- ETH could be close to its bottom after the transaction size failed to spike.

- While the price might slip, traders are convinced of a quick recovery.

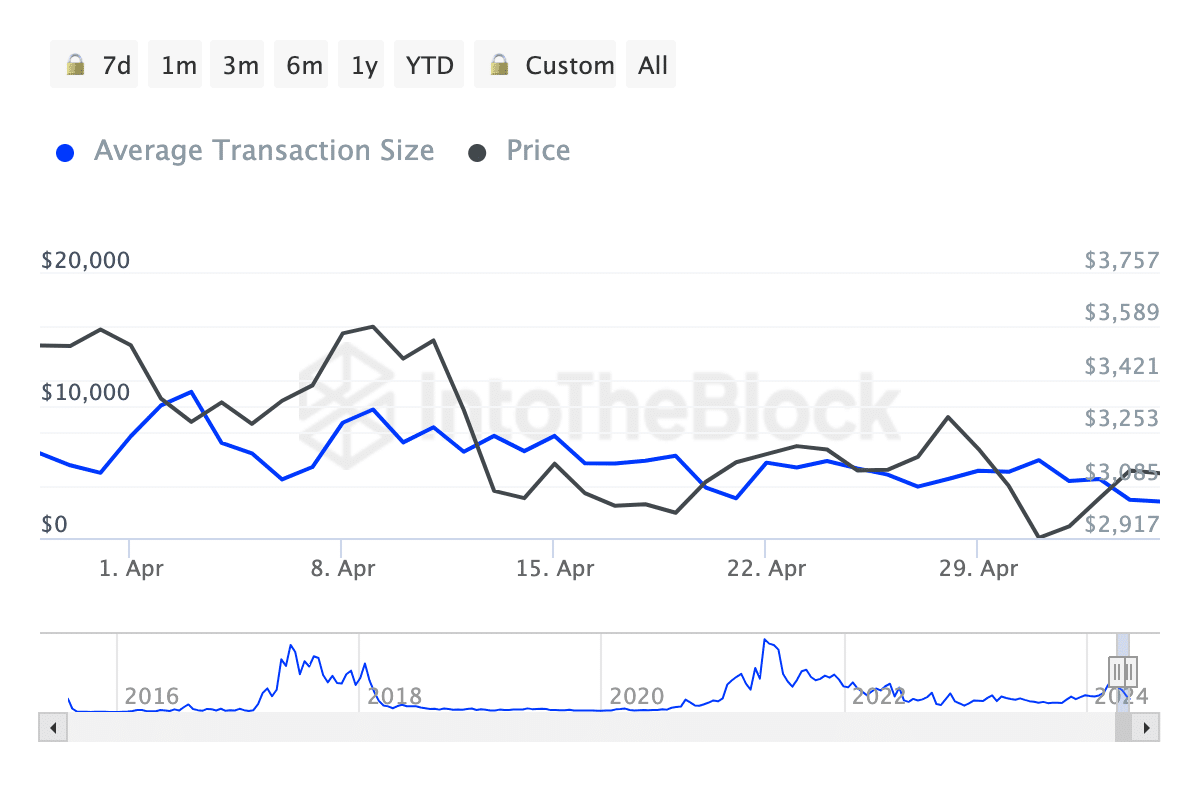

On the 19th of May, AMBCrypto observed that Ethereum’s [ETH] average transaction size had fallen to $2,767. This was a 54.13% decline from the metric when the month began.

At that time, the average transaction size was $5,893, according to data from IntoTheBlock.

For the uninitiated, the average transaction size checks in dollar terms the mean transaction value for an asset on a particular day.

Historically, spikes in this metric signal high user activity—Especially from large investors and institutions. But when it decreases, it implies an absence of institutional interaction.

Institutions out, retail in

As such, the recent state of Ethereum implies a presence of more retail users. Apart from that, this indicator identifies potential tops and bottoms.

From the value mentioned, it was obvious that ETH seemed closer to its bottom than the top. At press time, ETH’s price was $3,106, indicating that it had swung around the same range in the last 24 hours.

Source: IntoTheBlock

Going by the analysis above, the price of the cryptocurrency could be set to hit a higher value in the short term. However, other metrics need to be considered.

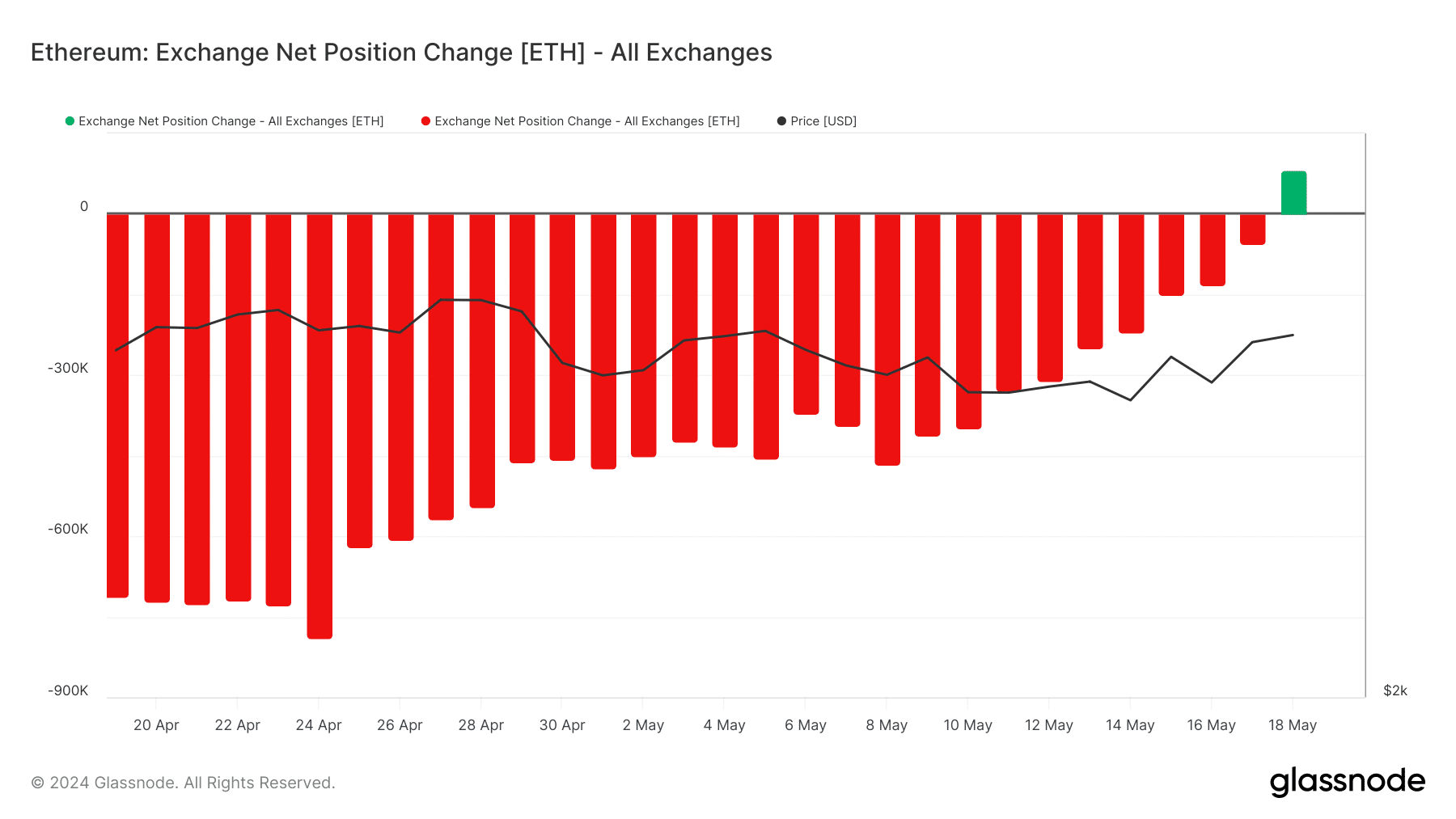

As a result of this, AMBCrypto looked at the Ethereum Exchange Net Position Change. According to data obtained from Glassnode, the Exchange Net Position Change has been in the negative region for most of the last 30 days.

ETH gets set for a big move

This metric tracks the 30-day change of the supply held in exchange wallets. A positive value indicates that more coins are in exchanges.

On the other hand, a negative value indicates increased withdrawals from exchanges.

One thing we noticed was that the metric suddenly became positive on the 18th of May. As of this writing, the ETH net position change was 81,715.

This increase could be a sign that Ethereum participants are taking profits off the 6.50% increase within the last week.

If this number continues to increase, then ETH’s price might decrease below $3,000 before the potential rally happens.

Source: Santiment

However, if exchange withdrawals intensify once more, the price might begin a slow increase toward $3,500. In a highly bullish situation, an increase to $4,000 could be an option.

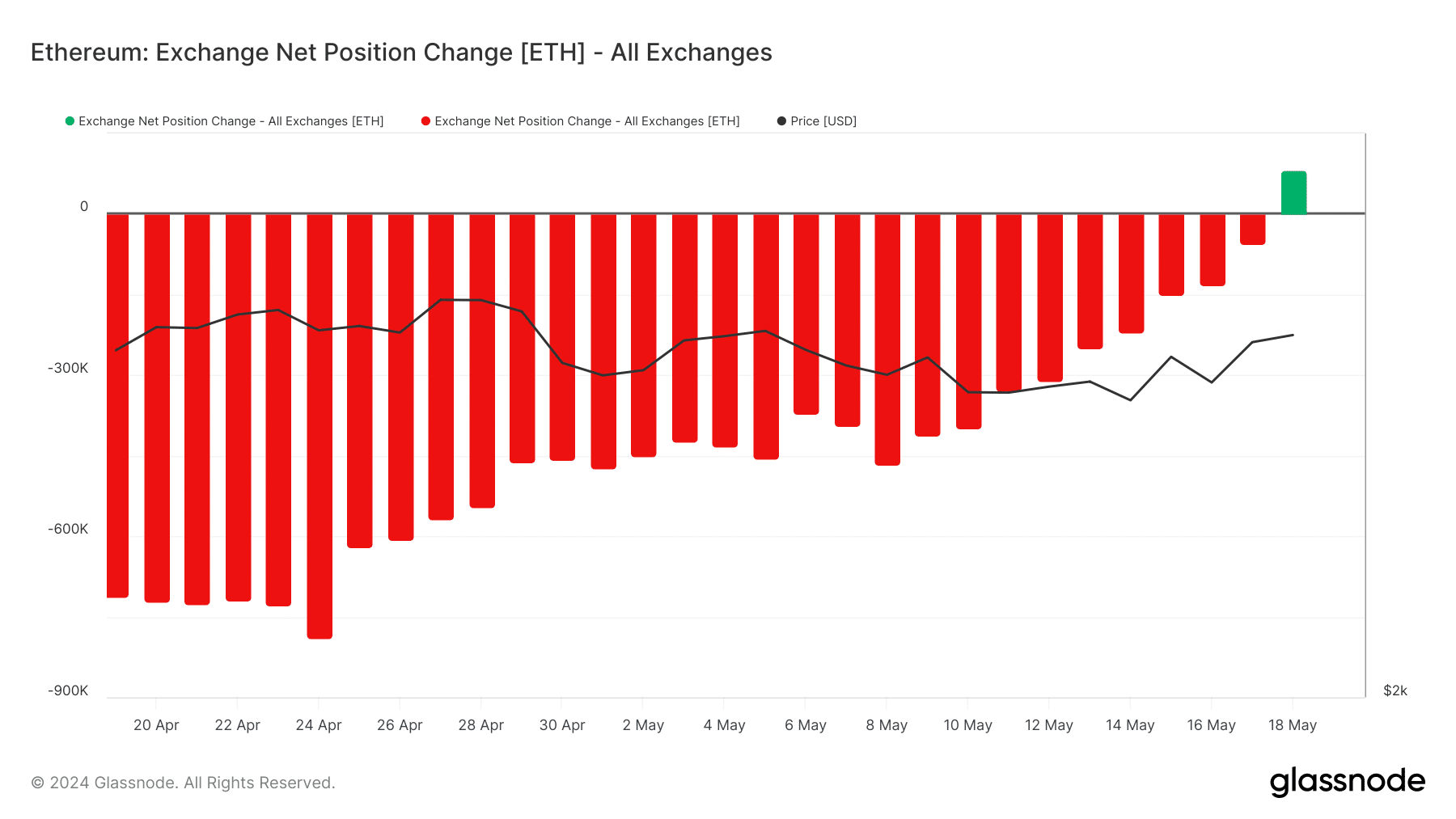

On Friday, the 17th of May, AMBCrypto reported how options traders were expecting ETH’s price to hit $3,600 between May and the end of June.

At press time, Glassnode data showed that the sentiment had not changed. This is because of the signals from the Put/Call Ratio (PCR).

Is your portfolio green? Check the Ethereum Profit Calculator

If the PCR is over 0.70, it implies a bearish sentiment and there are more puts than calls.

However, a reading below 0.50 implies otherwise. At press time, Ethereum’s Put/Call Ratio was 0.35, meaning that most traders expect the value of the cryptocurrency to increase in the coming weeks.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.