Precious metals were also on a tear on Friday, with silver surging to an 11-year high, and gold rallying back toward an all-time peak reached in April. Strong gains in copper are spilling over to silver as the metal is also considered an industrial commodity given its usage in things such as solar panels, according to Phil Streible, chief market strategist at Blue Line Futures.

“There’s three things that impact a commodity: supply, demand, and price momentum,” Streible said. Silver “has all three of those right now.”

Industrial and precious metals have both jumped this year on the back of surging investor interest, with an increasingly supportive macroeconomic backdrop dovetailing with tightening supply in several physical markets.

“While there were a lot of western funds that missed out on the gold rally, it’s clear that they’re very eager to participate in copper,” Matthew Heap, a portfolio manager at Orion Resource Partners, the largest metals-focused fund manager, said in an interview this week. “That reflects the fact that, thematically, there’s a very clear story to tell for copper, and you can explain in an elevator ride why prices are likely to rally substantially higher from here.”

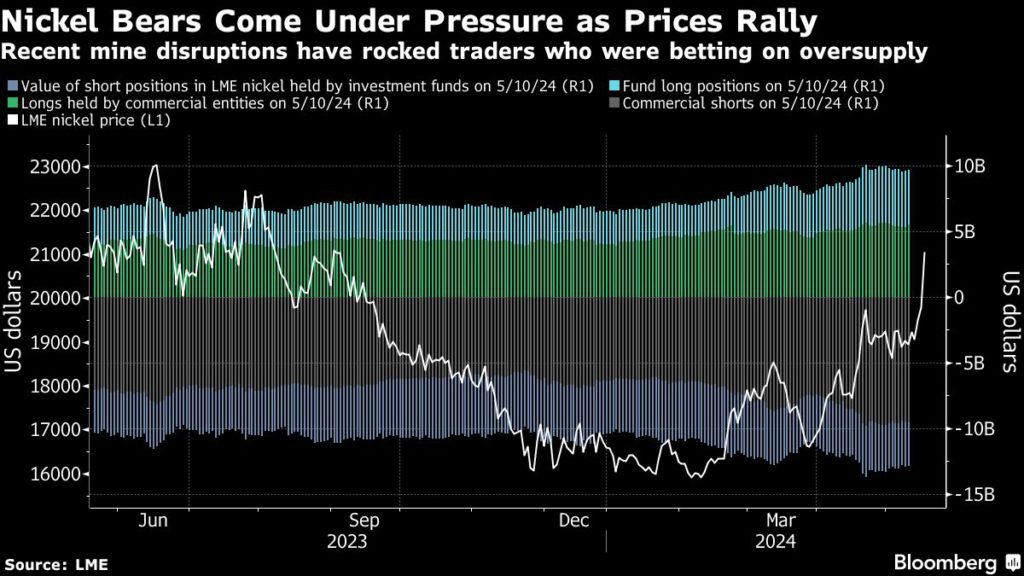

Disruptions to supply have caught many traders off guard, helping to fuel outsized moves as holders of short positions have raced to close out their contracts. Nickel prices spiked as much as 7.9% on the LME on Friday after violent protests broke out in New Caledonia, the world’s third-biggest supplier.

“Whilst people have talked about poor demand in the here and now, we’ve got supply issues — as you’ve seen with copper and nickel,” said Al Munro, a base metals strategist at Marex in London. “We’re a futures market, and the future we’re talking about? Big demand.”

For months, the copper market has been caught in a tug of war between bulls who see a supply crunch and demand boom on the horizon, versus more cautious traders who have raised the alarm about historically weak spot demand conditions in China.

But this week, the balance of power shifted sharply as a rush of buying in New York left holders of short positions nursing heavy mark-to-market losses.

There were fresh signs of stress in the Comex copper market on Friday, with front-month contracts surging back toward a record struck on Wednesday. Many traders have been betting that prices on the exchange would fall relative to Shanghai and London benchmarks, and the sharp spike has left them exposed to heavy margin calls against their positions.

Across the global copper market, the race is now on to source metal to deliver on to the exchange ahead of the expiry of the front-month contract in July, but traders are battling against constraints on supply and shipping bottlenecks.

LME copper traded at $10,707 a ton on Friday afternoon in London, closing in on the 2022 record of $10,845, as Comex copper for July delivery jumped 3.2%. Gold was 1.3% higher while silver gained 3.7%. Gold, silver and copper equities all jumped as well.

(By Mark Burton, Yvonne Yue Li and Guillermo Molero)

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.