- New demand for DOGE peaked during the week

- Memecoin’s MVRVA ratio hinted at a buying opportunity too

According to IntoTheBlock, the crypto-market’s leading memecoin Dogecoin [DOGE] has recorded a major spike in new demand. On 2 May, 28,000 new addresses were created to trade DOGE. This figure marked a 102% hike from the monthly low in DOGE’s new demand that was set on 29 April.

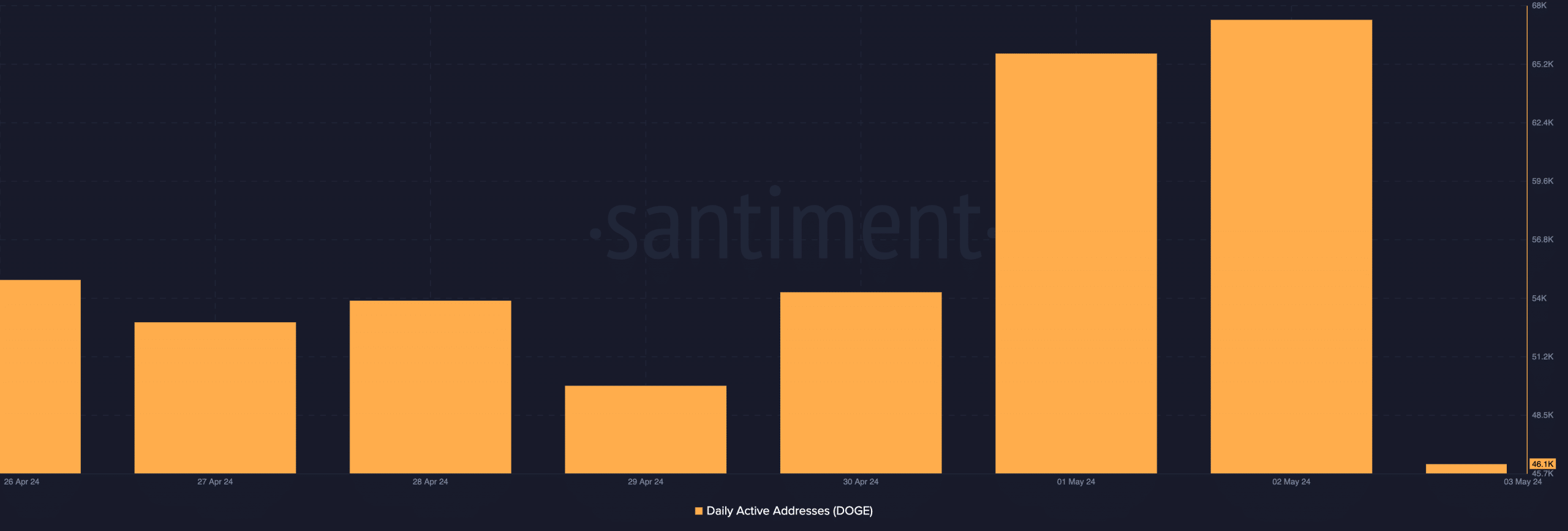

As new demand grew, the daily count of addresses involved in DOGE transactions also rallied over the past week. In fact, data from Santiment revealed that the memecoin’s daily active addresses hiked by 27% in the past seven days alone.

Source: Santiment

Here is how DOGE reacted

An uptick in an asset’s network activity often precedes a rally in its price. However, this has not been the case for DOGE. The sustained demand for the altcoin over the past week failed to initiate any significant jump in its price.

At the time of writing, DOGE was trading at $0.15. According to CoinMarketCap, it recorded a price appreciation of just 2% over the week, with most of it seen over the last 24 hours. DOGE’s minor price rally in the last seven days mirrors the general market decline seen during that period. In fact, the low trading recorded during the period under review pushed the cryptocurrency market’s capitalization below $2.3 trillion on 1 May, before it rebounded.

However, DOGE’s hike over the last 24 hours is a sign of bullish sentiment.

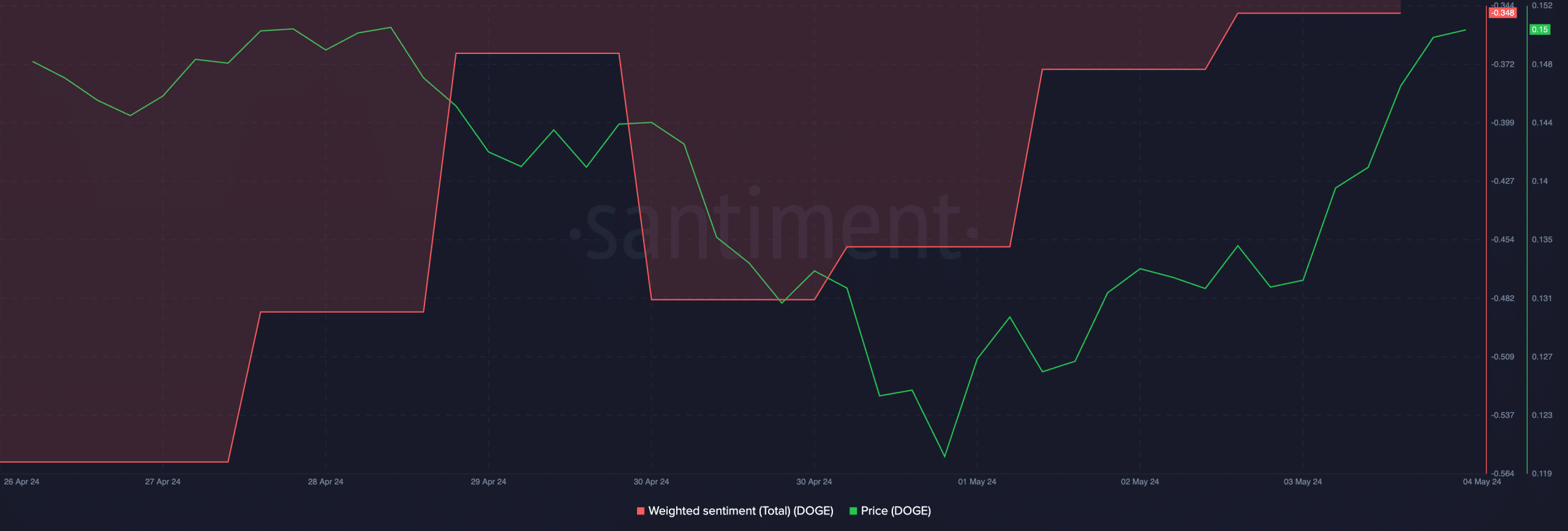

Also, according to Santiment, DOGE’s weighted sentiment is now poised to breach its center line on an uptrend. This metric tracks the general market sentiment about a crypto-asset. When it returns a value above zero, market sentiment is positive. Conversely, market sentiment is predominantly bearish when its value is below the zero line.

At press time, DOGE’s weighted sentiment was -0.348. This metric’s value will rise if trading activity increases and DOGE extends its gains in the short term.

Source: Santiment

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Now might be your time

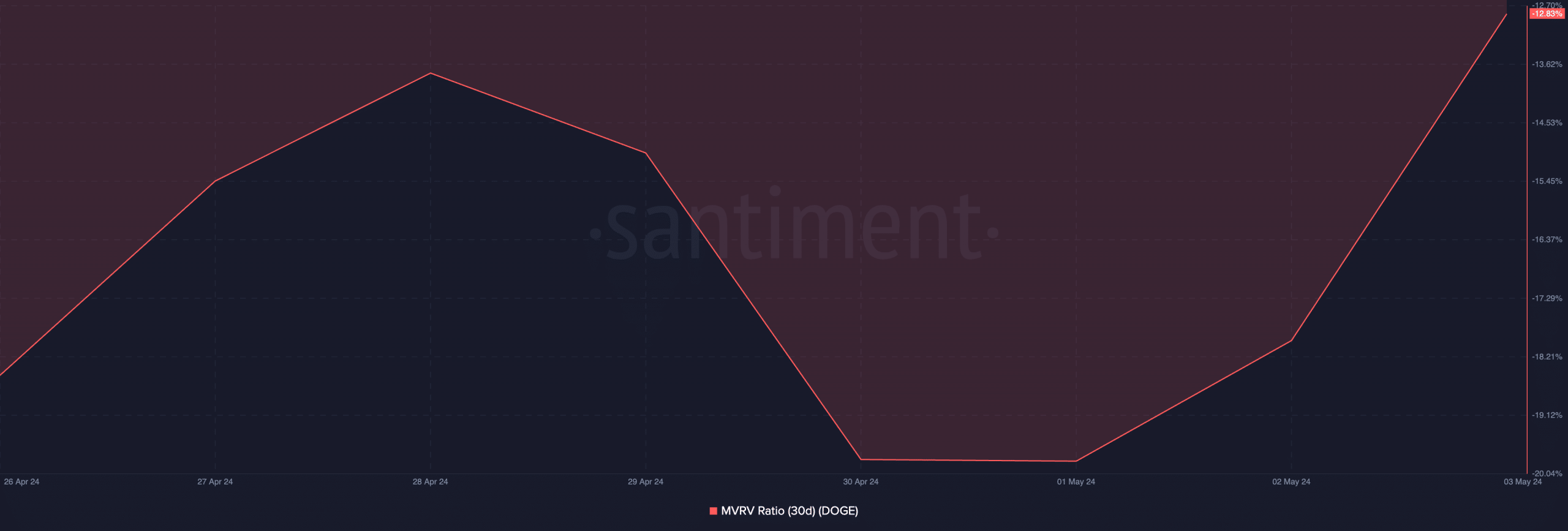

AMBCrypto’s assessment of DOGE’s Market Value to Realized Value (MVRV) ratio revealed that it is now flashing a buy signal. This metric, assessed over the 30-day moving average, returned a negative value of -12.83% at press time.

Source: Santiment

An asset’s MVRV tracks the ratio between the asset’s current market price and the average price of every coin or token acquired for that asset.

When its value is above one, the asset’s market value is significantly higher than the price at which most investors acquired their holdings. When this happens, the asset is said to be overvalued.

On the other hand, when it returns a negative value, the asset is said to be undervalued, as its market value is below the average purchase price of all its tokens in circulation.

Traders interpret a negative MVRV ratio as a sign to “buy the dip” in anticipation of a price rally.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.