- Bitcoin’s price has risen by over 6% in 24 hours

- If the bulls hold on to market control, a rally past $65,000 might be possible

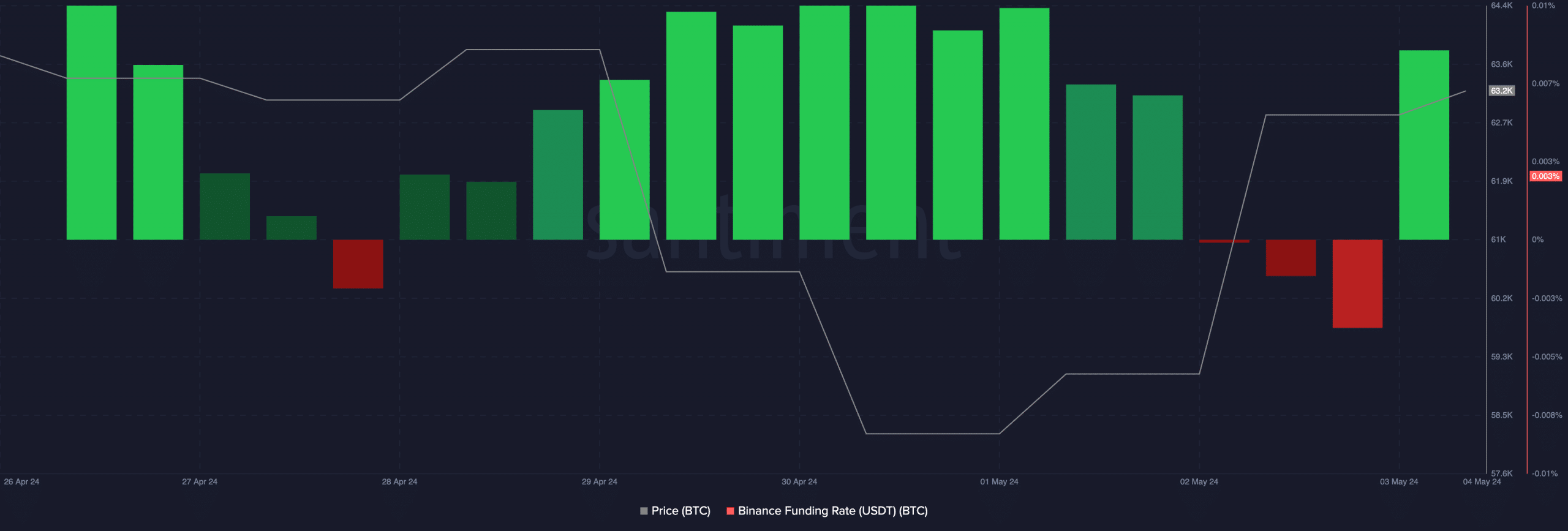

According to Santiment, the 6% hike in Bitcoin’s [BTC] price over the last 24 hours has led to a notable change in its funding rate, from negative to positive on Binance.

📈 #Bitcoin has bounced on a #bullish Friday with its market cap rising +5.4% in 24 hours. The crowd has completely #flipflopped on their #Binance trades, going from liquidated #shorts to #longs after this bounce. For the rally to continue, we don’t want to see #FOMO rising too… pic.twitter.com/fY3lEX3REb

— Santiment (@santimentfeed) May 3, 2024

Funding rates are a mechanism used in perpetual futures contracts to ensure that the contract price stays close to the spot price. When an asset’s contract price is higher than its spot price, traders who hold long positions pay a fee to traders shorting the asset. Funding rates return positive values when this happens.

Conversely, negative funding rates are recorded when the asset’s contract price is lower than the spot price. Here, short traders pay a fee to traders holding long positions,

When an asset witnesses a sudden shift from negative to positive funding rates, it suggests that there is a strong demand for long positions. It is considered a bullish signal and a precursor to an asset’s continued price growth.

According to Santiment, Bitcoins funding rate on Binance closed on 3 May at a year-to-date low of -0.008%. However, after the price initiated an uptrend to climb by over 6% in 24 hours, its funding rate on the leading exchange changed to positive.

At press time, this had a reading of 0.0027%, indicating that there were more long than short positions in the coin’s derivatives market.

Source: Santiment

Is your portfolio green? Check out the BTC Profit Calculator

What should you look out for?

Bitcoin’s price surge in the last 24 hours has led to a rally in trading activity in its derivatives market. According to Coinglass, for instance, trading volume in that market had a cumulative figure of $78.05 billion over that period, with the same climbing by 30%.

Signaling that market participants are opening new trading positions, BTC’s futures open interest registered a 7% uptick in 24 hours too. At press time, the coin’s futures open interest was $30 billion, while the crypto was valued at just over $63,000 on the charts.

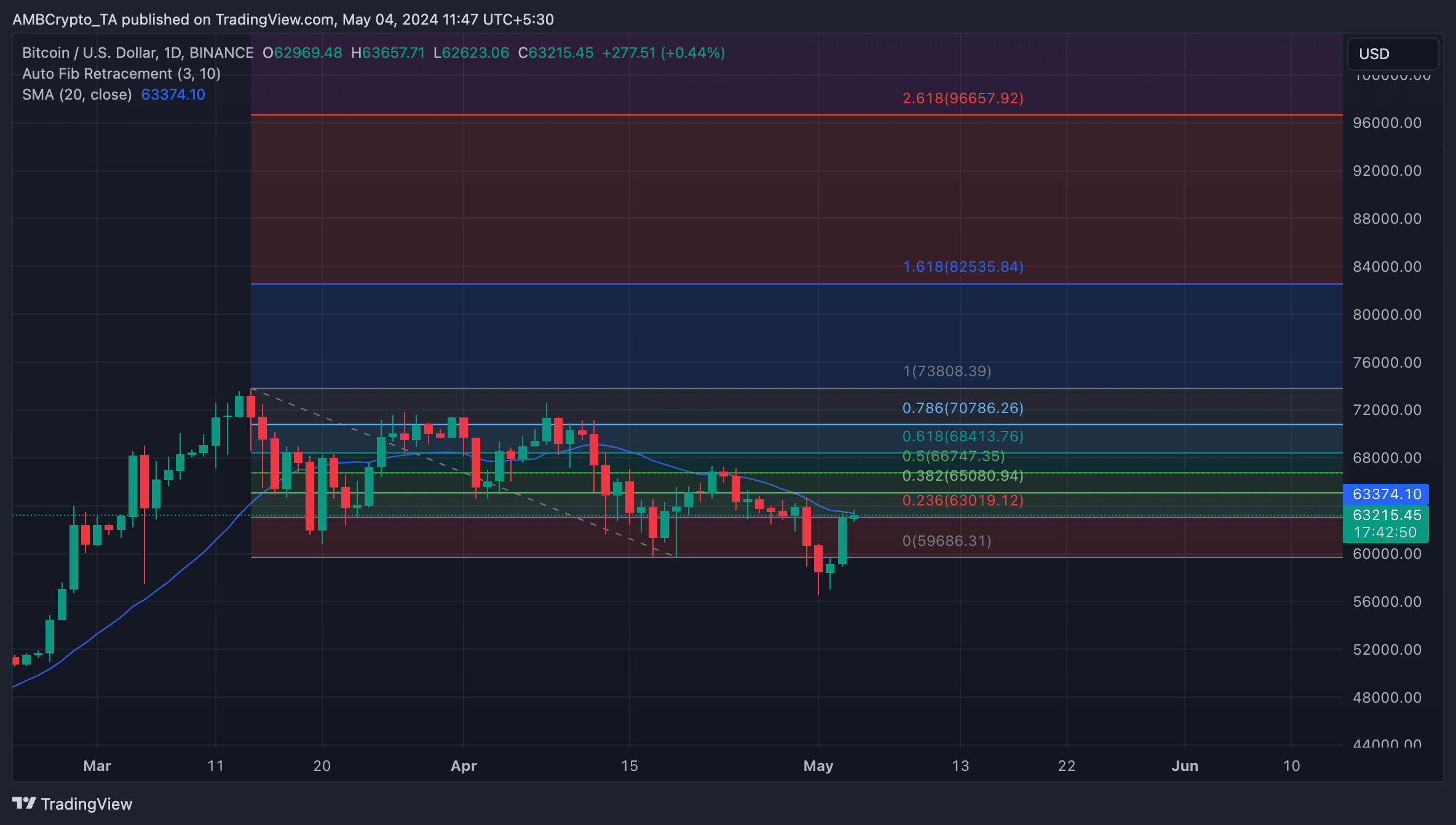

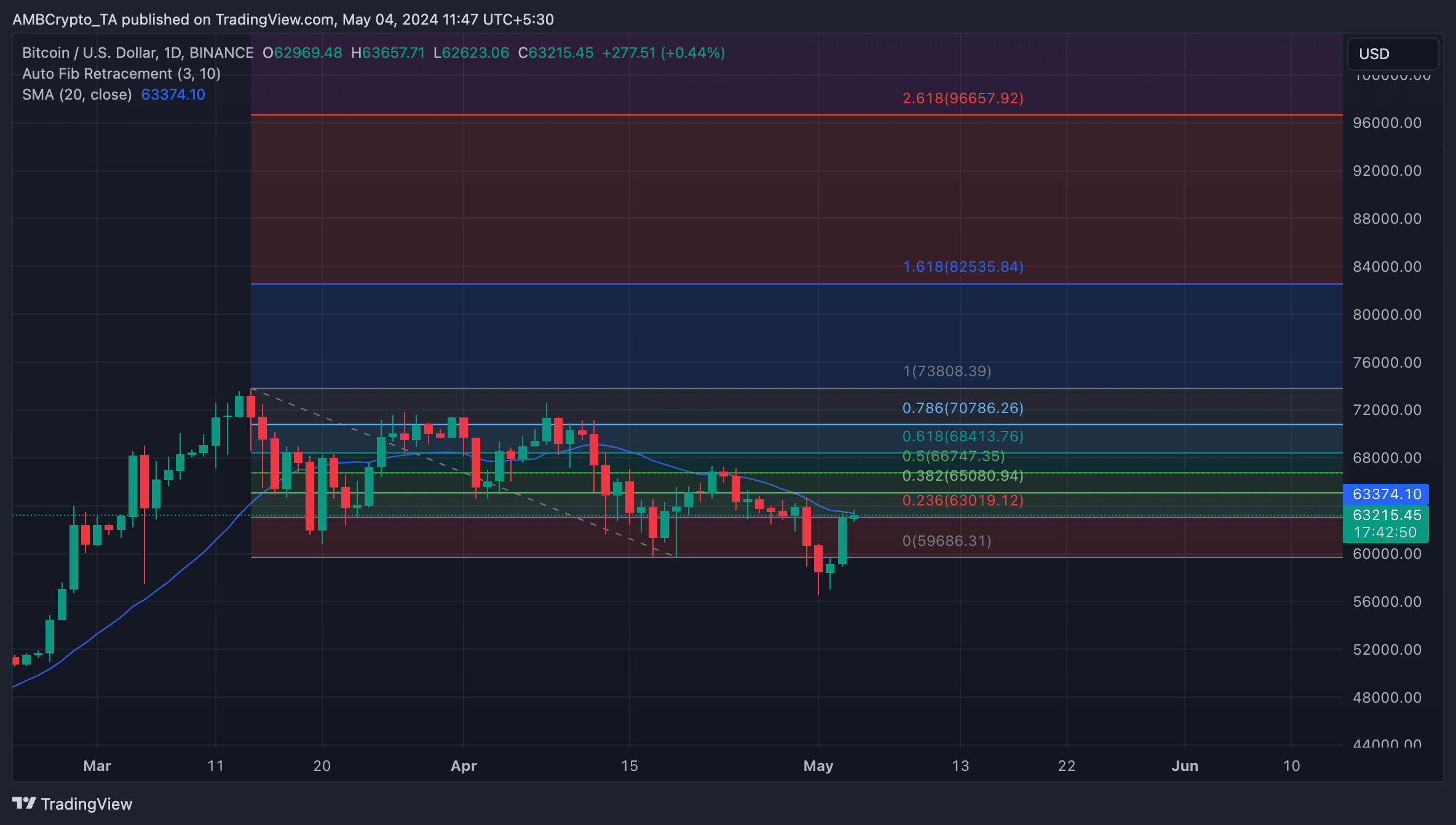

Additionally, readings from BTC’s Fibonacci retracement levels on the 1-day chart revealed that if this bullish momentum is sustained, the coin’s next price point will be $65,050.

Source: DOGE/USDT on TradingView

However, if the bears re-emerge and put pressure on its price, the bullish projection will be invalidated. If that happens, BTC’s price will fall under $60,000 to exchange hands at $59,700.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.