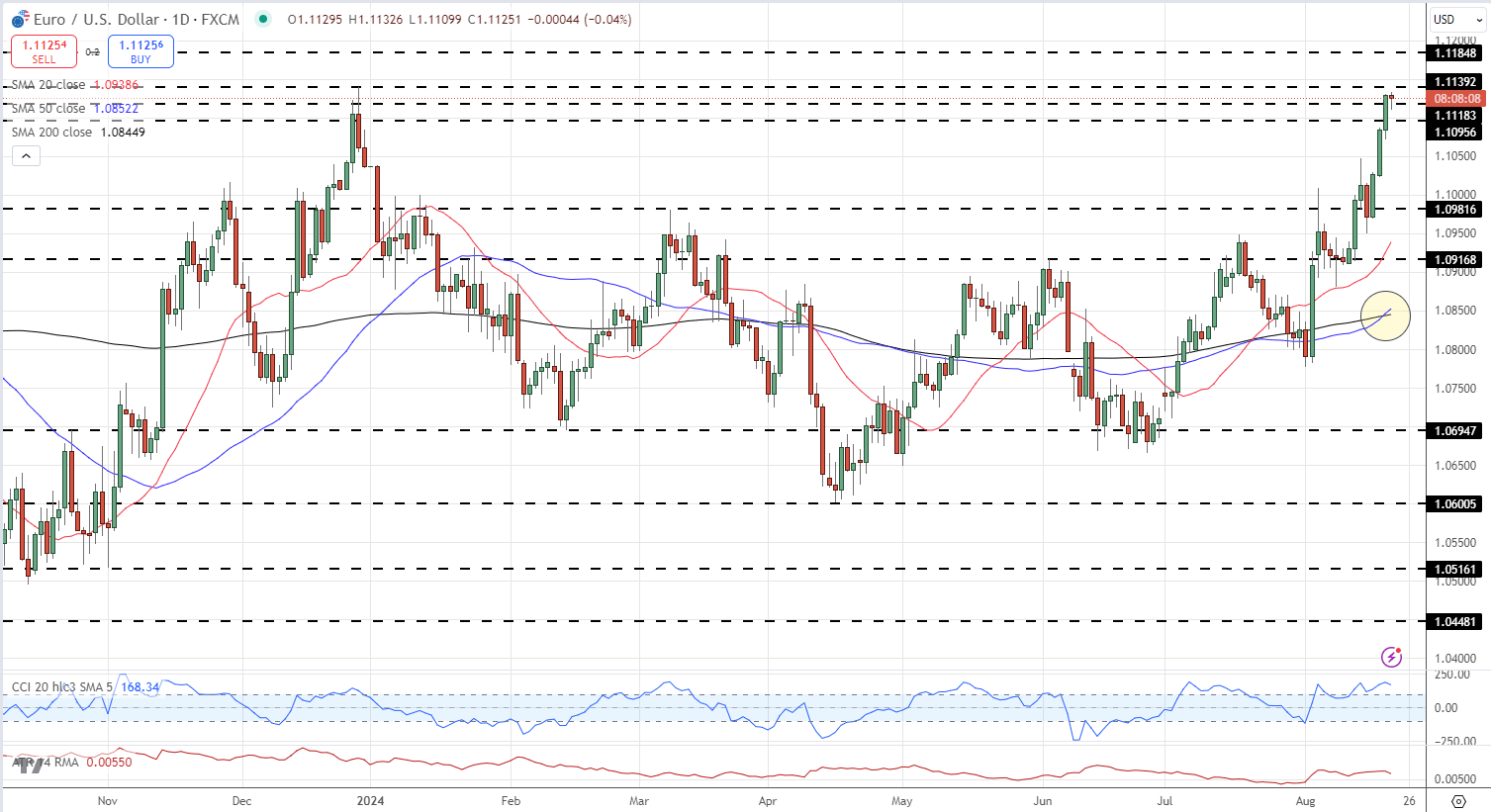

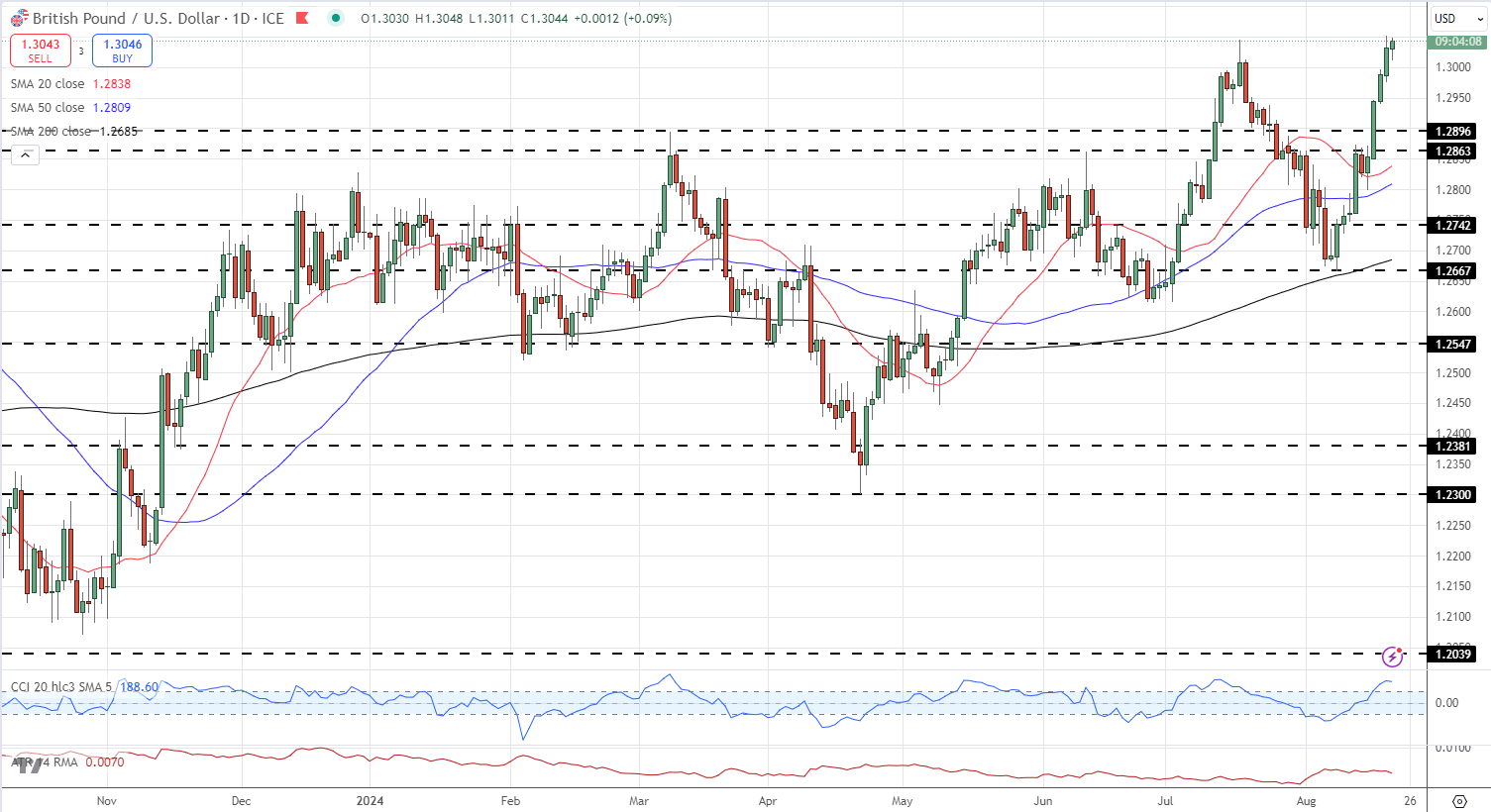

The Euro and Sterling have benefited from this weak dollar backdrop with EUR/USD and GBP/USD making fresh multi-month highs yesterday.

EUR/USD has made a strong recovery after posting a five-month low of 1.0600 in mid-April and Monday’s bullish 50-day/200-day simple moving average crossover suggests that the pair are likely to move higher in the coming weeks.

Recommended by Nick Cawley

How to Trade EUR/USD

EUR/USD Daily Chart

The GBP/USD daily chart also looks positive with an unbroken series of higher lows and higher highs made since late-April. While Sterling has strengthened in its own right recently, further gains in the pair will be dictated by the US dollar outlook.

GBP/USD Daily Chart

Charts usingTradingView

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.