Entertainment

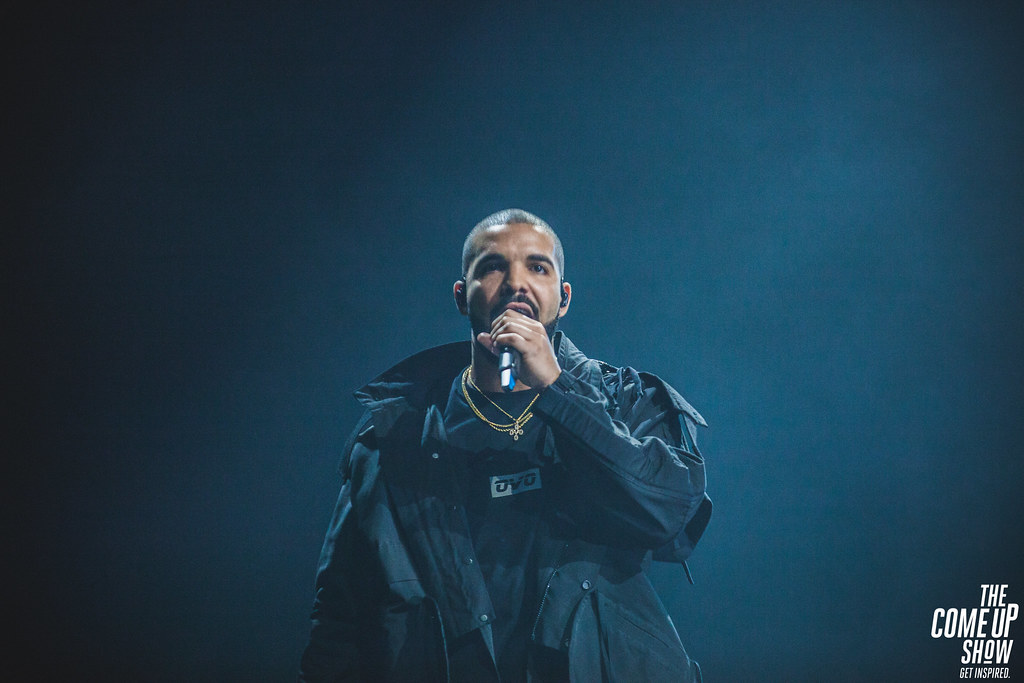

Drake and UMG Legal Tensions Escalate as Defamation Lawsuit Gains Attention

YEEZY SLPR SL-01: Kanye West’s $20 Slipper Gains Global Attention

Entertainment

Kanye West has introduced the YEEZY SLPR SL-01, a $20 slipper that is already making waves in the fashion world. With its …

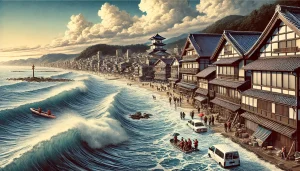

Powerful Earthquake Triggers Tsunami Advisory in Southwestern Japan

Science

Southwestern Japan experienced a powerful earthquake on January 13, 2025, prompting a tsunami advisory across coastal regions. The Japan Meteorological Agency (JMA) …

Apple Set to Launch iPhone 17 Air and Revamped iPad Lineup in 2025

Technology

Apple is preparing to introduce the iPhone 17 Air, a sleek new addition to its smartphone lineup, later this year. Alongside this …

Hackers Target Gravy Analytics, Expose Risks in Location Data Industry

Technology

In a troubling development, Gravy Analytics, a leading location data provider, has been targeted in a cyberattack that compromised vast amounts of …

Kohl’s Restructuring Efforts Lead to 27 Store Closures Nationwide

Business

Kohl’s, the prominent department store chain, announced plans to close 27 underperforming stores across 15 states by April 2025. This move is …

VLC Brings AI-Powered Subtitles to CES 2025

Technology

VLC Media Player is taking the spotlight at CES 2025 with a groundbreaking announcement: the introduction of real-time AI-powered subtitles and translations. …

PayPal Users Targeted in Sophisticated Phishing Scam

Technology

A new wave of phishing scams targeting PayPal users is causing widespread concern among cybersecurity experts and consumers. Cybercriminals are employing highly …

Samsung’s Galaxy Subscription Plan to Launch with S25 Ultra Next Month

Technology

Samsung is preparing to introduce a groundbreaking subscription service that allows users to rent Galaxy smartphones, starting with the highly anticipated Galaxy …