World

World leaders urge calm after Israeli drone strike on Iran ratchets up tension | Middle East and north Africa

Inside ‘world’s deadliest cave’ that could cause next pandemic: Kitum in Kenya gave rise to Ebola and ‘eye bleeding’ Marburg virus

Health

Carved by the tusks of elephants, who visit its caverns to scrape the walls for salt, Kitum cave in Kenya hosts some of …

Met Police apologises for using phrase ‘openly Jewish’ as antisemitism campaigner accuses force of ‘victim-blaming’ | UK News

U.K.

The Met has said an officer’s use of the term was “hugely regrettable”, but added that a video shared by the Campaign …

Trump denied last-minute request to halt hush money trial by appeals court

World

Sign up for the daily Inside Washington email for exclusive US coverage and analysis sent to your inbox Get our free Inside …

Police launch probe after self-styled Robin Hoods ‘steal from M&S’ to give to food banks

Business

By Matt Drake 20:23 19 Apr 2024, updated 20:32 19 Apr 2024 Share or comment on this article: A group of self-styled …

Live Pixel 9 Pro photos surface, highlighting rumored design changes

Technology

What you need to know A set of alleged “live photos” of the upcoming Pixel 9 Pro have leaked, and highlight several …

Amanda Holden says her feud with Sharon Osbourne is ‘all b******s’ after she labelled her ‘bitter’ and ‘pathetic’ over Simon Cowell remarks

Entertainment

Amanda Holden has broken her silence on the Sharon Osbourne row and revealed her dreams of hosting a dating show. The Britain’s …

Oxford United 1-1 Stevenage: Oxford’s play-off hopes dented

Sports

Cameron Brannagan’s penalty was his 11th goal of the season Oxford United squandered a great opportunity to strengthen their bid to reach …

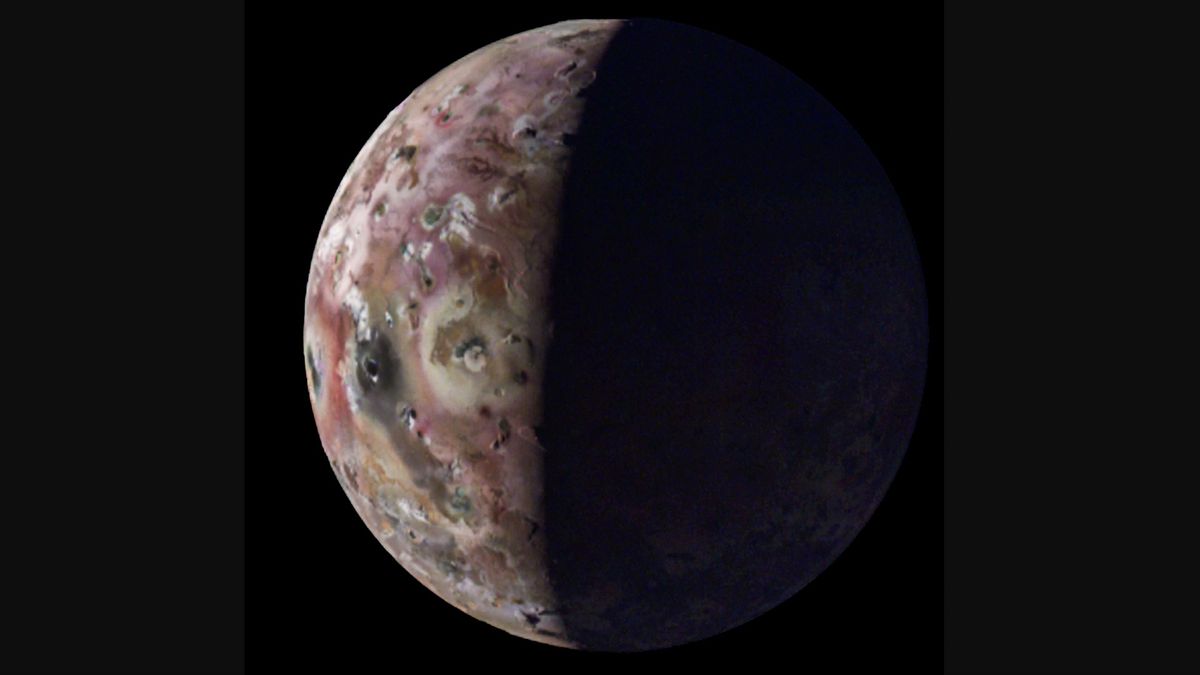

Something strange is happening on Venus, experts don’t know why

Science

Earth-like magnetic field is not present in Venus. — Nasa/JPL-Caltech Scientists were baffled by the strange phenomena occurring in Venus as it …