- Ethereum ICO participants moved a significant amount of their holdings.

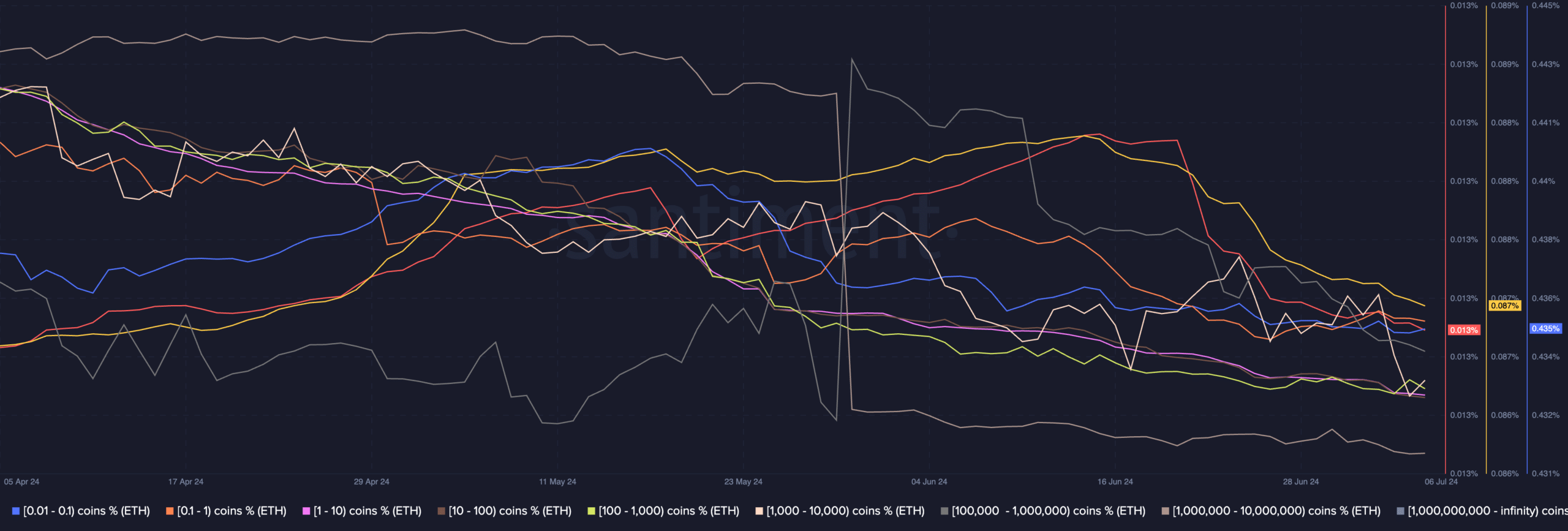

- Whale interest and retail interest in ETH declined.

Due to the rising bearish sentiment in the market, the price of Ethereum [ETH] declined significantly, dipping below the $3,000 mark.

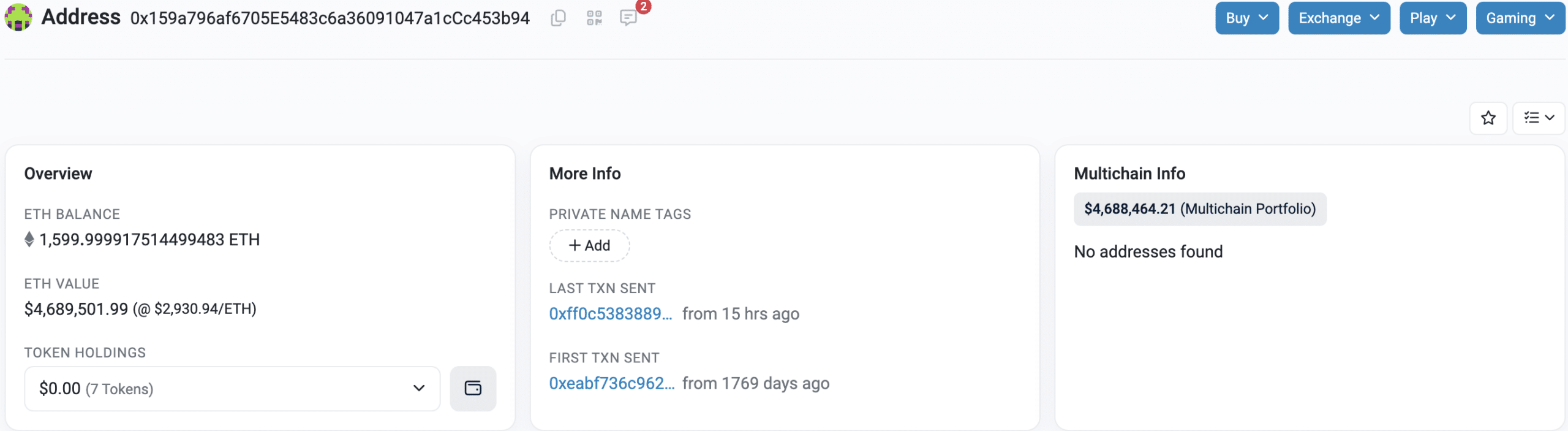

Initial coin offering

In November 2016, the Golem project conducted a successful Initial Coin Offering (ICO), raising a significant sum of 820,000 ETH.

Over a 37-day period, Golem transferred 36,000 ETH to major cryptocurrency exchanges like Binance [BNB], Coinbase, and Bitfinex. This transfer amounted to roughly $115 million.

Despite these transfers, Golem still held a substantial amount of ETH, with a press time balance of 231,400 ETH, valued at approximately $656 million.

This indicates that Golem maintained a strong financial position and may be strategically planning for future developments.

When a large amount of cryptocurrency hits exchanges, it creates sell pressure. This means that more ETH is available for purchase, potentially exceeding current demand and driving the price down.

Moreover, a large holder like Golem moving their ETH to exchanges can trigger speculation in the market.

Investors might interpret this as a sign that Golem believes the price of ETH is about to fall, leading them to sell their own holdings to avoid losses. This can create a snowball effect, pushing the price further down.

Source: Etherscan

The sell-off of these tokens wasn’t an isolated event. AMBCrypto’s analysis of Santiment’s data indicated that large addresses were losing interest in ETH and their holdings had declined.

Coupled with that, retail interest had also decreased over the last few days. This indicated a potential lack of overall demand across different investor segments, further increasing sell pressure.

Source: Santiment

New developments on the Ethereum network

Despite these factors, development on the Ethereum network continued to soar.

Ethereum developers recently held an online meeting to discuss the Pectra upgrade, a major update for the Ethereum blockchain. The upcoming Pectra Devnet 1 launch is on hold waiting for other software updates.

Researchers presented ways to improve data collection on the software diversity used to run Ethereum. Additionally, they debated a new feature to prevent software bugs from disrupting the network.

Read Ethereum’s [ETH] Price Prediction 2024-25

The meeting also included discussions about potentially including further changes in the future, but no final decisions were made.

At press time, ETH was trading at $2,914.63 and its price had fallen by 3.19% in the last 24 hours.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.