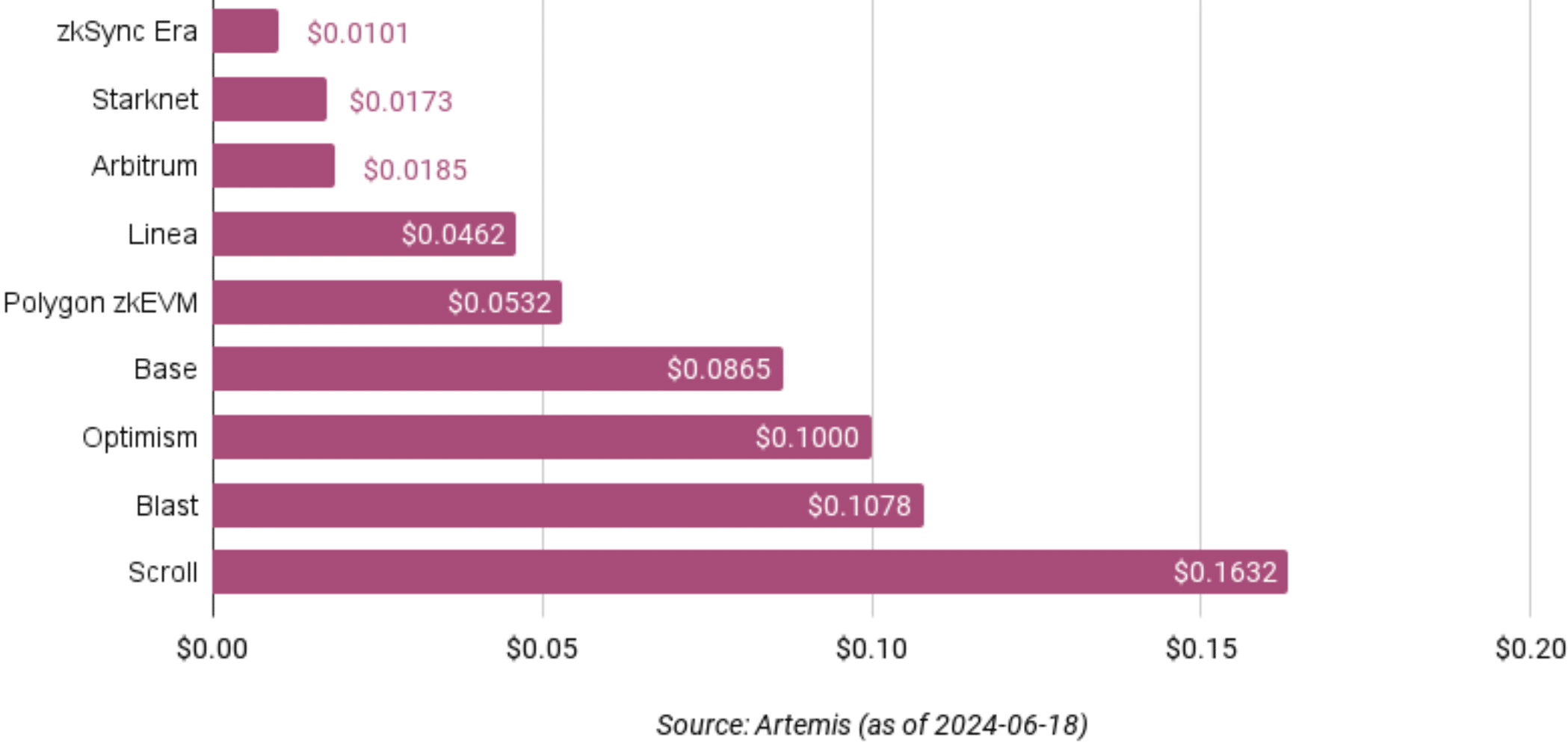

- Starknet and Arbitrum led the pack in user fees, surpassed only by zkSync Era.

- The price of both tokens declined despite positive protocol performance.

After the Dencun upgrade, the competition in the Layer 2 sector has grown significantly over the last few days. Two networks, in particular, have been in the limelight, namely Starknet [STRK] and Arbitrum [ARB].

Low gas fees

Starknet and Arbitrum outperformed all other networks in terms of fees charged per user, coming second to only zkSync Era.

Source: Artemis

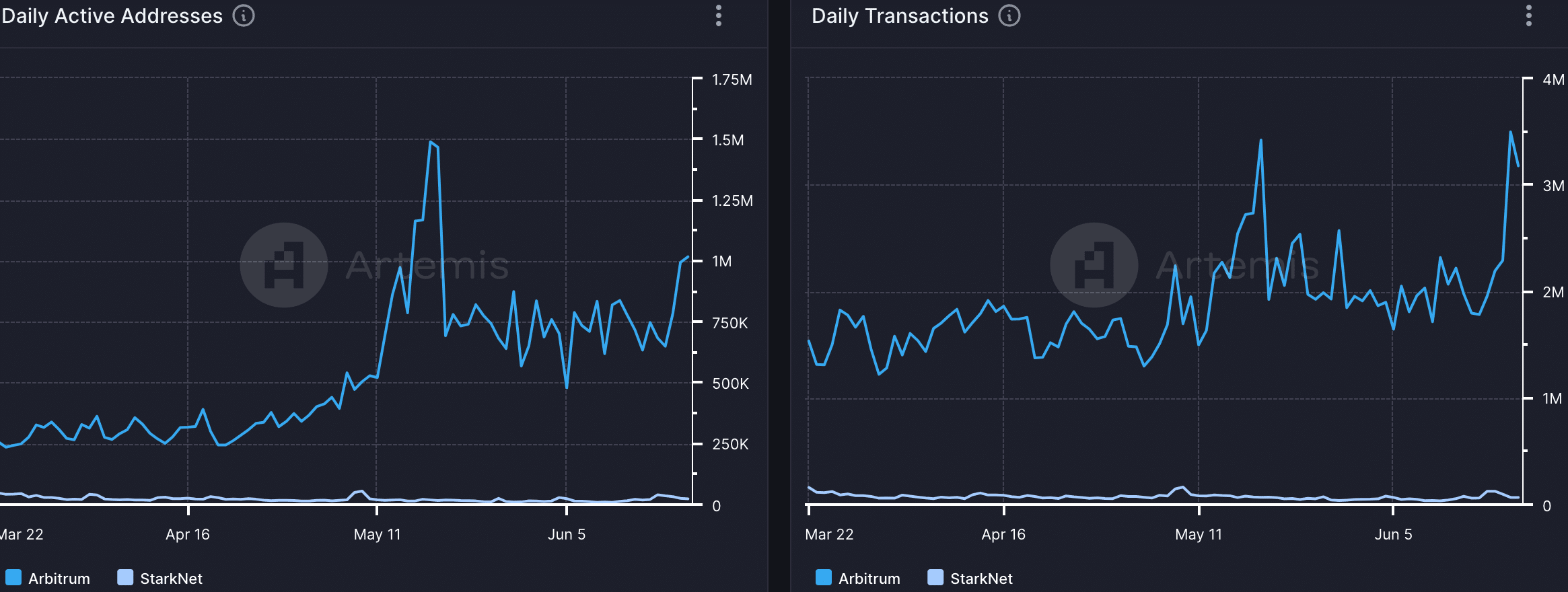

Despite the fees being similar on both networks, there was a huge discrepancy in between the activity on both these protocols.

Arbitrum, notably, was able to attract a large number of addresses on the network and witnessed a significant uptick in activity, crossing the 1 million mark in terms of daily active addresses.

The daily transactions occurring on the Arbitrum network also grew and surpassed the 3 million point. Starknet saw similar growth on both fronts, but the numbers were nowhere near Arbiturm.

For Starknet to adequately compete in the L2 space, it would need to attract more users to the network.

Source: Artemis

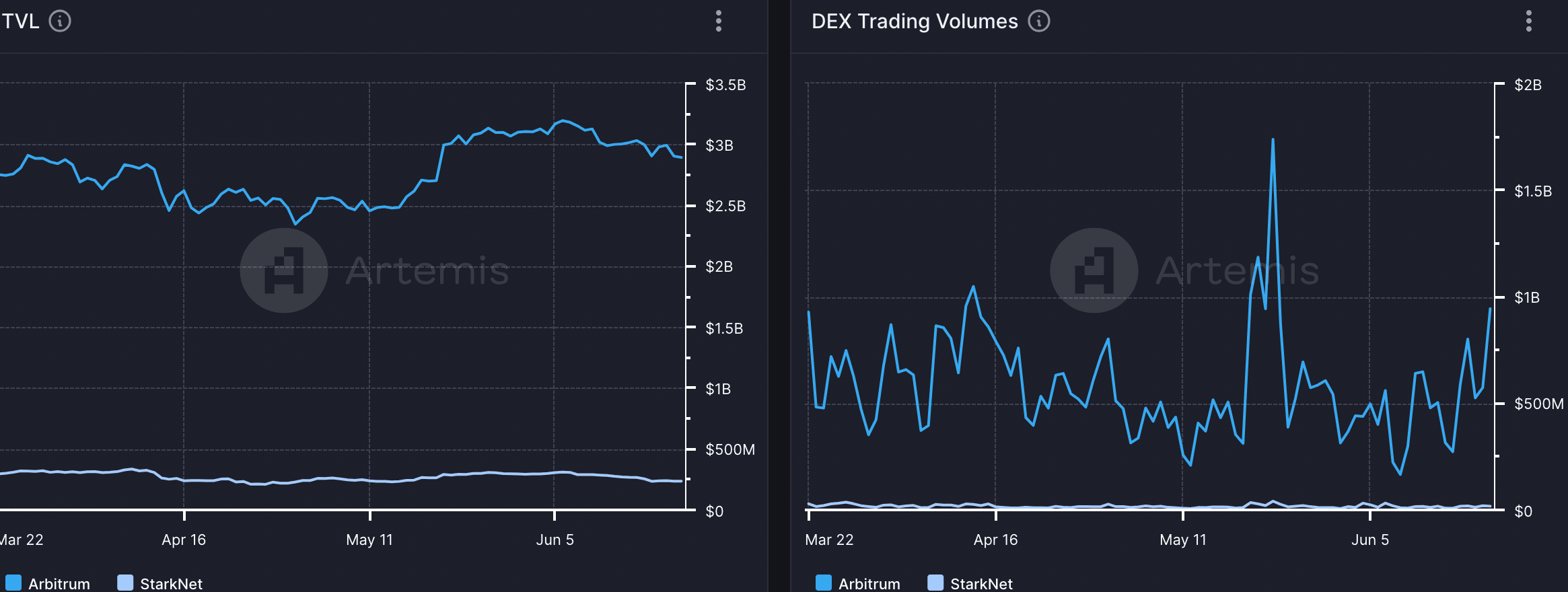

This same discrepancy was seen in the performance of both these protocols in the DeFi sector.

For example, the TVL (Total Value Locked) remained stable for both networks. But DEX volumes on both protocols fluctuated significantly.

Source: Artemis

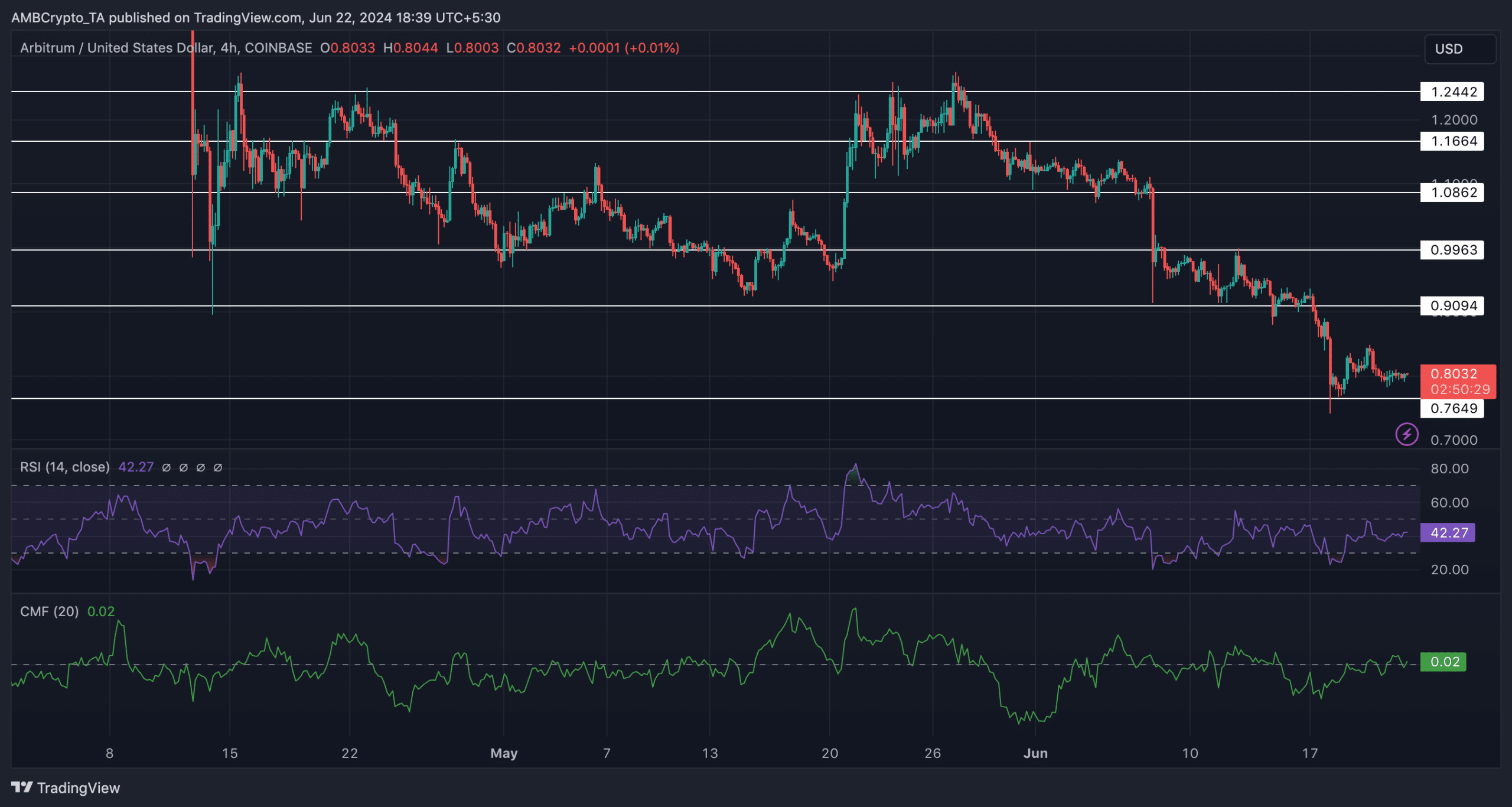

STRK vs. ARB: Price movements

Coming to the price movement, at press time, ARB was trading at $0.8017, having grown by 1.1% in the last 24 hours. Since the 27th of May, its price had fallen significantly, displaying multiple lower lows and lower highs.

Even though there was a recent spike in ARB’s price, there would likely not be a reversal in the ongoing bearish trend.

ARB’s RSI (Relative Strength Index) remained at 42.27 at press time, indicating that bullish momentum had waned. However, the CMF (Chaikin Money Flow) remained high, indicating that there still was some money flowing into the network.

Source: Trading View

Realistic or not, here’s ARB’s market cap in BTC’s terms

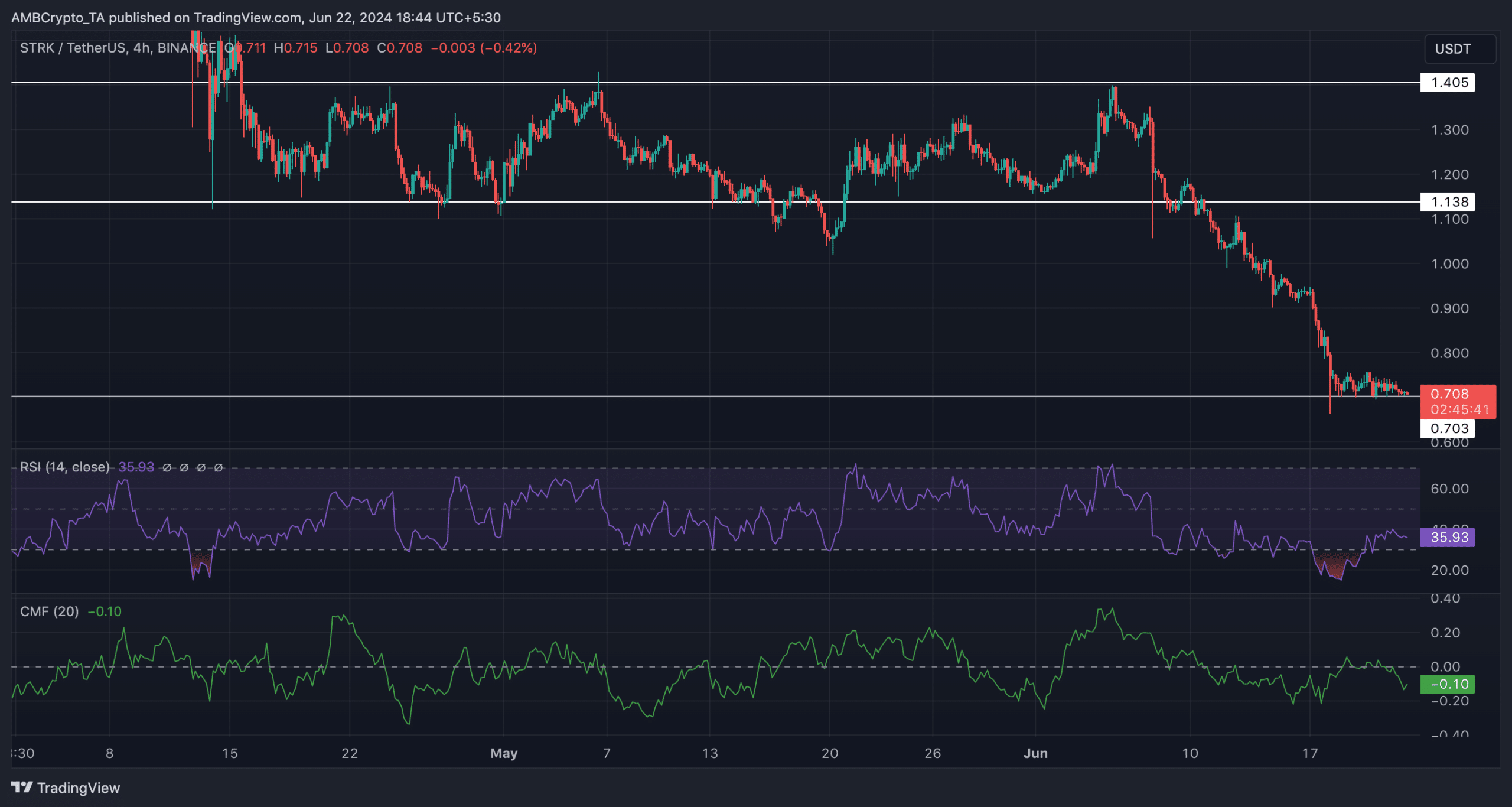

STRK also saw similar price movement after moving sideways throughout the month of May, as the token fell significantly in the last few days. There was no significant uptick observed in its price.

Both the RSI, at 35, and the CMF, at -0,10, painted a bearish picture for the future of the token. At press time, STRK was trading at $0.708.

Source; Trading View

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.