Savers are missing out on a “considerable” financial boost worth £1,900 by not taking advantage of high interest accounts, new research has found.

Banks and building societies are offering as much as six per cent but higher rates are being missed by much of the greater public, who are earning just three per cent savings interest, according to investment platform Charles Stanley Direct.

A survey of bank customers found that 44 per cent get three per cent or less on their savings, with around one in four saying they make under two per cent.

Some 14 per cent of respondents said they have no idea what interest rate they are currently getting on their savings.

Savings interest rates are on the rise but many Britons are not taking advantage of them

GETTY

According to the firm, the difference in average interest being earned on savings compared to the top rates could mean savers miss out on as much as £1,900.

If a saver deposited £21,840 in a 4.5 per cent rate account for five years, they could earn £1,898.07 more than they would with a three per cent rate, the analysis found.

Experts are sounding the alarm that millions of Britons could potentially missing out on a “considerable” boost to their savings pots.

Rob Morgan, the chief analyst at Charles Stanley Direct, said: “Many have not taken advantage of high interest rates, causing them to miss out on a considerable savings boost.

“Ultimately, just as many do with their energy providers, savers need to vote with their feet and seek out competitive returns.

“But with so much information out there and rates continuously updating, it can be hard to keep up and decide where is best to keep your savings.”

The investment platform has launched a new Cash Savings tool to assist savers in accessing the best interest rates on the market.

This allows people to manage their money and take advantage of the competitive rates from a single online account.

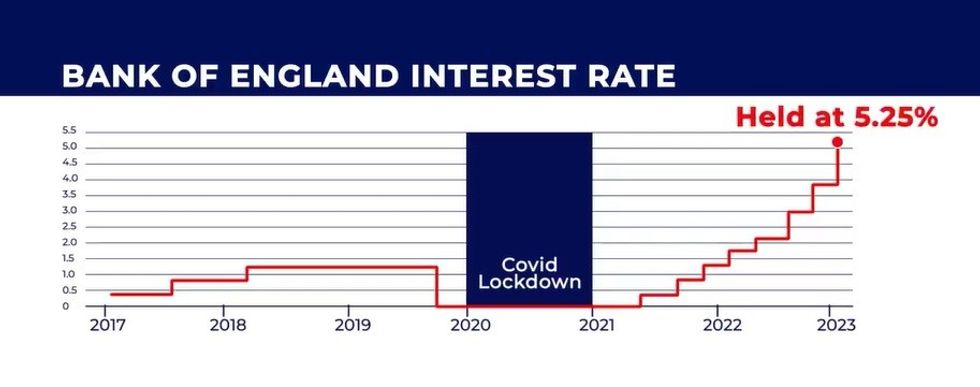

The Bank of England has held interest rates at 5.25 per cent GB NEWS

The Bank of England has held interest rates at 5.25 per cent GB NEWS

It is possible to pick from multiple different savings accounts via the Cash Savings proposition, including easy-access, fixed-term and notice.

In the last year-and-a-half, savers have benefited from the central bank hiking the base rate to rein in inflation.

The Bank of England is next set to make an announcement regarding interest rates from February 2, 2024.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.