- Solana is currently among the best performing cryptos in the top-15

- Strong bullish sentiment within the community could help SOL’s price too

It is no secret that Solana (SOL) has been making waves in the crypto-market for quite some time now. The entire crypto-community loves SOL, and its memecoins have been making investors and traders alike remarkable profits. So much so that the community is dubbing 2024 summer ‘Solana Summer,’ anticipating the altcoin to trigger the highly-expected altseason.

Solana’s network has never been healthier

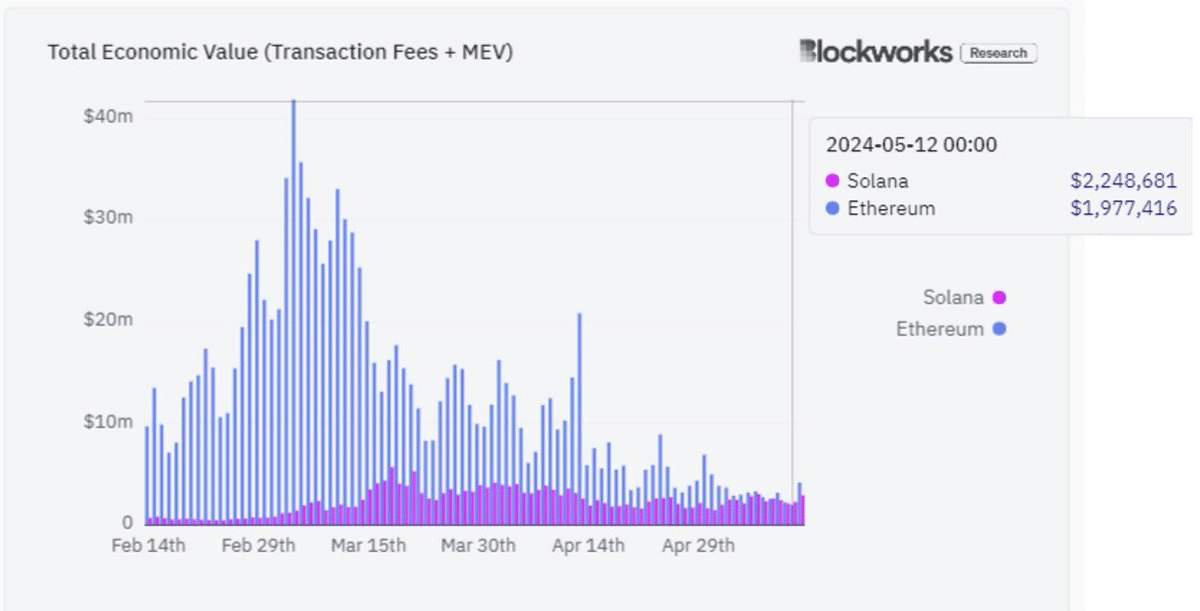

It has been reported that Solana’s network is the best-performing one in the industry at the moment. According to on-chain analysis by Leon Waidmann, Solana’s total economic value, which includes transaction fees and MEV, has surpassed that of Ethereum’s mainchain.

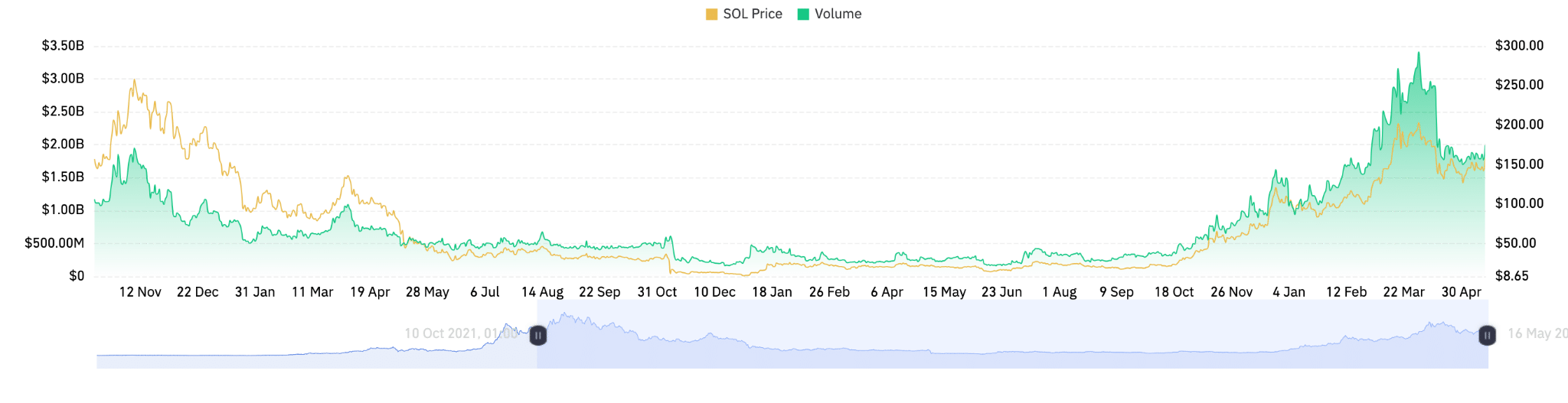

Additionally, data from Coinglass revealed that open interest in Solana has risen by over 1% in the last 24 hours, bringing it to about $2.1 billion. Its trading volume has hiked by about 41% too, adding nearly $8 billion into its market cap.

Source: Coinglass

The trading activity also revealed that there is typically strong buying interest when prices are lower. If you look at the end of the chart, there is a very strong sign of the return of Solana bulls, clearly confirming that Solana really is at the top right now.

Examining SOL’s price performance

AMBCrypto analyzed TradingView’s data for Solana’s performance since the year started. The data revealed that starting in early 2024, SOL projected a strong upward movement, peaking around mid-February when the general market was bullish.

After the peak, there was a notable decline with several bearish consecutive weeks of price drops for the coin.

Initial resistance was around the $220-mark, where the price peaked before turning south. Following the peak, the price stabilized and found support at around the $160-level, as indicated by the latest green candlestick that signifies a rebound or consolidation around this price.

The recent recovery around the $160-support level could suggest that prices might begin to stabilize or potentially increase if additional buyer momentum enters the market.

The upcoming week will determine if the rebound will sustain itself or if the downward trend will resume. Watch for a potential resistance retest around $180-$190 as a sign of sustained recovery strength in the short-term.

As for whether SOL might trigger a bull run or not, the general agreement based on data and community sentiment is – It might.

Robert Johnson is a UK-based business writer specializing in finance and entrepreneurship. With an eye for market trends and a keen interest in the corporate world, he offers readers valuable insights into business developments.