- Bitwise submits the Ethereum ETF filing early, suggesting a mid-July launch.

- Ethereum price drops but ETH holders are bullish with the potential for price surge.

In the latest update on the potential approval of a spot Ethereum [ETH] ETF, Bitwise, an asset manager, has taken proactive steps by submitting an amended S-1 form ahead of schedule.

Bitwise move amidst unexpected delays

Initially expected to launch around 2nd July, as per Bloomberg’s Senior Analyst Eric Balchunas, the timeline for ETH ETFs has since been adjusted to 8th July following the SEC’s new deadline for firms to amend their S-1 submissions.

For context, this delay originated from the SEC’s request on 28th May for issuers to address minor queries in their S-1 filings.

Remarking on the same, Bloomberg ETF analyst James Seyffart said,

“We’ve got another amended S-1 from @BitwiseInvest for their #Ethereum ETF. Expect more from other issuers throughout the rest of the week. We’re thinking these things could potentially list later next week or the week of the 15th at this point.”

Adding to the fray was Nate Geraci, president of ETF Store, who recently expressed his optimism about the ETF’s approval, suggesting that the SEC could grant final approval by 12th July, paving the way for trading to start by 15th July.

The delay was not required

This has caused significant confusion within the industry regarding the final approval date. However, Bitwise’s early filing of the amended S-1 forms on 3rd July suggests that the products are nearing launch.

Providing further insights on the matter, Balchunas noted,

“Prob just wanted to get it off their plate and from what I hear the last round of comments were ‘literally nothing’ = took zero time to update. Also, no fee yet. Prob get those next week-ish.”

This has sparked criticism towards SEC Chair Gary Gensler. Many also argue that it’s time for a change in SEC leadership. Echoing these sentiments was X user Circuit, who claimed,

“This is just Garry throwing this weight around one last time before he is out the door.”

Impact on ETH: Should you be concerned?

Unfortunately, despite Bitwise’s efforts to speed up the ETH ETF process, Ethereum’s price took a hit. According to CoinMarketCap, ETH dropped by 5.09%, trading at $3,189.50.

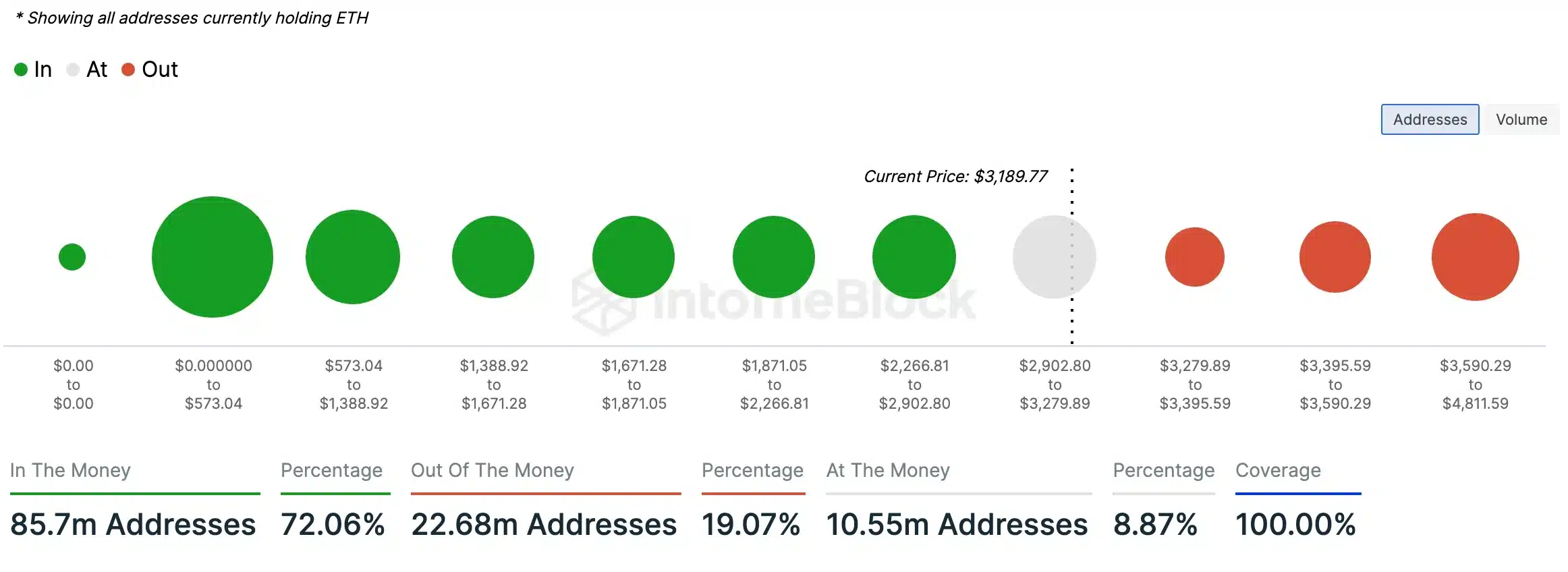

However, AMBCrypto’s analysis of IntoTheBlock data reveals that a significant majority (72.06%) of ETH holders currently hold tokens valued higher than their purchase price, indicating they are “in the money.”

In contrast, a smaller segment (19.07%) holds ETH tokens that are worth less than their purchase price, placing them “out of the money.” This suggests a bullish sentiment or potential upcoming price surge for Ethereum.

Source: IntoTheBlock

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.